Sterling and Euro rise broadly today and maintain gains in early US session. Progress in Brexit trade negotiations and stronger than expected PMIs lift both currencies as well as their respective stock markets. Canadian Dollar is currently the worst performing one for today, apparently reacting to BoC’s jawboning. Risk-on markets keep Dollar under pressure. Focus will turn to FOMC rate decisions first, followed by SNB and BoE tomorrow, and then BoJ on Friday. Still a long way to go before weekend.

Some FOMC previews here:

- FOMC Preview – Fed to Update Forward Guidance on QE

- Fed Likely to Skip QE Boost, May Adjust Composition and Forward Guidance

- FOMC Meeting Preview: Threading A Needle

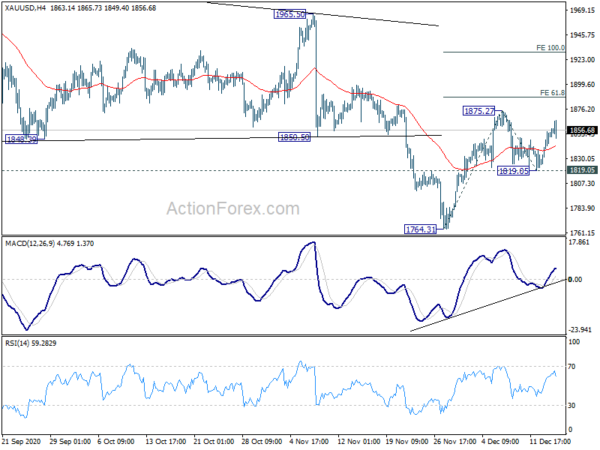

Technically, EUR/USD’s break of 1.2177 resistance confirmed resumption in Dollar’s selloff. Immediate focus will be on whether GBP/USD could sustain above 1.3539 resistance, and whether USD/JPY would power through 103.17 low. Gold will also be watched closely as a guidance to confirm Dollar’s move. Firm break of 1875.27 will confirm resumption of whole rebound from 1764.31, and target 61.8% projection of 1764.31 to 1875.27 from 1819.05 at 1887.62 next.

In Europe, currently, FRSE is up 0.56%. DAX is up 1.35%. CAC is up 0.08%. Germany 10-year yield is up 0.0548. Earlier in Asia, Nikkei rose 0.26%. Hong Kong HSI rose 0.97%. China Shanghai SSE dropped -0.01%. Singapore Strait Times rose 0.56%. Japan 10-year JGB yield rose 0.0064 to 0.010.

US retail sales dropped -1.1% in Nov, ex-auto sales dropped -0.9%

US retail sales dropped -1.1% mom to USD 546.5B in November, below expectation of -0.2% mom. Ex-auto sales dropped -0.9% mom, below expectation of 0.2% mom rise. Ex-gasoline sales dropped -0.9% mom. Ex-auto, ex-gasoline sales dropped -0.8% mom.

Canada CPI accelerated to 1% yoy in Nov

Canada CPI accelerated to 1.0% yoy in November, up from 0.7% yoy, above expectation of 0.8% yoy. Prices rose in six of the eight major components on a year-over-year basis. CPI common slowed to 1.5% yoy, down from 1.6% yoy, missed expectation of 1.6% yoy. CPI median was unchanged at 1.9% yoy, matched expectations. CPI trimmed slowed to 1.7% yoy, down from 1.8% yoy, missed expectation of 1.8% yoy.

Also from Canada, foreign securities purchases rose to CAD 6.92B in October. Wholesale sales rose 1.0% mom, versus expectation of 0.7% mom.

EU von der Leyen: Brexit governance issues largely resolved, fishing and level playing field outstanding

European Commission President Ursula von der Leyen said today that “we have found a way forward on most issues” in Brexit trade talks. But “two issues still remain outstanding: the level playing field and fisheries”. Still ” issues linked to governance now have largely been resolved. The next days are going to be decisive.”

“On standards, we have agreed a strong mechanism of non- regression. That’s a big step forward. And this is to ensure that our common high labour, social and environmental standards will not be undercut,” von der Leyen added,

“Difficulties still remain on the question of how to really future-proof fair competition. But I’m also glad to report that issues linked to governance by now are largely being resolved.”

UK PMI manufacturing rose to 55.9, services rose to 49.9

UK PMI Manufacturing rose to 57.3, up from 55.6, above expectation of 55.9, 37-month high. PMI Services rose to 49.9, up from 47.6, below expectation of 50.5. PMI Composite rose to 50.7, up from 49.0.

