Markets are in full risk-on mode for now, with DOW closing above 30k handle for the first time overnight. Asian stocks are also generally higher, with strong rally in Nikkei and HSI. WTI oil prices powered through a key near term resistance level while Gold is set to break through 1800 psychological support with next move. Yen, Swiss Franc and Dollar are the worst performing ones for the week while commodity currencies are the strongest, led by New Zealand Dollar. Nevertheless, Euro has the potential to catch up.

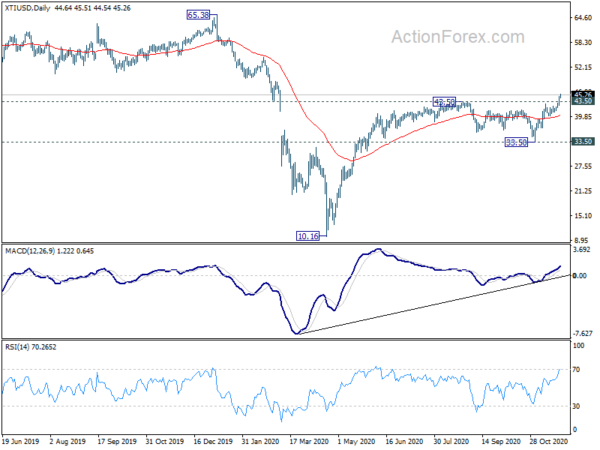

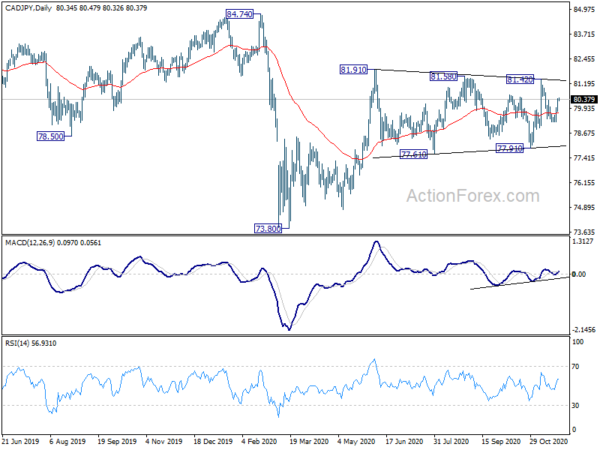

Technically, WTI crude oil’s strong break of 43.50 resistance confirms resumption of the rebound from March’s spike low. 50 psychological level is the next hurdle while 65.38 resistance could be the target for medium term. USD/CAD is set to take on 1.2928 support soon and break there will resume whole fall from 1.4667. CAD/JPY might also take on 81.42 resistance soon too and break will resume the rebound from 73.80.

In Asia, Nikkei is currently up 1.53%. Hong Kong HSI is up 1.14%. China Shanghai SSE is down -0.22%. Singapore Strait Times is up 0.43%. Japan 10-year JGB yield is up 0.0032 at 0.029. Overnight, DOW rose 1.54%. S&P 500 rose 1.62%. NASDAQ rose 1.31%. 10-year yield rose 0.025 to 0.882.

DOW broke 30k as investors welcome Yellen as US treasury secretary

US stocks broke out of range overnight to extend recent record run, with DOW closing at all time high at 30046.24, up 1.54%. Investors cheered the news that former Fed Chair Janet Yellen was picked by Joe Biden as the next Treasury Secretary. Yellen’s position on loose fiscal policy was clear, as she support continuation of extraordinary fiscal support, beyond necessary. Also, as Fed’s interest will stay low for many years to come, the government can afford to have more debt.

With the current rally resumption, DOW is now close to 38.2% projection of 18213.65 to 29119.35 at 26143.77 at 30340.30. Sustained break there will be seen as a vote of confidence on the sustainability of the up trend, and pave the way to 61.8% projection at 32932.93 next. However, rejection by this projection level, would turn focus back to 55 day EMA (now at 28333.92) instead.

Fed Williams: Bond purchases serving their purposes really well right now

New York Fed President John Williams said yesterday that the asset purchases are “serving their purposes really well right now”. The purchases are providing support for smooth market conditions, as well as holding down longer-term yields. The program could be adjusted if needed, but he gave no indication for the need of imminent change. .

On negative interest rates, Williams said they are “a possible option but I think have less benefits relative to costs. Forward guidance and asset purchases would continued to be the “primary tools for policy”.

Separately, St. Louis Fed President James Bullard said “there’s light at the end of the tunnel” with vaccine developments. “In terms of being able to see the end of the crisis, that’s very much a realistic view at this point.”

RBNZ Orr: Financial system not been tested as severely as it could have been

RBNZ Governor Adrian Orr said the New Zealand economy has been “relatively resilient” to the economic shock from the pandemic so far. The financial system “as not been tested as severely as it could have been”. However, he warned, “businesses domestically and internationally face ongoing challenges as fiscal support measures unwind, which will lead to an increase in loan impairments for banks.”

