Dollar rebounds broadly today while Yen and Swiss Franc lead the way down as risk aversion seems to have eased. US officials tried to talk down the risk of war with North Korea. European indices are trading generally in positive as FTSE is gaining 0.5% while DAX is is up 1.1%. US futures point to higher open where DOW might have triple digit gain. In other markets, Gold starts to feel heavy ahead of 1300 and dips back below 1290 today. WTI crude oil is struggling in tight range below 49. The US economic calendar is empty today. The immediate focus is that US President Donald Trump would order a broad probe of China’s unfair trade practices today including intellectual property thefts.

US officials talk down war risks

U.S. Joint Chiefs of Staff Chairman Joseph Dunford met with South Korean Moon Jae-in for nearly an hour and assured Moon that US will only use military options against North Korea when diplomatic and economic sanctions fail. National Security Adviser H.R. McMaster said that "we’re not closer to war than a week ago, but we are closer to war than we were a decade ago". Central Intelligence Agency Director Mike Pompeo said that "I’ve seen no intelligence that would indicate that we’re in that place today" regarding the chance of a nuclear war.

South Korea President Moon: US will respond calmly and responsibly

South Korean President Moon Jae-in emphasized that "there must be no more war on the Korean peninsula". And he urged that "whatever ups and downs we face, the North Korean nuclear situation must be resolved peacefully." He also side "I am certain the United States will respond to the current situation calmly and responsibly in a stance that is equal to ours." South Korean Vice Defence Minister Suh Choo-suk said that "both the United States and South Korea do not believe North Korea has yet completely gained re-entry technology in material engineering terms."

Japan GDP grew fastest in more than two years

Japan GDP grew 1.0% qoq in Q2, much higher than expectation of 0.6% qoq, more than triple of Q1’s 0.3% qoq. On annualized balance, GDP grew 4% in the period, much higher than Q1’s 1.5% annualized. The quarterly rate was the fastest pace in more than two years. That’s also the sixth straight quarter of expansion as recovery gathered steam. Strong domestic demand, which grew 1.3% qoq, is seen as an encouraging sign of the recovery while private consumption also grew 0.9%. That’s more than enough to offset the -0.5% qoq fall in exports of goods and services. GDP deflator dropped less than expected by -0.4% yoy.

China data showed deeper slowdown

China retails sales grew 10.4% yoy in July, down from 11% a month ago. The market had anticipated a milder moderation to 10.8%. Industrial production expanded 6.4% yoy in July, decelerating from 7.6% in the prior month. The slowdown is much sharper than consensus. Urban fixed asset investment expanded 8.3% in the first 7 months of the year, slowing from 8.6% in the first half of the year. The market had anticipated a steady growth of 8.6%. The slowdown in economic activities in China has been widely expected as the government pledged to deleverage in at attempted to defend and prevent systematic risks. However the dataflow in July suggests that the slowdown came in deeper than expected.

Hammond and Fox published joint Brexit article

In UK, Chancellor of Exchequer Philip Hammond and International Trade Secretary Liam Fox released a joint article on Brexit over the weekend. They reiterated that UK will definitely leave EU in March 2019. And, they emphasized any trade deal will not be the "back door" to stay in EU. But they emphasized that a "time-limited" transition period would "further our national interest and give business greater certainty". One of the key takeaways from the article is that Hammond and Fox appeared to be trying to settle their differences regarding Brexit. And that raised the prospect of a more united cabinet on the issue.

New Zealand retail sales jumped on sporting events

New Zealand retail sales rose strongly by 2.0% qoq versus expectation of 0.7% qoq. Core retail sales rose 2.1% qoq, above expectation of 0.7% qoq. Sporting events were the main drivers in the strong growth. More than 28000 people attended the World Masters Game back in April. And there were 23000 visitors from UK and Ireland for the Lions rugby series in June. But these event driven figures won’t alter RBNZ’s neutral stance.

