Commodity currencies are the strongest performers today as lifted by firm risk appetite. European indices are trading in black while US futures point to higher open. Sterling is staging a relief recovery after solid job data. Euro, on the other hand, trades softer on report that ECB President Mario Draghi will not sign policy changes in the upcoming Jackson Hole conference. Yen and Swiss are also weak in risk seeking markets. Nonetheless, the greenback remains the strongest one for the week as markets await FOMC minutes.

ECB Draghi won’t deliver a big monetary policy speech at Jackson Hole

Euro trades generally lower today in response to a Reuters report that ECB president Mario Draghi will not deliver new messages regarding monetary policy in the Jackson Hole symposium in US on August 25. A spokesman of ECB said that Draghi will focus on the theme of symposium instead, that is, fostering a dynamic global economy. Reuters also quoted an unnamed source saying that "expectations that this will be a big monetary policy speech are wrong".

While the Euro trades softer, it’s staying well above key near term support levels against Dollar, Yen and Sterling, and maintain bullishness against these currencies. It’s understandable that the September ECB meeting is an important one regarding tapering the asset purchase program. And Draghi would like to keep his cards close to his chest.

Separately, ECB governing council member Ardo Hansson said that "as the exit from the asset buying program is in line with the recovery of economic activity, everything is calm." And, "after the completion of the purchase of bonds, the reinvestment of bonds already bought will continue for some time; that is, when the earlier purchased bonds expire, new ones will be bought instead."

Released from Eurozone, Q2 GDP grew 0.6% qoq, unchanged from Q1’s figure and met expectations. Italian GDP rose 0.2% qoq in Q2, same as in Q1, and met expectations.

Sterling relief recovery as unemployment dropped to lowest since 1975

Sterling recovers against other major currencies, but not commodity currencies today, after solid job data. Claimant counts dropped -4.2k in July, much better than expectation of 3.7k rise. Unemployment rate dropped to 4.4% in the three months to June. Unemployment rate also hit the lowest level since 1975. Average weekly earnings rose by 2.1% 3moy in June, above expectation of 1.8% 3moy. However, some economists point out that real wage growth was at -0.5% yoy after adjustment for inflation.

The recovery is in the Pound is more of a relief rally as at least the set of job data is overall positive. But there is no change in the view that BoE is still distant from raising interest rate. Lower than expected inflation, which some talks that CPI won’t hit 3% this year, would not prompt BoE for an early hike. And the central bank would at least wait for the result of Brexit negotiation before acting.

FOMC minutes watched for views on inflation

Regarding minutes of July FOMC meeting, the markets will be particularly interested in knowing policy-makers’ views on inflation outlook. In the accompanying statement of the meeting, policymakers acknowledged that the overall inflation and the measure excluding food and energy prices (core inflation) have "declined" and are "running below 2%". The removal of the word "somewhat" signaled the weakness in inflation is more than the Fed had anticipated. We would look to see if the Fed maintained the view that weak inflation is "transitory".

So far, Fed officials have been rather cautious regarding the chance of another rate hike by the end of the year. The main exception is New York Fed President William Dudley while remained "favor of doing another rate hike later this year". After his comments earlier this week, market pricing of Fed rate path returned to normal. For now, Fed fund futures are pricing in 98.6% chance for Fed to stand pat in September. Chance of a rate hike in December is roughly 50%.

In US, housing starts dropped -4.8% mom to 1.15m annualized rate in July, below expectation of 1.22m. Building permits dropped -4.1% mom to 1.22m, below expectation of 1.25m. Canada International securities transactions dropped -0.92b in June.

