Dollar’s selloff picked up again as year end approaches. While US stocks took a breath overnight, Asia markets ex-Japan is enjoying some solid buying for now. While Euro is strong against Dollar, it’s mixed against other European majors. Meanwhile, Canadian Dollar is clearly lagging behind Aussie and Kiwi in the current risk-on buying. Gold and oil remain range bound too.

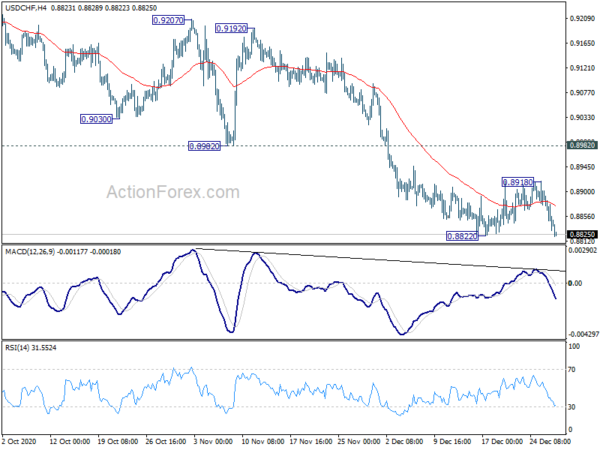

Technically, EUR/USD’s break of 1.2272 resistance confirms up trend resumption. AUD/USD is not far behind in breaking 0.7639 resistance. One focus is on when USD/CHF would break through 0.8822 support to resumes down trend too. Another focus in the developments in USD/JPY, which suggests that near term recovery from 102.87 has completed. We might see a test on this low again soon…maybe next year.

In Asia, currently, Nikkei is down -0.57%. Hong Kong HSI is up 1.47%. China Shanghai SSE is up 0.80%. Singapore Strait Times is up 0.45%. Japan 10-year JGB yield is down -0.0032 at 0.023. Overnight, DOW dropped -0.22%. S&P 500 dropped -0.22%. NASDAQ dropped -0.38%. 10-year yield rose 0.002 to 0.935.

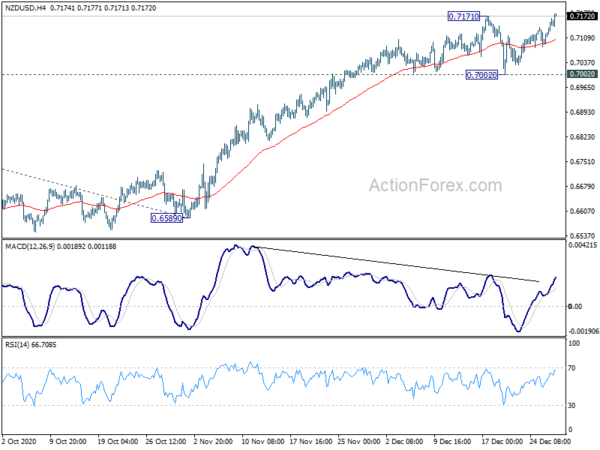

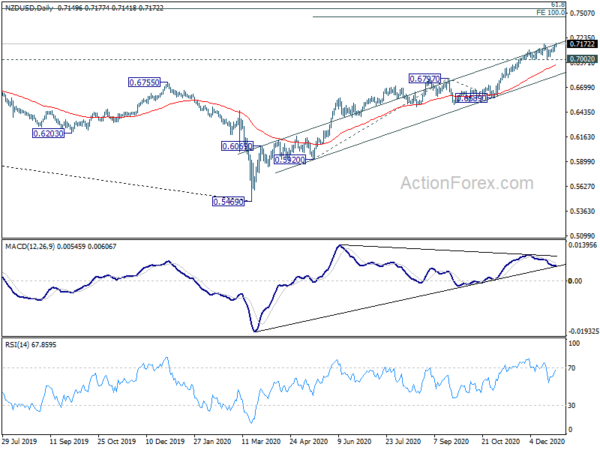

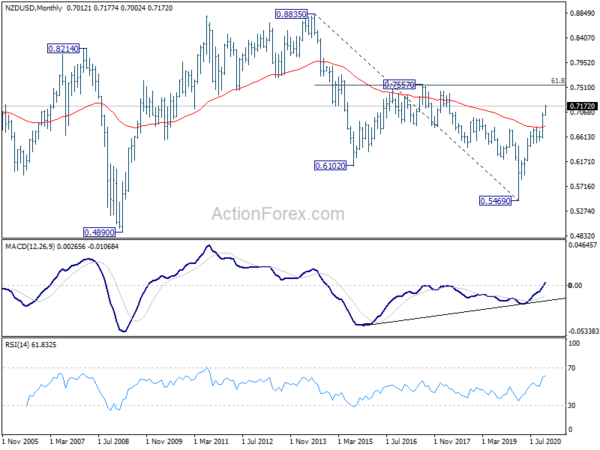

NZD/USD upside breakout, targets 0.74/75 next

Following broad based selloff in Dollar in Asian session, NZD/USD finally breaks 0.7171 short term top. The development suggests resumption of whole up trend from 0.5469. Outlook will now stay bullish as long as 0.7002 support holds. Next target would be 100% projection of 0.5920 to 0.6797 from 0.6589 at 0.7466.

The real test to the up trend would be found in 0.7557 long term cluster resistance. That coincide with 61.8% retracement of 0.8835 (2014 high) to 0.5469 at 0.7549. We’d look for loss of momentum approaching this level, to bring a sizeable medium term correction. That’s something for next year, anyway.

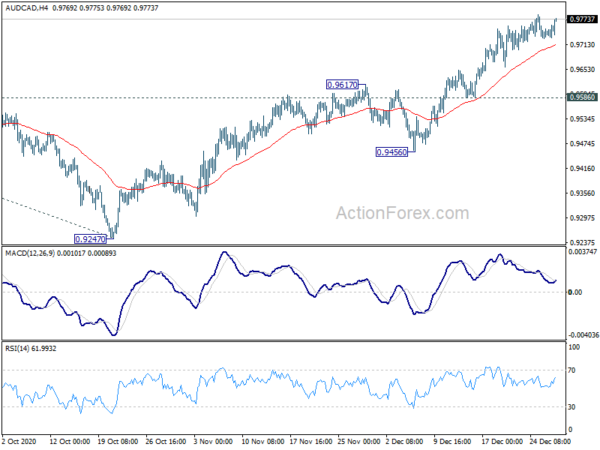

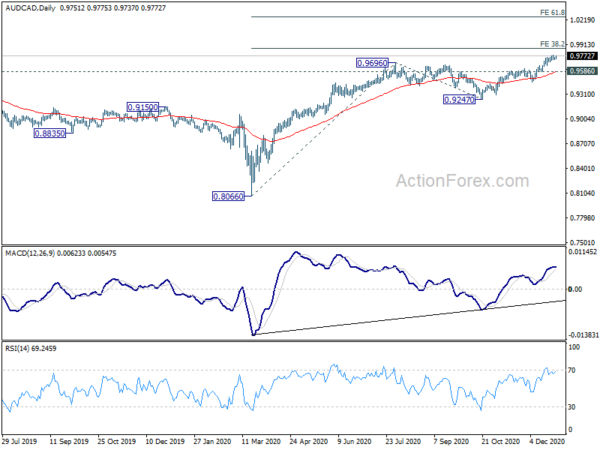

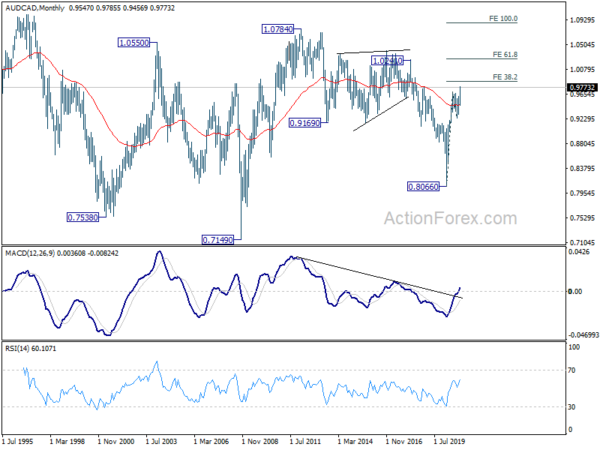

AUD/CAD up trend continues as CAD underperforms

Canadian Dollar has been under performing other commodity currencies in the current risk-on markets. AUD/CAD’s up trend is continuing this week, despite relatively weak upside momentum. Outlook will stay bullish as long as 0.9586 minor support holds, nonetheless. Rise from 0.8066 should target 38.2% projection of 0.8066 to 0.9696 from 0.9247 at 0.9870 next.

Decisive break there could bring some upside acceleration to 61.8% projection at 1.0254. This level coincides with a structural resistance at 1.0241, part of the multiyear down trend from 1.0784 (2012 high). Reactions from there could decide how powerful the current long term up trend would evolve into.

Looking ahead

Swiss KOF economic barometer and Credit Suisse economic expectations are the only features in European session. US will release goods trade balance, Chicago PMI and pending home sales later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.2214; (P) 1.2245; (R1) 1.2281; More….

EUR/USD’s break of 1.2272 resistance suggests up trend resumption. Intraday bias is back on the upside. Rise from 1.0635 should now target 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next. On the downside, break of 1.2129 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | CHF | KOF Leading Indicator Dec | 100.5 | 103.5 | ||

| 09:00 | CHF | Credit Suisse Economic Expectations Dec | 30 | |||

| 13:30 | USD | Goods Trade Balance (USD) Nov | -80.3B | |||

| 14:45 | USD | Chicago PMI Dec | 56.6 | 58.2 | ||

| 15:00 | USD | Pending Home Sales M/M Nov | 0.00% | -1.10% | ||

| 15:30 | USD | Crude Oil Inventories | -0.6M |