It seems that traders are already on holiday with the subdued market activity today. Sterling softens again on reports that EU rejected UK’s latest proposal on fishing rights. Australia and Zealand Dollars also dip mildly. On the other hand, Swiss France firms up together with Euro, followed by Dollar and Yen. Gold and oil are also trading sideway as this week’s consolidations are extending.

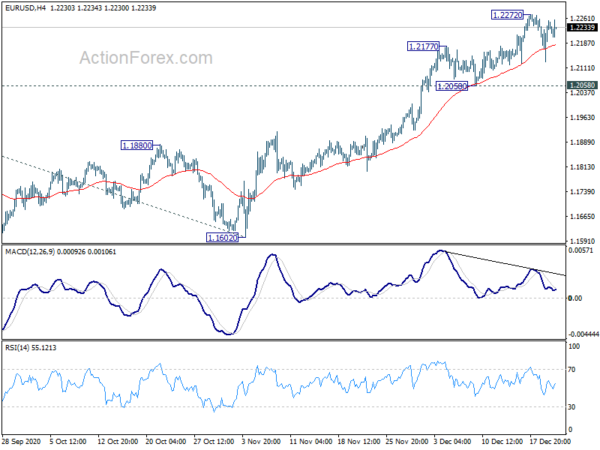

Technically, eyes will be on 1.2272 resistance in EUR/USD before the long weekend. We’re not expanding a break there before extending the consolidation with another falling leg. Though, outlook should stay bullish as long as 1.2058 support holds. Meanwhile, a break of 1.2272 could set the stage for a delayed correction after holidays.

In Europe, currently, FTSE is up 0.48%. DAX is up 1.11%. CAC is up 1.13%. Germany 10-year yield is down -0.0051 at -0.584. Earlier in Asia, Nikkei dropped -1.04%. Hong Kong HSI dropped -0.71%. China Shanghai SSE dropped -1.86%. Singapore Strait Times dropped -0.67%. Japan 10-year JGB yield dropped -0.0037 to 0.010.

US Q3 GDP growth revised up to 33.4% annualized

According to the third estimate, US GDP grew at an annualized rate of 33.4% in Q3, revised up from 33.1%. The upward revision primarily reflected larger increases in personal consumption expenditures (PCE) and nonresidential fixed investment.

BoE Haldane: The risks are still with us and the risks are still real

BoE Chief Economist Andy Haldane said in a Guardian interview, the central bank would continue to provide monetary policy support to the economy, as “the risks are still with us and the risks are still real.” The right time “to signal and to execute” the reduction of insurance provided by policies is “when you actually see the risks being reduced for people in terms of their jobs and for businesses in terms of their viability.”

“We are still in a hole and the hole is still deep. We need to keep climbing out that hole through policy measures and the vaccine. But once we have climbed out – and we will – we mustn’t forget about long-term structural issues: what will give us good work at good pay,” he added.

UK Q3 GDP was estimated to have increased by a record 16.0% qoq in Q3, revised up from first estimate of 15.5%. Over the year, GDP dropped -8.6% yoy. The level of GDP was still -8.6% below that at the end of 2019. Current account deficit widened to GBP -15.7B in Q3. Public sector net borrowing rose to GBP 30.8B in November.

Germany Gfk consumer climate dropped to -7.6, about to enter a very difficult phase

Germany Gfk consumer climate for January dropped slightly to -7.3, down from -6.8. In December, economic expectations rose to 4.4, up from -0.2. Income expectations dropped to 3.6, down from 4.6. Propensity to buy rose to 36.6, up from 30.5.

Rolf Bürkl, GfK Consumer Expert said: “There is reason to fear that the consumer climate is about to enter a very difficult phase in the coming weeks. Any relaxation or recovery can certainly only come when the infection rates have dropped so far that the strict restrictions can be loosened once more.”

Australia retail sales rose 7% in Nov, Victoria led with large rise

Australian retail sales rose 7% mom in November to AUD 2072B, well above expectation of 2.5% mom. In seasonally adjusted terms, sales turnover rose 13.2% yoy.

Ben James, Director of Quarterly Economy Wide Surveys, said: “Victoria saw a large rise, up 21 per cent, as retail stores experienced a full month of trade following the easing of coronavirus restrictions in that state. Excluding Victoria, retail sales rose 2.7 per cent.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2159; (P) 1.2206; (R1) 1.2282; More….

EUR/USD is staying in consolidation from 1.2272 and intraday bias remains neutral. On the upside, break of 1.2272 will resume larger rally to 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next. However, considering bearish divergence condition in 4 hour MACD, break of 1.2058 will bring deeper correction instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Nov P | 7.00% | 2.50% | 1.40% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Jan | -7.3 | -9.5 | -6.7 | -6.8 |

| 07:00 | GBP | GDP Q/Q Q3 F | 16..00% | 15.50% | 15.50% | |

| 07:00 | GBP | Total Business Investment Q/Q Q3 F | 9.40% | 8.80% | 8.80% | |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Nov | 30.8B | 26.3B | 21.6B | 20.9B |

| 07:00 | GBP | Current Account (GBP) Q3 | -15.7B | -12.9B | -2.8B | -11.9B |

| 13:30 | USD | GDP Annualized Q3 F | 33.40% | 33.10% | 33.10% | |

| 13:30 | USD | GDP Price Index Q3 F | 3.50% | 3.60% | 3.60% | |

| 15:00 | USD | Existing Home Sales Nov | 6.73M | 6.85M | ||

| 15:00 | USD | Consumer Confidence Dec | 97.5 | 96.1 |