EUR/USD Mid-Day Outlook

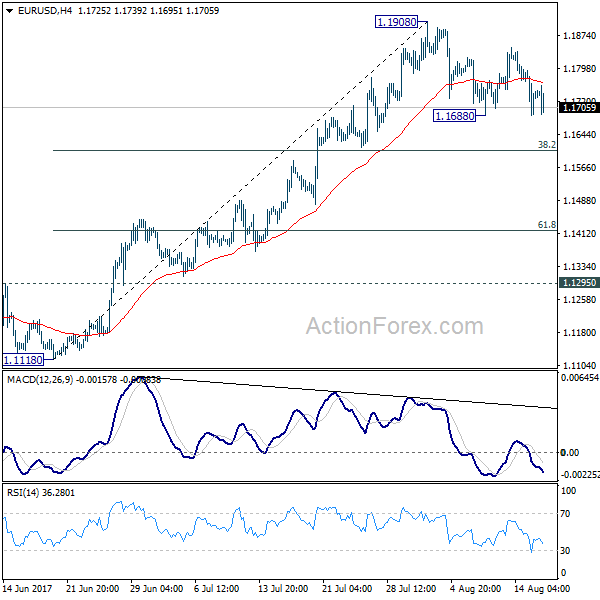

Daily Pivots: (S1) 1.1753; (P) 1.1796 (R1) 1.1822; More…

EUR/USD dips mildly today but it’s staying above 1.1688 support and intraday bias stays neutral. Consolidation from 1.1908 is still in progress and deeper pull back might be seen. But downside should be contained by 38.2% retracement of 1.1119 to 1.1908 at 1.1606 to bring rebound. On the upside, break of 1.1908 will extend recent up trend to 1.2042 long term support turned resistance next.

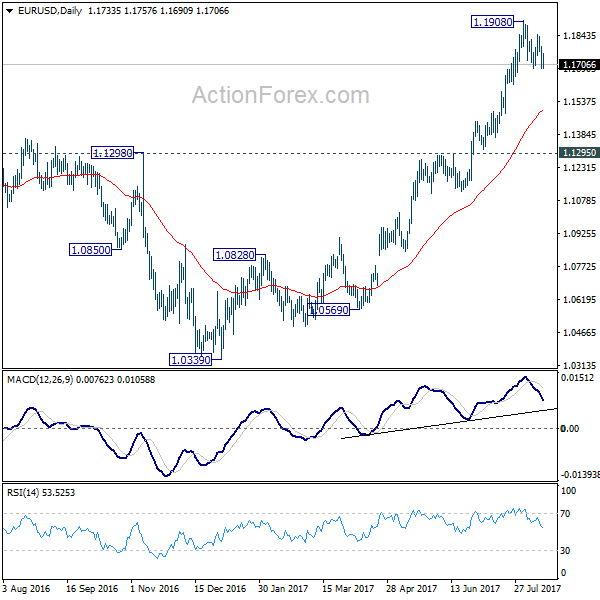

In the bigger picture, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Sustained trading above 55 month EMA (now at 1.1768) will pave the way to key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. While rise from 1.0339 is strong, there is no confirmation that it’s developing into a long term up trend yet. Hence, we’ll be cautious on strong resistance from 1.2516 to limit upside. But for now, medium term outlook will remain bullish as long as 1.1295 support holds, in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Jul | 0.10% | -0.10% | -0.20% | |

| 01:30 | AUD | Wage Cost Index Q/Q Q2 | 0.50% | 0.50% | 0.50% | 0.60% |

| 08:00 | EUR | Italian GDP Q/Q Q2 P | 0.40% | 0.40% | 0.40% | |

| 08:30 | GBP | Jobless Claims Change Jul | -4.2K | 3.7K | 6.0K | 3.5K |

| 08:30 | GBP | Claimant Count Rate Jul | 2.30% | 2.30% | ||

| 08:30 | GBP | Average Weekly Earnings 3M/Y Jun | 2.10% | 1.80% | 1.80% | 1.90% |

| 08:30 | GBP | ILO Unemployment Rate 3M Jun | 4.40% | 4.50% | 4.50% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.60% | 0.60% | 0.60% | |

| 12:30 | CAD | International Securities Transactions (CAD) Jun | -0.92B | 23.45B | 29.46B | |

| 12:30 | USD | Housing Starts Jul | 1.16M | 1.22M | 1.22M | |

| 12:30 | USD | Building Permits Jul | 1.22M | 1.25M | 1.25M | 1.28M |

| 14:30 | USD | Crude Oil Inventories | -3.0M | -6.5M | ||

| 18:00 | USD | FOMC Meeting Minutes Jul |