Consolidative trading continue as Dollar rises in general in Asian session together, followed by Swiss Franc. On the the other hand, Sterling is reversing some of this week’s gains together with Aussie and Kiwi. News on coronavirus vaccines are unable to give investor sentiments further lift. Instead, concerns are growing on more new cases and restrictions globally. Nevertheless, overall, major pairs and crosses are bounded inside last week’s range.

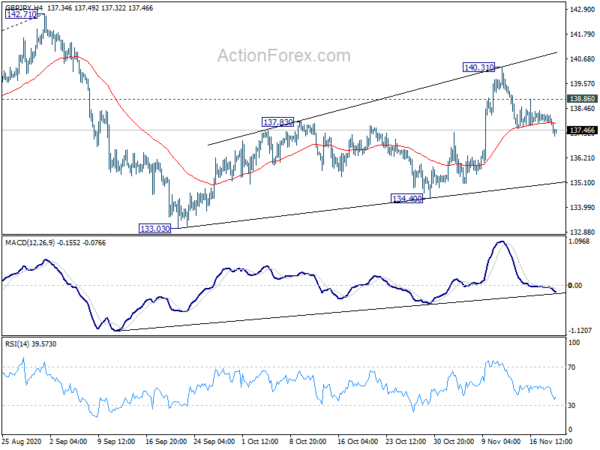

Technically, Yen has advanced a bit with break of 123.18 minor support in EUR/JPY and 137.83 minor support in GBP/JPY. A focus would be on whether AUD/JPY would decisively break equivalent support at 75.47 to indicate completion of near term rebound from 73.13. Gold is also a focus as the fall after rejection by 4 hour 55 EMA is gathering some momentum. Break of 1848.39 would resume whole decline from 2075.18, which could be accompanied by strong rebound in Dollar, in particular against Euro.

In Asia, Nikkei closed down -0.36%. Hong Kong HSI is up -0.49%. China Shanghai SSE is up 0.26%. Singapore Strait Times is down -0.19%.Japan 10-year JGB yield is down -0.0020 at 0.019. Overnight, DOW dropped -1.16%. S&P 500 dropped -1.16%. NASDAQ dropped -0.82%. 10-year yield rose 0.010 to 0.882.

Tokyo raises coronavirus alert to highest as daily cases hit record

Tokyo raised coronavirus alert to the highest level today, as new daily cases hit record high above 500. Governor Yuriko Koike said the government would would take steps to combat the coronavirus “with the view that infections could reach 1,000 cases a day”.

Prim Minister Yoshihide Suga also urged citizens “once again to be vigilant about taking basic precautions… “We ask that people engage in quiet, masked, dining. I will do the same starting today,”

While facing risks of more restrictions, Finance Minister Taro Aso said it’s currently not thinking about giving households cash handouts for a second time.

Australia employment rose 178.8k in Oct, hours worked surged

Australia added 178.8k jobs in October, much better than expectation of -30.0k decline. Full-time jobs rose 97k while part-time jobs rose 81.8k. Unemployment rate rose 0.1% to 7.0%, better than expectation of 7.2%. Also, participation rate jumped notably by 0.9% to 65.8%. Monthly hours worked jumped 21million or 1.2%.

Bjorn Jarvis, head of Labour Statistics at the ABS, said: “This strong increase means that employment in October was only 1.7 per cent below March, and reflects a large flow of people from outside the labour force back into employment. Encouragingly, the rise in employment was also accompanied by a strong rise in hours worked, particularly in Victoria, where hours increased by 5.6 per cent.”

Bundesbank Weidmann: ECB should consider only purchasing climate compliant securities

Bundesbank President Jens Weidmann urged a Financial Times article that the Eurosystem should consider “only purchasing securities or accepting them as collateral for monetary policy purposes if their issuers meet certain climate-related reporting obligations”.

Additionally, central banks should only use credit ratings from agencies that that appropriately include climate-related financial risks.

Weidmman also said governments should do their part on climate, by raising taxes on carbon, or using “cap and trade” schemes. It is not the task of the Eurosystem to penalize or promote certain industries, Weidmann added.

Looking ahead

Swiss trade balance and Eurozone current account will be released in European session. Later in the day, Canada ADP employment, US jobless claims, Philly Fed survey and existing home sales will be featured.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 137.58; (P) 137.90; (R1) 138.06; More…

GBP/JPY’s fall from 140.31 resumes by breaking 137.83 support and 4 hour 55 EMA firmly. The development suggests that corrective rebound from 133.03 has completed with three waves up to 140.31. Large fall from 142.71 might be resuming. Intraday bias is back on the downside for 133.03/134.40 support zone first. On the upside, through, break of 138.86 minor resistance will turn bias back to the upside for 140.31 instead.

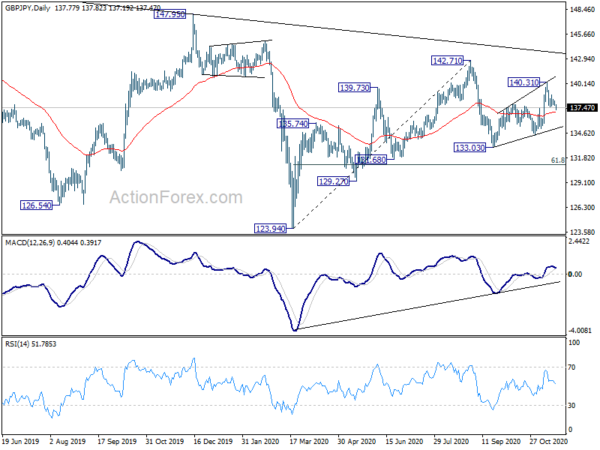

In the bigger picture, rise from 123.94 is seen only as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Employment Change Oct | 178.8K | -30.0K | -29.5K | -42.5K |

| 0:30 | AUD | Unemployment Rate Oct | 7.00% | 7.20% | 6.90% | |

| 7:00 | CHF | Trade Balance (CHF) Oct | 3.28B | |||

| 9:00 | EUR | Eurozone Current Account (EUR) Sep | 19.9B | |||

| 13:30 | CAD | ADP Employment Change Oct | -240.8K | |||

| 13:30 | USD | Initial Jobless Claims (Nov 13) | 707K | 709K | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Nov | 24 | 32.3 | ||

| 15:00 | USD | Existing Home Sales Oct | 6.45M | 6.54M | ||

| 15:30 | USD | Natural Gas Storage | 8B |