Dollar trades notably higher against Japanese Yen and Swiss Franc as comments from a top Fed official revived the speculation of one more hike this year. On the background, risk aversion also receded as threat of imminent war between US and North Korea abated. DOW rebounded 0.62% to close at 21993.71. S&P 500 also gained 1.00% to close at 24.52. Sentiment in Asian session is also positive with Nikkei trading up 1.2% at the time of writing. While the greenback is trying to stage a general rebound, it should be noted that Euro is staying firm too. EUR/USD is bounded in range of 1.1688/1908, maintaining near term bullishness. Also, we don’t see any solid buying to push Dollar index back above 94.28 key near term resistance yet.

Fed Dudley favors another rate hike this year

New York Fed President William Dudley, an influential member of FOMC, affirmed that he remained in "favor of doing another rate hike later this year". He prefers a rate hike despite soft inflation as "1) monetary policy is still accommodative, so the level of short-term rates is pretty low, and 2) and this is probably even more important, financial conditions have been easing rather than tightening". He indicated that "financial conditions are easier today than they were a year ago". Dudley added that it is not unreasonable to announce the balance sheet reduction plan in September. He forecast the portfolio would shrink to between USD 2.5-3.5T after five years.

Market’s pricing of Fed rate path is back to normal. On Friday just after the release of weak CPI, Fed fund futures priced in 4.1% of a rate cut in September and less than 36% chance of a hike by December. Currently, Fed fund futures are pricing 0% chance of a cut in September. Chance of a rate hike by December is now back at around 50%.

German FM Schaeuble hoped ECB to end ultra-loose policy soon

In Eurozone, German Finance Minister Wolfgang Schaeuble said the he hoped ECB’s ultra-loose monetary policy would end in the foreseeable future. He noted that "no one seriously disputes that interest rates are rather too low for the strength of the German economy and the exchange rate of the euro, which is rising now." And in his view, most people expect ECB to take a further step at the upcoming meeting in September.

RBA minutes paint positive outlook

RBA’s minutes for the August meeting revealed that policymakers were optimistic over the global and domestic economies. The central bank forecast that the economy would soon be growing at an annual rate of 3%, assuming that there’s no major change in the Australian dollar. The central bank added that ‘This assumption was one source of uncertainty’. Policymakers went to warn of the Aussie’s strength, suggesting that ‘a further appreciation of the Australian dollar would be expected to result in a slower pick-up in inflation and economic activity than currently forecast’. Meanwhile, RBA also signaled concerns over the housing market and household debt, while appeared more comfortable over the employment situation. More in RBA’s Main Concerns Shifted to Housing Market From Employment

Oil price falls on China slowdown

WTI crude oil dropped notably overnight and is now back trading at 47.6. The decline in crude oil prices was the most in 5 weeks, driven mainly by weakened Chinese demand and bigger-than-expected slowdown in Chinese economic activities at the start of the second quarter. Bloomberg estimated that the country’s oil processing dropped 4.4% ,p, to 10.76M bpd in July. The decline was the biggest since 2014. Chinese industry consultant SCI99 noted that state refineries in northwest and southern regions cut runs to 66.9% and 64.68% of capacity, respectively, also the lowest since 2014, last month. Independent refiners were operating at just around 58.78%, a level not seen since May 5.

UK CPI the main focus in European session

Looking ahead, the economic calendar is very busy today. UK inflation will be a key to watch in European session. Headline CPI in UK is expected to climb back to 2.7% yoy while core CPI might rise back to 2.5% yoy. Sterling was under much selling pressure after last month’s CPI miss. Another downside surprise today will send GBP/USD through 1.2932 key near term support. German GDP and Swiss PPI will be other features of European session.

From US, main focus will be on retail sales which is expected to stage a rebound in July. Empire state manufacturing index, import price, NAHB housing index and business inventories will also be featured.

