Sterling’s exceptional volatility continued as traders turned a bit more optimistic on a Brexit trade deal. But upside remains capped, as nothing is done until everything is done. Markets are also mixed elsewhere, with the positive impact of US fiscal stimulus being offset by worries over new strain of coronavirus. Economic calendar continues to be light today with Q3 GDP final from UK and US featured. But these “old” data are unlikely to give markets any new inspirations.

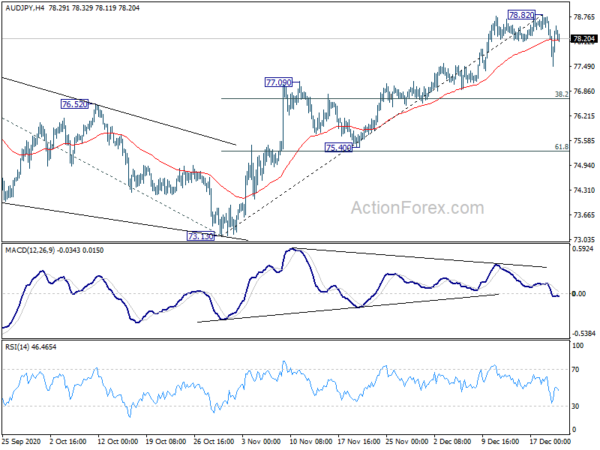

Technically, Dollar’s rebound overnight quickly faltered. Still, we’re not expecting resumption of the recent down trend for the moment. EUR/USD will likely be capped below 1.2272 short term top, AUD/USD below 0.7639 short term top too. Similarly, we’re also not expecting upside break outs in Yen crosses for now, like EUR/JPY and AUD/JPY.

In Asia, currently, Nikkei is down -0.54%. Hong Kong HSI is down -0.07%. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is up 0.0016 at 0.016. Overnight, DOW rose 0.12%> S&P 500 dropped -0.39%. NASDAQ dropped -0.10%. 10-year yield dropped -0.007 to 0.941.

Sterling rebounds on UK’s new fishing proposal to EU

Sterling rebounded overnight on reports that UK has tabled a new proposal regarding fishing rights that could finally reach a comprise with the EU. UK had demanded a 60% reduction in the catch by value in its water by EU. That percentage of reduction was lowered to 35% in the new proposal. That’s much closer to EU’s demanded number of 25%.

Additionally, the UK would accept a five-year phase-in period for the new arrangements, rather than seven. The EU had initially called for 10 years to adjust and the U.K. had proposed three.

Separately, Prime Minister Boris Johnson’s spokesman reiterated that the Brexit transition period will end on December 31. “We’ve said before that we will need to ratify any agreement ahead of 1 January. The leader of the house made it clear that we would recall parliament in order to give MPs a vote on the necessary legislation,” he added.

US House passed USD 900B pandemic relief bill

US House passed the USD 900B coronavirus relief package late Monday night. Additionally, a USD 1.4T measures was also passed to fund the government through September 30. The Senate is expected to approve the plans together, but the vote might drag late into the night. The White House has also said that President Donald Trump will sign the bill.

Senate Majority Leader Mitch McConnell, a Republican, told reporters at the Capitol that passage of the legislation in the Senate would “probably be late, but we’re going to finish tonight.”

Australia retail sales rose 7% in Nov, Victoria led with large rise

Australian retail sales rose 7% mom in November to AUD 2072B, well above expectation of 2.5% mom. In seasonally adjusted terms, sales turnover rose 13.2% yoy.

Ben James, Director of Quarterly Economy Wide Surveys, said: “Victoria saw a large rise, up 21 per cent, as retail stores experienced a full month of trade following the easing of coronavirus restrictions in that state. Excluding Victoria, retail sales rose 2.7 per cent.

Looking ahead

Germany Gfk consumer confidence and UK Q3 GDP final are the major focuses in European session. US Q3 GDP final, existing home sales and consumer confidence will be featured later in the day.

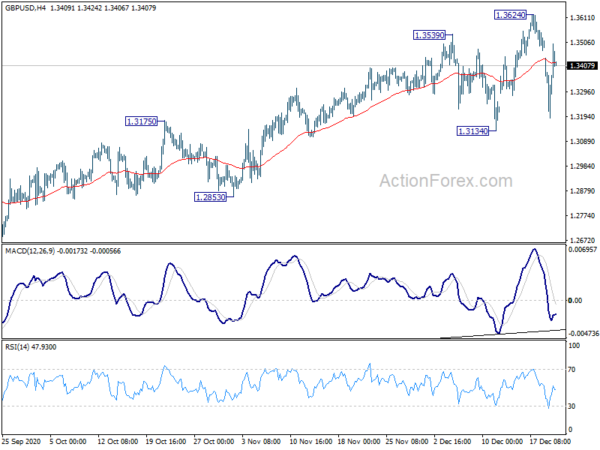

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3266; (P) 1.3382; (R1) 1.3576; More…

Range trading continues in GBP/USD and intraday bias remains neutral first. On the upside, break of 1.3624 will target 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. However, firm break of 1.3134 will confirm short term topping and turn bias to the downside for deeper decline towards 1.2675 support.

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3308). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Nov P | 7.00% | 2.50% | 1.40% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Jan | -9.5 | -6.7 | ||

| 07:00 | GBP | GDP Q/Q Q3 F | 15.50% | 15.50% | ||

| 07:00 | GBP | Total Business Investment Q/Q Q3 F | 8.80% | 8.80% | ||

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Nov | 26.3B | 21.6B | ||

| 07:00 | GBP | Current Account (GBP) Q3 | -12.9B | -2.8B | ||

| 13:30 | USD | GDP Annualized Q3 F | 33.10% | 33.10% | ||

| 13:30 | USD | GDP Price Index Q3 F | 3.60% | 3.60% | ||

| 15:00 | USD | Existing Home Sales Nov | 6.73M | 6.85M | ||

| 15:00 | USD | Consumer Confidence Dec | 97.5 | 96.1 |