Trading in the forex markets is rather subdued today. Major pairs and crosses are staying inside yesterday’s range for now. Dollar and Yen turn softer. Sterling is in a weak recovery, but lacks follow through buying. It’s too hard for traders to commit to a bet on a trade deal between UK and EU, or not. Swiss Franc is currently the strong one, together with Euro.

Technically, as Dollar’s recovery falters, focus is back 1.2177 minor resistance in EUR/USD. Besides, EUR/JPY might also have a take on 126.68 temporary top too. We’ll see if any one of the two pairs could have an upside breakout first, or both together. But for that to happen, stocks could have to turn stronger today. In particular, DOW has to stay firm above 30k handle first, and challenge yesterday’s high at 30233.

In Europe, currently, FTSE is down -0.35%. DAX is down -0.07%. CAC is down -0.50%. Germany 10-year JGB yield is down -0.0144 at -0.593. Earlier in Asia, Nikkei dropped -0.30%. Hong Kong HSI dropped -0.76%. China Shanghai SSE dropped -0.19%. Singapore Strait Times ended flat. Japan 10-year JGB yield dropped -0.0068 to 0.020.

UK Johnson: We will prosper mightily under any version of Brexit

UK Prime Minister Boris Johnson said the situation is “very tricky” and Brexit trade talks are “very, very difficult at the moment”. “We’re willing to engage at any level political or otherwise, we’re willing to try anything,” he said. “But there are just limits beyond which, obviously, no sensible independent government or country could go.”

But Johnson also added, “you know there may come a moment when we have to acknowledge that its time to draw stumps and that’s just the way it is.” He emphasized, “we will prosper mightily under any version and if we have to go for an Australian solution then that’s fine too.” Australia currently has no free trade agreement with EU.

Johnson is expected to have a physical meeting with European commission President Ursula von der Leyen in the “coming days”. But there is no firm schedule yet. Also, von der Leyen said in a tweet yesterday, “the conditions for finalizing an agreement are not there due to the remaining significant differences on three critical issues: level playing field, governance and fisheries”.

German ZEW sentiment rose to 55.0, vaccines boost confidence

Germany ZEW Economic Sentiment rose 16.0 pts to 55.0 in December, above expectation of 45.2. Current Situation dropped -2.2 pts to -66.5. Eurozone ZEW Economic Sentiment rose 21.6 pts to 54.4. Eurozone current situation rose 0.7 pts to 75.7.

“The announcement of imminent vaccine approvals makes financial market experts more confident about the future. The ZEW Indicator of Economic Sentiment increased significantly in December despite the still high numbers of new coronavirus infections. This is most likely due to the announced forthcoming COVID-19 vaccine approvals,” comments ZEW President Achim Wambach on the current expectations.

Also released Swiss unemployment rate rose 0.1% to 3.4% in November. France non-farm payrolls rose 1.6% qoq in Q3. France trade deficit narrowed to EUR -4.8B in October.

Eurozone Q3 GDP growth revised down to 12.5% qoq, France, Spain and Italy led rebound

Eurozone Q3 GDP growth was revised down slightly by -0.1% qoq to 12.5% qoq. That’s still the sharpest increase since the time series started in 1995. Over the year, GDP dropped -4.3% yoy.

EU GDP grew 11.5% qoq in Q3, down -4.2% yoy. France (+18.7%), Spain (+16.7%) and Italy (+15.9%) recorded the sharpest increases of GDP compared to the previous quarter. These countries were also among the highest decreases in the second quarter. Greece (+2.3%), Estonia and Finland (both +3.3%) and Lithuania (+3.8%) had the lowest increases of GDP. Except for Greece, which registered a decrease of 14.1%, these other countries also had less pronounced declines during the second quarter.

Japan PM Suga announced JPY 73.5T fresh stimulus

Japanese Prime Minister Yoshihide Suga announced today a fresh economic stimulus package worth JPY 73.6T. Suga said, “we will maintain employment, keep businesses going, revive the economy and open a path to growth including through green and digital technology.”

A batch of economic data is released from Japan today. Q3 GDP growth was finalized at 5.3% qoq, revised up from 5.0% qoq. In annualized term, GDP grew 22.9%, revised up from 21.4%. In October, labor cash earnings dropped -0.8% yoy versus expectation of -0.7% yoy. Household spending rose 1.9% yoy versus expectation of 2.5% yoy. Current account surplus widened to JPY 1.98%. In November, bank lending rose 6.3% yoy.