On the topic of house prices, Deputy Governor Geoff Bascand said, “high leverage in the housing sector poses risks if house prices fall sharply or unemployment rises, reducing the ability to service loans”. Hence, RBNZ “intends to re-impose LVR restrictions to guard against continued growth in high-risk lending and ensure that banks remain resilient to a future housing market downturn.”

On the data front

Japan corporate service price index dropped -0.6% yoy in October, matched expectations. Australia construction work done dropped -2.6% in Q3, below expectatio nof -2.0%.

THe US calendar is heavy today, with Q3 GDP revisiion, jobless claims, personal income and spending, durable goods orders, whole sale inventories, and new home sales featured. Also, Fed will release FOMC minutes.

AUD/USD Daily Report

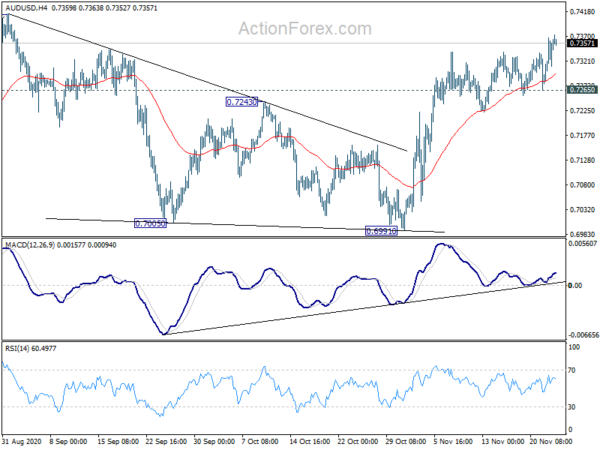

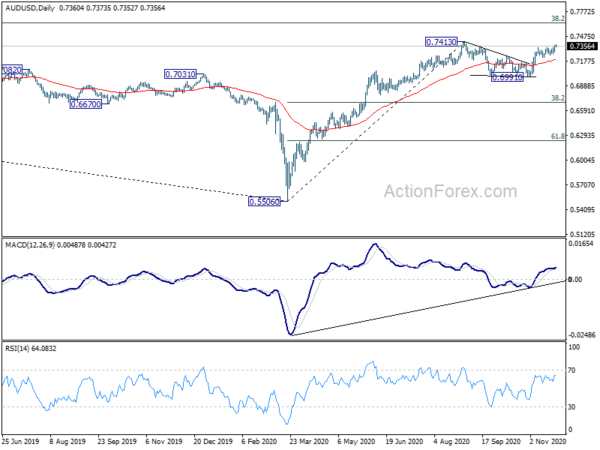

Daily Pivots: (S1) 0.7308; (P) 0.7338; (R1) 0.7392; More….

Intraday bias in AUD/USD remains on the upside at this point, for retesting 0.7413 high. Decisive break there will resume whole rally from 0.5506. Next target is 0.7635 long term fibonacci level. On the downside, though, break of 0.7265 support will turn bias back to the downside, to extend the consolidation from 0.7413 with another falling leg.

In the bigger picture, the sustained trading above 55 week EMA (now at 0.6978) is a sign of medium term bullishness. Nevertheless, AUD/USD will still need to overcome 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635 decisively to indicate completion of long term down trend from 1.1079. Otherwise, current rebound from 0.5506 could still turn out to be a correction in the long term down trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Oct | -0.60% | -0.60% | 1.30% | 1.40% |

| 00:30 | AUD | Construction Work Done Q3 | -2.60% | -2.00% | -0.70% | 0.50% |

| 09:00 | CHF | Credit Suisse Economic Expectations Nov | 2.3 | |||

| 13:30 | USD | GDP Annualized Q3 P | 33.10% | 33.10% | ||

| 13:30 | USD | GDP Price Index Q3 P | -2.00% | 3.70% | ||

| 13:30 | USD | Initial Jobless Claims (Nov 20) | 725K | 742K | ||

| 13:30 | USD | Personal Income M/M Oct | 0.10% | 0.90% | ||

| 13:30 | USD | Personal Spending Oct | 0.40% | 1.40% | ||

| 13:30 | USD | PCE Price Index M/M Oct | 0.20% | |||

| 13:30 | USD | PCE Price Index Y/Y Oct | 1.40% | |||

| 13:30 | USD | Core PCE Price Index M/M Oct | 0.00% | 0.20% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Oct | 1.40% | 1.50% | ||

| 13:30 | USD | Wholesale Inventories Oct P | 0.40% | |||

| 13:30 | USD | Durable Goods Orders Oct | 1.00% | 1.90% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Oct | 0.40% | 0.90% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Nov F | 77 | 77 | ||

| 15:00 | USD | New Home Sales Oct | 972K | 959K | ||

| 15:30 | USD | Natural Gas Storage | 33B | 31B | ||

| 15:30 | USD | Crude Oil Inventories | 0.1M | 0.8M |