USD/CHF Daily Outlook

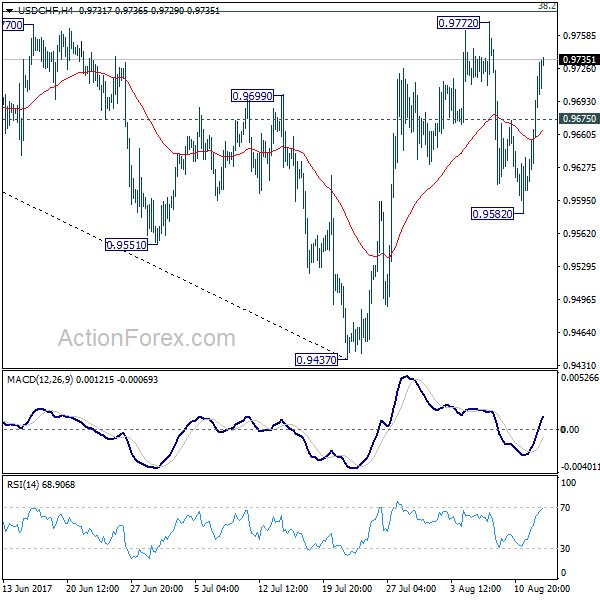

Daily Pivots: (S1) 0.9642; (P) 0.9687; (R1) 0.9765; More…

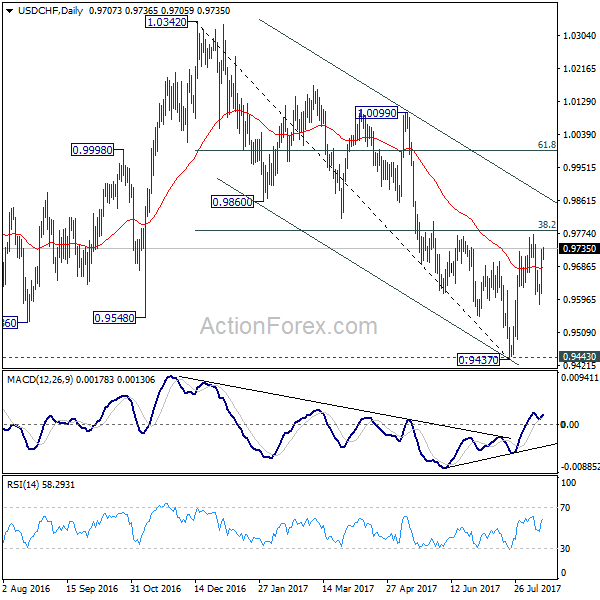

Intraday bias in USD/CHF remains on the upside as rebound from 0.9582 is in progress for retesting 0.9772. Decisive break there will revive the bullish case of reversal. That is, whole decline from 1.0342 has completed at 0.9437 after defending 0.9443 support. USD/CHF should then target channel resistance (now at 0.9880) next. On the downside, below 0.9675 minor support will turn intraday bias neutral first. Also, the pair is bounded inside medium term falling channel and limited below 38.2% retracement of 1.0342 to 0.9437 at 0.9783 for the moment. Break of 0.9582 will dampen our bullish view and turn bias back to the downside for 0.9437. This could also extend the fall from 1.0342 through 0.9437/43 key support level.

In the bigger picture, current development argues that USD/CHF has successfully defended 0.9443 key support level. And long term range trading in 0.9443/1.0342 is extending with another rise. At this point, there is no sign of an up trend yet. Hence, while further rise is expected in USD/CHF, we’ll start to be cautious on loss of momentum above 61.8% retracement of 1.0342 to 0.9437 at 0.9996. However, firm break of 0.9443 will carry larger bearish implication and would target next key support at 0.9072.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Minutes Aug | ||||

| 04:30 | JPY | Industrial Production M/M Jun F | 1.60% | 1.60% | ||

| 06:00 | EUR | German GDP Q/Q Q2 P | 0.70% | 0.60% | ||

| 07:15 | CHF | Producer & Import Prices M/M Jul | 0.00% | -0.10% | ||

| 07:15 | CHF | Producer & Import Prices Y/Y Jul | 0.00% | -0.10% | ||

| 08:30 | GBP | CPI M/M Jul | 0.00% | 0.00% | ||

| 08:30 | GBP | CPI Y/Y Jul | 2.70% | 2.60% | ||

| 08:30 | GBP | Core CPI Y/Y Jul | 2.50% | 2.40% | ||

| 08:30 | GBP | RPI M/M Jul | 0.10% | 0.20% | ||

| 08:30 | GBP | RPI Y/Y Jul | 3.50% | 3.50% | ||

| 08:30 | GBP | PPI Input M/M Jul | 0.40% | -0.40% | ||

| 08:30 | GBP | PPI Input Y/Y Jul | 6.90% | 9.90% | ||

| 08:30 | GBP | PPI Output M/M Jul | 0.00% | 0.00% | ||

| 08:30 | GBP | PPI Output Y/Y Jul | 3.10% | 3.30% | ||

| 08:30 | GBP | PPI Output Core M/M Jul | 0.10% | 0.20% | ||

| 08:30 | GBP | PPI Output Core Y/Y Jul | 2.50% | 2.90% | ||

| 08:30 | GBP | House Price Index Y/Y Jun | 4.30% | 4.70% | ||

| 12:30 | USD | Import Price Index M/M Jul | 0.10% | -0.20% | ||

| 12:30 | USD | Empire State Manufacturing Index Aug | 10.3 | 9.8 | ||

| 12:30 | USD | Advance Retail Sales Jul | 0.40% | -0.20% | ||

| 12:30 | USD | Retail Sales Less Autos Jul | 0.30% | -0.20% | ||

| 14:00 | USD | NAHB Housing Market Index Aug | 64 | 64 | ||

| 14:00 | USD | Business Inventories Jun | 0.40% | 0.30% | ||

| 20:00 | USD | Net Long-term TIC Flows Jun | 91.9B |