Canadian Dollar is given another boost in early US session after stronger than expected job data. In the background, the Loonie has already risen following higher oil prices. Dollar, on the other hand, has little reaction to much worse than expected non-farm payroll report. For the week, Dollar and Yen remain the worst performing one. Swiss Franc and Euro are the strongest, followed by Canadian.

In Europe, currently, FTSE is up 0.66%. DAX is down -0.06%. CAC is up 0.24%. Germany 10-year yield is up 0.0072 at -0.547. Earlier in Asia, Nikkei dropped -0.22%. Hong Kong HSI rose 0.40%. China Shanghai SSE rose 0.07%. Singapore Strait Times rose 0.62%. Japan 10-year JGB yield dropped -0.0004 to 0.026.

US non-farm payroll rose 245k, well below expectations

US non-farm payroll employment grew only 245k in November, well below expectation of 520k. Overall non-farm payroll employment was below its February level by 9.8m, or 6.5%. Though, unemployment rate dropped to 6.7%, down from 6.9%. But labor force participation rate also edged down to 61.5%. Average hourly earnings rose 0.3% mom, above expectation of 0.1% mom.

Trade deficit widened slightly to USD -63.1B in October, versus expectation of USD -64.7B.

Canada employment rose 62k in Nov, well above expectations

Canada employment rose 62k in November, well above expectation of 22.0k. Unemployment rate dropped to 8.5%, down from 8.9%, much better than expectation of 8.9%.

Trade deficit widened to CAD -3.76B in October, larger than expectation of CAD -3.2B.

BoE Saunders: Effective lower bound interest rate a little below zero

Michael Saunders talked about “Some Monetary Policy Options – If More Support Is Needed” in a speech. He said, “My judgment at present is that the ELB (effective lower bound) for the UK is probably a little below zero, provided appropriate mitigations (eg reserve tiering, bank funding scheme) are in place”. Though, there is “considerable uncertainty over its exact level”, which has several implications.

Firstly, “monetary policy space is still relatively limited. Secondly, “further asset purchases by themselves may be less effective in providing additional stimulus”. Thirdly, “forward guidance can probably only achieve modest extra support”. Fourthly, while there maybe scope to cut Bank Rate further, the approach “should take account of ELB uncertainty”. Fifthly, “complementarities and synergies between policy instruments matter more than usual.”

UK PMI construction rose to 54.7, beat expectations

UK PMI Construction rose to 54.7 in November, up from 53.1, well above expectation of 52.3. Markit noted that house building remained the best-performing category. New order growth was highest for just over six years. But stretched supply chains led to rising costs.

Also released from Europe, Italy retail sales rose 0.6% mom in October versus expectation of -0.2% mom. Germany factory orders rose 2.9% mom in October versus expectation of 1.4% mom.

Australia retail sales rose 1.4% in Oct, Victoria led on reopening

Australia retail sales rose 1.4% mom to AUD 29.6B in October, above expectation of 0.5% mom. Comparing to October 2019, sales rose 7.1% yoy.

Victoria (5.1%) led state and territory rises, and there were also rises for New South Wales (0.7%), Western Australia (1.0 %), and South Australia (0.6%). Queensland (-0.5%), Tasmania (-1.4%), the Northern Territory (-0.6%) fell, while the Australian Capital Territory (-0.1%) was relatively unchanged.

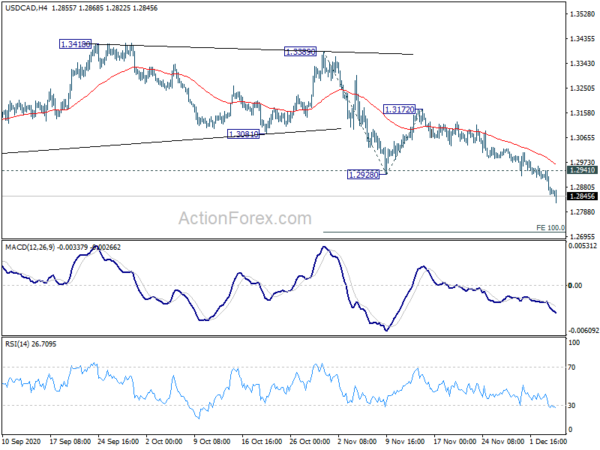

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2832; (P) 1.2886; (R1) 1.2921; More….

Intraday bias in USD/CAD remains on the downside at this point. Current down trend should target 100% projection of 1.3389 to 1.2928 from 1.3172 at 1.2711 next. On the upside, above 1.2941 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Rejection by 55 week EMA is keeping outlook bearish. Such decline should now target 1.2061 (2017 low). In any case, break of 1.3389 resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Oct | 1.40% | 0.50% | 1.60% | |

| 07:00 | EUR | Germany Factory Orders M/M Oct | 2.90% | 1.40% | 0.50% | 1.10% |

| 09:00 | Italy | Retail Sales M/M Oct | 0.60% | -0.20% | -0.80% | |

| 09:30 | GBP | Construction PMI Nov | 54.7 | 52.3 | 53.1 | |

| 13:30 | USD | Nonfarm Payrolls Nov | 245 K | 520K | 638K | 610 K |

| 13:30 | USD | Unemployment Rate Nov | 6.70% | 6.80% | 6.90% | |

| 13:30 | USD | Average Hourly Earnings M/M Nov | 0.30% | 0.10% | 0.10% | |

| 13:30 | USD | Trade Balance (USD) Oct | -63.1 B | -64.7B | -63.9B | -62.1 B |

| 13:30 | CAD | Net Change in Employment Nov | 62 K | 22.0K | 83.6K | |

| 13:30 | CAD | Unemployment Rate Nov | 8.50% | 8.90% | 8.90% | |

| 13:30 | CAD | International Merchandise Trade (CAD) Oct | -3.76 B | -3.2B | -3.3B | |

| 15:00 | USD | Factory Orders M/M Oct | 1.00% | 1.10% |