USD/CHF Mid-Day Outlook

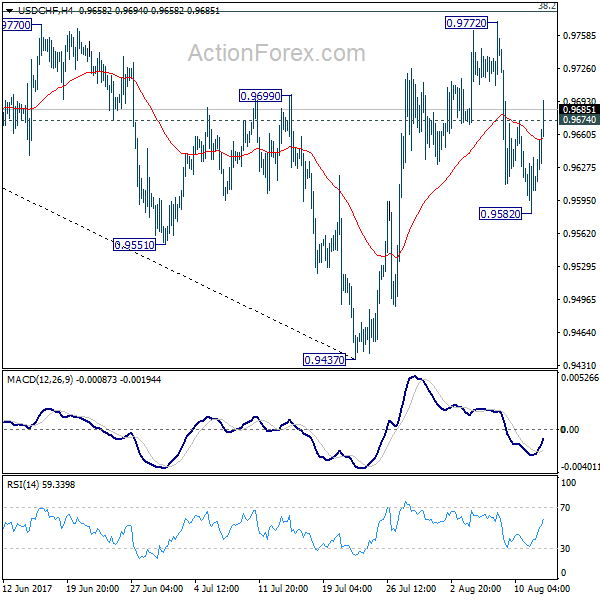

Daily Pivots: (S1) 0.9585; (P) 0.9611; (R1) 0.9641; More…

USD/CHF’s strong rebound and break of 0.9674 minor resistance argues that pull back from 0.9772 is completed at 0.9582 already. Intraday bias is turned back to the upside for 0.9772 first. Decisive break there will revive the bullish case of reversal. That is, whole decline from 1.0342 has completed at 0.9437 after defending 0.9443 support. However, the pair is bounded inside medium term falling channel and limited below 38.2% retracement of 1.0342 to 0.9437 at 0.9783 for the moment. Break of 0.9582 will dampen our bullish view and turn bias back to the downside for 0.9437. This could also extend the fall from 1.0342 through 0.9437/43 key support level.

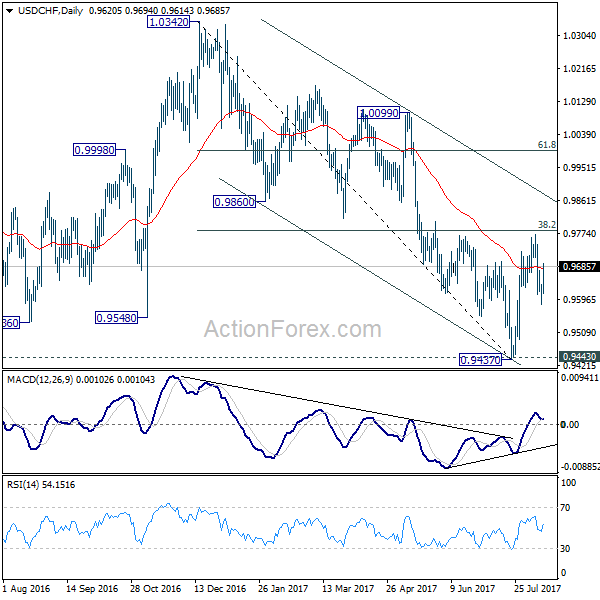

In the bigger picture, current development argues that USD/CHF has successfully defended 0.9443 key support level. And long term range trading in 0.9443/1.0342 is extending with another rise. At this point, there is no sign of an up trend yet. Hence, while further rise is expected in USD/CHF, we’ll start to be cautious on loss of momentum above 61.8% retracement of 1.0342 to 0.9437 at 0.9996. However, firm break of 0.9443 will carry larger bearish implication and would target next key support at 0.9072.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | 2.00% | 0.70% | 1.50% | 1.60% |

| 22:45 | NZD | Core Retail Sales Q/Q Q2 | 2.10% | 0.70% | 1.20% | 1.50% |

| 23:50 | JPY | GDP Q/Q Q2 P | 1.00% | 0.60% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | -0.40% | -0.50% | -0.80% | |

| 2:00 | CNY | Retail Sales Y/Y Jul | 10.40% | 10.80% | 11.00% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jul | 8.30% | 8.60% | 8.60% | |

| 2:00 | CNY | Industrial Production Y/Y Jul | 6.40% | 7.10% | 7.60% | |

| 9:00 | EUR | Eurozone Industrial Production M/M Jun | -0.60% | -0.50% | 1.30% | 1.20% |