Chris Williamson, Chief Business Economist at IHS Markit, said: “The UK economy returned to growth in December after the lockdown-driven downturn seen in November, adding to signs that the hit to the economy from the second wave of virus infections has so far been far less harsh than the first wave in the spring….

“Business optimism about the year ahead also remained buoyant, reflecting the light at the end of the tunnel created by the roll-out of the COVID-19 vaccines. Optimism waned slightly compared to November, however, largely due to rising concerns over a no-deal Brexit.”

UK CPI slowed to 0.3% yoy in Nov, CPI core dropped to 1.1% yoy

UK CPI slowed sharply to 0.3% yoy in November, down from 0.7% yoy, missed expectation of 0.6% yoy. CPI core slowed to 1.1% yoy, down from 1.5% yoy, missed expectation of 1.4% yoy. RPI also slowed to 0.9% yoy, down from 1.3% yoy, missed expectation of 1.3% yoy.

PPI input came in at 0.2% mom, -0.5% yoy. PPI output was at 0.2% mom, -0.8% yoy. CPPI core output was at 0.0% mom, 0.9% yoy.

Eurozone PMI manufacturing rose to 55.5, companies also become increasingly optimistic

Eurozone PMI Manufacturing rose to 55.5 in December, up from 53.8, above expectation of 53.0, a 55-month high. PMI Services rose to 47.3, up from 41.7, well above expectation of 40.9. PMI Composite also rose to 49.8, up from 45.3.

Chris Williamson, Chief Business Economist at IHS Markit said: “The data hint at the economy close to stabilising after having plunged back into a severe decline in November amid renewed COVID- 19 lockdown measures. The fourth quarter downturn consequently looks far less steep than the hit from the pandemic seen earlier in the year, though the picture is very mixed by sector.

“Companies have also become increasingly optimistic about the year ahead, with vaccine rollouts expected to help restore businesses to more normal trading conditions as 2021 progresses.”

Germany PMI Manufacturing rose to 58.6 in December, up from 57.8, above expectation of 56.6, a 34-month high. PMI Services rose to 47.7, up from 46.0, above expectation of 44.0. PMI Composite rose to 52.5, up from 51.7.

France PMI Manufacturing rose to 51.1 in December, up from 49.6, above expectation of 49.6. PMI Services rose to 49.2, up from 48.8, above expectation of 39.3. PMI Composite rose to 49.6, up from 40.6, a 4-month high.

Japan exports struggled in record losing streak

Japan’s exports dropped -4.2% yoy to JPY 6.11T. Imports dropped -11.1% yoy to JPY 5.75T. Trade surplus came in at JPY 367B. In seasonally adjusted terms, Trade surplus widened to JPY 0.57T, slightly above expectation of JPY 0.55T.

The data marked the 24th straight month of year-over year decline in exports, longest streak on record since 1979. By destination, exports to the US contracted for the first time in three months, by -2.5% yoy. Exports to China rose 3.8% yoy, slowest pace in five months. Exports to Asia also dropped for the first time in two months, by -4.3% yoy. Exports to EU dropped -2.6% yoy.

Japan PMI Manufacturing rose to 49.5, still struggling but turning optimistic

Japan Jibun Bank PMI Manufacturing rose to 49.5 in December, up from 48.8. PMI Services dropped to 47.2, down from 47.8. PMI Composite dropped to 48.0, down from 48.1.

Usamah Bhatti, Economist at IHS Markit, said: “Despite the short-term disruption caused by a resurgence in coronavirus disease 2019 (COVID-19) cases, Japanese private sector businesses were optimistic that business conditions would improve in the year-ahead. Positive sentiment stemmed from the expectation that there would be an end to the pandemic which would fuel both domestic and international demand. Nevertheless, uncertainty surrounding the timing and pace of the economic recovery resulted in a softening of expectations.”

Australia PMI composite rose to 57, leading index rose to 4.38

Australia CBA PMI Manufacturing rose to 56.0 in December, up from 55.8, hitting a 36-month high. PMI Services rose to 57.4, up from 55.1, a 7-month high. PMI Composite rose to 57.0, up from 54.9, a 5-month high.

Westpac-Melbourne Institute Leading Index rose from 3.77% to 4.38% in November. That’s the strongest growth rate in the sixty year history of the measure. Though, Westpac said “the gains still largely reflect the severity of the preceding contraction”. In level terms, the index has now “recouped 80%” of that fall.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2128; (P) 1.2149; (R1) 1.2175; More…..