Australia NAB business confidence rose to 12, but no improvement in employment

Australia NAB Business Confidence rose to 12 in November, up from 3. Business Conditions rose to 9, up from 2. Trading conditions improved to 17, from 7. Profitability conditions rose to 15, up from 5. Employment conditions, however, was unchanged at -5. NAB noted, “Overall both confidence and conditions are now above average, and stronger than the period right before the pandemic – albeit this partly reflects some ‘snapback’ following the containment of the virus.”

However, “the employment index did not see a further improvement and remains in negative territory. So, while activity is picking up as the economy reopens, businesses are yet to move back into hiring mode. This is not completely surprising with the labour market often lagging developments in activity – so we will keep closely watching this measure,” said Alan Oster, NAB Group Chief Economist

Also released, house price index rose 0.8% qoq in Q3, much better than expectation of -0.4% qoq.

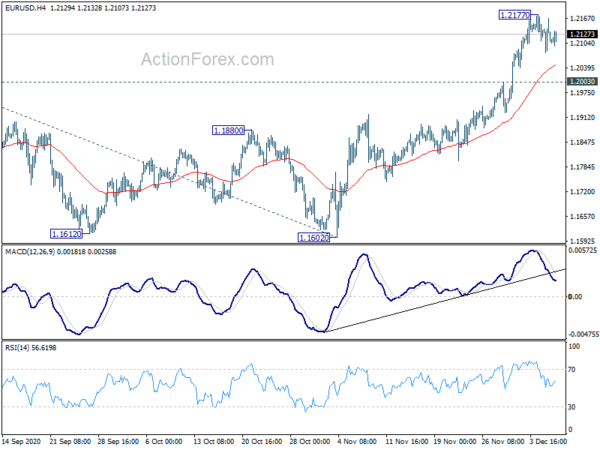

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2070; (P) 1.2118; (R1) 1.2157; More…..

EUR/USD is staying in consolidation from 1.2177 temporary top and intraday bias remains neutral. Downside of retreat should be contained by 1.2003 support to bring another rise. On the upside, break of 1.2177 will target 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q F | 5.30% | 5.00% | 5.00% | |

| 23:50 | JPY | GDP Deflator Y/Y F | 1.20% | 1.10% | 1.10% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Oct | -0.80% | -0.70% | -0.90% | -1.30% |

| 23:30 | JPY | Overall Household Spending Y/Y Oct | 1.90% | 2.50% | -10.20% | |

| 23:50 | JPY | Bank Lending Y/Y Nov | 6.30% | 6.30% | 6.20% | 6.10% |

| 23:50 | JPY | Current Account (JPY) Oct | 1.98T | 1.83T | 1.35T | |

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Nov | 7.70% | 5.20% | ||

| 00:30 | AUD | House Price Index Q/Q Q3 | 0.80% | -0.40% | -1.80% | |

| 00:30 | AUD | NAB Business Confidence Nov | 12 | 5 | ||

| 05:00 | JPY | Eco Watchers Survey: Current Nov | 45.6 | 52.6 | 54.5 | |

| 06:30 | EUR | France Nonfarm Payrolls Q/Q Q3 F | 1.60% | 1.80% | ||

| 06:45 | CHF | Unemployment Rate Nov | 3.40% | 3.40% | 3.30% | |

| 07:45 | EUR | France Trade Balance (EUR) Oct | -4.8B | -5.5B | -5.7B | -5.6B |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 | 12.50% | 12.60% | 12.60% | |

| 10:00 | EUR | Eurozone Employment Change Q/Q Q3 F | 1.00% | 0.90% | 0.90% | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Dec | 55 | 45.2 | 39 | |

| 10:00 | EUR | Germany ZEW Current Situation Dec | -66.5 | -69 | -64.3 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Dec | 54.4 | 37.5 | 32.8 | |

| 11:00 | USD | NFIB Business Optimism Index Nov | 101.4 | 102.6 | 104 | |

| 13:30 | USD | Nonfarm Productivity Q3 | 4.60% | 4.90% | 4.90% | |

| 13:30 | USD | Unit Labor Costs Q3 | -6.60% | -8.90% | -8.90% |