Trading remains rather subdued with markets already in holiday mode. Sterling has the potential to explode with wild moves, but we’re so far disappointed by the lack of progress in Brexit trade negotiations. The surge in cases of the coronavirus, with threats of a new strain, also kept risk appetite capped. A bunch of economic data will be released from the US today, including jobless claims, PCE inflation and durable goods orders. Let’s see if they could bring the markets back to some lives.

Technically, EUR/USD’s rejection below 1.2272 short term top was in line with our expectations. Focus will turn to 1.2058 support in EUR/USD and 125.70 support in EUR/JPY. We’re not expecting a break of these level for now. But if they do, that could be an early signal of a near term rebound in both Dollar and Yen, and possibly a overdue pull back in stocks.

In Asia, Nikkei closed up 0.33%. Hong Kong HSI is up 0.78%. China Shanghai SSE is up 0.74%. Singapore Strait Times is up 0.04%. Japan 10-year JGB yield is down -0.0002 at 0.010. Overnight, DOW dropped -0.67%. S&P 500 dropped -0.21%. NASDAQ rose 0.51%. 10-year yield dropped -0.023 to 0.918.

BoJ discussed impacts of prolonged pandemic impacts

In the minutes of October 28-29 BoJ meeting, one member said the bank should “avoid bringing a premature end” to the pandemic policy responses, as the impact “might be prolonged”.

Another member warned, “given that monetary easing was expected to be prolonged, the Bank should further look for ways to enhance sustainability of the policy measure so that it would not face difficulty in conducting such purchases when a lowering of risk premia of asset prices was absolutely necessary.”

Also, one noted “attention should be paid to the possibility that the more prolonged the crisis response, the more the structural reforms toward sustainable growth would be delayed”.

Asian business sentiment improved, with sense of optimism going forward

The Reuters/INSEAD Asian Business Sentiment Index rose to 62 in Q4, up from 53 in Q3. That’s the best reading since Q4 2019, signalling more positive outlook.

“There’s a sense of optimism going forward,” said Antonio Fatas, Singapore-based economics professor at global business school INSEAD. “Things are getting better but they are getting better with still a dose of uncertainty. The effect of the crisis is very different across sectors,” he added, noting the weakness in the transport sector due to curbs on global travel.

EU in final push for Brexit trade agreement

Brexit trade negotiations are still stuck at fishing, after EU rejected UK’s last offer. It’s believed that progress were made and both sides had political willing. Many issues were close to resolved, except that fisheries remained difficult to bridge.

Chief negotiator Michel Barnier said, as he went into a meeting with EU ambassadors: “We are really in the crucial moment. We are giving it the final push. In 10 days the UK will leave the single market and we continue to work in total transparency with the member states right now and with the parliament.”

It’s reported that he told the ambassadors, there was “political willing on both sides to get this over the line”, adding that “some things now have to go higher up”.

Looking ahead

Germany import price is the only feature in European session. Later in the day, Canada will release GDP. US will release jobless claims personal income and spending, durable goods orders and new home sales.

EUR/USD Daily Outlook

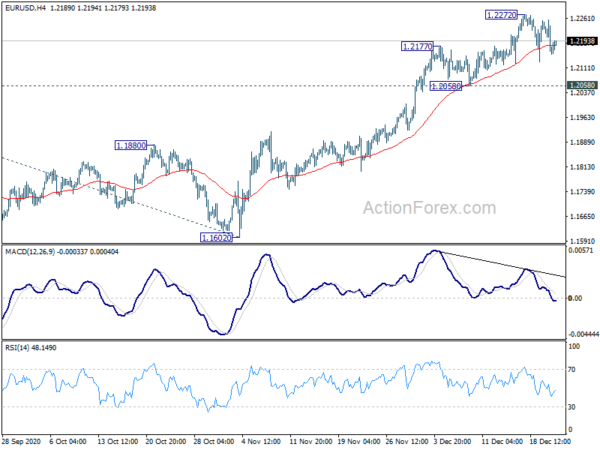

Daily Pivots: (S1) 1.2126; (P) 1.2191; (R1) 1.2231; More….

Intraday bias in EUR/USD remains neutral for the moment as consolidation from 1.2272 is extending. Considering bearish divergence condition in 4 hour MACD, break of 1.2058 will confirm short term topping. Intraday bias will be turned to the downside for deeper pull back to 55 day EMA (now at 1.1956). On the upside, though, firm break of 1.2272 will resume larger rally to 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Monetary Policy Meeting Minutes | ||||

| 7:00 | EUR | Germany Import Price Index M/M Nov | 0.50% | 0.30% | ||

| 13:30 | CAD | GDP M/M Oct | 0.80% | |||

| 13:30 | USD | Initial Jobless Claims (Dec 18) | 900K | 885K | ||

| 13:30 | USD | Personal Income Nov | -0.30% | -0.70% | ||

| 13:30 | USD | Personal Spending Nov | -0.20% | 0.50% | ||

| 13:30 | USD | PCE Price Index M/M Nov | -0.10% | 0.00% | ||

| 13:30 | USD | PCE Price Index Y/Y Nov | 1.20% | 1.20% | ||

| 13:30 | USD | Core PCE Price Index M/M Nov | 0.10% | 0.00% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Nov | 1.50% | 1.40% | ||

| 13:30 | USD | Durable Goods Orders Nov | 0.60% | 1.30% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Nov | 0.50% | 1.30% | ||

| 15:00 | USD | New Home Sales Nov | 990K | 999K | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Dec F | 81.4 | 81.4 | ||

| 15:30 | USD | Crude Oil Inventories | -3.1M | |||

| 17:00 | USD | Natural Gas Storage | -122B |