EUR/USD’s up trend resumes by breaking 1.2177 resistance. Intraday bias is back on the upside. Current rise should target 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next. On the downside, break of 1.2058 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q3 | -3.52B | -3.65B | 1.83B | 1.91B |

| 22:00 | AUD | CBA Manufacturing PMI Dec P | 56 | 55.8 | ||

| 22:00 | AUD | CBA Services PMI Dec P | 57.4 | 55.1 | ||

| 23:30 | AUD | Westpac Leading Index M/M Nov | 0.50% | 0.10% | 0.30% | |

| 23:50 | JPY | Trade Balance (JPY) Nov | 0.57T | 0.55T | 0.31T | 0.36T |

| 00:30 | JPY | Manufacturing PMI Dec P | 49.7 | 48.9 | 49 | |

| 07:00 | GBP | CPI M/M Nov | -0.10% | 0.00% | ||

| 07:00 | GBP | CPI Y/Y Nov | 0.30% | 0.60% | 0.70% | |

| 07:00 | GBP | Core CPI Y/Y Nov | 1.10% | 1.40% | 1.50% | |

| 07:00 | GBP | RPI M/M Nov | -0.30% | 0.20% | 0.00% | |

| 07:00 | GBP | RPI Y/Y Nov | 0.90% | 1.30% | 1.30% | |

| 07:00 | GBP | PPI Input M/M Nov | 0.20% | 0.20% | ||

| 07:00 | GBP | PPI Input Y/Y Nov | -0.50% | -1.30% | ||

| 07:00 | GBP | PPI Output M/M Nov | 0.20% | 0.00% | ||

| 07:00 | GBP | PPI Output Y/Y Nov | -0.80% | -1.40% | ||

| 07:00 | GBP | PPI Core Output M/M Nov | 0.00% | 0.10% | 0.20% | |

| 07:00 | GBP | PPI Core Output Y/Y Nov | 0.90% | 0.40% | 0.50% | |

| 08:15 | EUR | France Manufacturing PMI Dec P | 51.1 | 49.6 | 49.6 | |

| 08:15 | EUR | France Services PMI Dec P | 49.2 | 39.3 | 38.8 | |

| 08:30 | EUR | Germany Manufacturing PMI Dec P | 58.6 | 56.5 | 57.8 | |

| 08:30 | EUR | Germany Services PMI Dec P | 47.7 | 44 | 46 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Dec P | 55.5 | 53 | 53.8 | |

| 09:00 | EUR | Eurozone Services PMI Dec P | 47.3 | 40.9 | 41.7 | |

| 09:30 | GBP | DCLG House Price Index Y/Y Oct | 5.40% | 5.10% | 4.70% | |

| 09:30 | GBP | Manufacturing PMI Dec P | 57.3 | 55.9 | 55.6 | |

| 09:30 | GBP | Services PMI Dec P | 49.9 | 50.5 | 47.6 | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | 25.9B | 24.0B | 23.7B | |

| 12:30 | CAD | CPI M/M Nov | 0.10% | 0.40% | ||

| 12:30 | CAD | CPI Y/Y Nov | 1.00% | 0.80% | 0.70% | |

| 12:30 | CAD | CPI Common Y/Y Nov | 1.50% | 1.60% | 1.60% | |

| 12:30 | CAD | CPI Median Y/Y Nov | 1.90% | 1.90% | 1.90% | |

| 12:30 | CAD | CPI Trimmed Y/Y Nov | 1.70% | 1.80% | 1.80% | |

| 13:30 | CAD | Foreign Securities Purchases (CAD) Oct | 6.92B | 10.05B | 4.46B | |

| 13:30 | CAD | Wholesale Sales M/M Oct | 1.00% | 0.70% | 0.90% | |

| 13:30 | USD | Retail Sales M/M Nov | -1.10% | -0.20% | 0.30% | -0.10% |

| 13:30 | USD | Retail Sales ex Autos M/M Nov | -0.90% | 0.20% | 0.20% | -0.10% |

| 14:45 | USD | Manufacturing PMI Dec P | 56 | 56.7 | ||

| 14:45 | USD | Services PMI Dec P | 55.9 | 58.4 | ||

| 15:00 | USD | Business Inventories Oct | 0.40% | 0.70% | ||

| 15:00 | USD | NAHB Housing Market Index Dec | 88 | 90 | ||

| 15:30 | USD | Crude Oil Inventories | 15.2M | |||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |