Sterling suffers notable selling today after slightly weaker than expected Q3 GDP data. Though, pull back against Euro could be a bigger driver for the profit-taking. Elsewhere, better than expected US job data and worse than expected Eurozone production data were generally ignored. For now, Aussie is following the Pound as the second weakest, then commodity currencies. Euro is surprisingly the strongest one, followed by Swiss Franc and then Yen.

Technically, EUR/GBP recovered notably after breaching 0.8866 key near term support. GBP/USD also retreated after hitting near term channel resistance. Is the Pound’s rally finished? We’ll keep an eye on 0.9068 minor resistance in EUR/GBP and 1.3118 minor support in GBP/USD. Break of these levels would likely flip Sterling’s momentum to the downside for short term.

In Europe, currently, FRTSE is down -0.94%. DAX is down -1.25%. CAC is down -1.53%. German 10-year yield is down -0.0099 at -0.513. Earlier in Asia, Nikkei rose 0.68%. Hong Kong HSI dropped -0.22%. China Shanghai SSE dropped -0.11%. Singapore Strait Times dropped -0.05%. Japan 10-year JGB yield dropped d-0.0087 to 0.031.

US initial jobless claims dropped to 709k, continuing claims dropped to 6.8m

US initial jobless claims dropped -48k to 709 in the week ending November 7, better than expectation of 745k. Four-week moving average of initial claims dropped -33k to 755k. Continuing claims dropped -436k to 6786k in the week ending October 31. Four-week moving average of continuing claims dropped -653k to 7576k.

CPI rose 0.0% mom in October, below expectation of 0.2% mom. CPI core was also flat at 0.0% mom, below expectation of 0.2% mom. Annually, headline CPI slowed to 1.2% yoy, down from 1.4% yoy, missed expectation of 1.3% yoy. CPI core slowed to 1.6% yoy, down form 1.7% yoy, missed expectation of 1.7% yoy.

ECB: Forward EONIA curve does not suggest firm expectation of imminent rate cut

In the monthly Economic Bulletin, ECB said ‘the resurgence in coronavirus (COVID-19) infections presents renewed challenges to public health and the growth prospects of the euro area and global economies… the associated intensification of containment measures is weighing on activity, constituting a clear deterioration in the near-term outlook.”

ECB also noted that “forward curve of the euro overnight index average (EONIA) shifted slightly downwards and remained mildly inverted”. The curve “does not suggest firm market expectations of an imminent rate cut”. Though, “long-term sovereign bond spreads declined steadily across euro area countries, amid expectations of further monetary policy and fiscal support.”

It’s also reiterated that new round of macroeconomic projections in December ” will allow a thorough reassessment of the economic outlook and the balance of risks”. On that basis, ECB will “recalibrate its instruments, as appropriate, to respond to the unfolding situation”.

Eurozone industrial production dropped -0.4% in Sep, well below expectations

Eurozone industrial production dropped -0.4% mom in September, much worse than expectation of 0.9% mom. Production of durable consumer goods fell by -5.3% mom, energy by -1.0% mom, while production of intermediate goods rose by 0.5% mom, capital goods by 0.6% mom and non-durable consumer goods by 2.1% mom.

EU industrial production was unchanged in the month. Among Member States, for which data are available, the largest decreases were observed in Italy (-5.6% mom), Ireland (-4.7% mom) and Portugal (-3.8% mom). The highest increases were registered in Czechia (4.1% mom), Slovakia (3.4% mom) and Poland (3.1% mom).

Also released, Germany CPI was finalized at 0.1% mom, -0.2% yoy in October.

UK GDP grew 1.1% in Sep, still -8.2% below Feb’s level

UK GDP grew 1.1% mom in September, matched market expectations. That’s the fifth consecutive monthly increase. Industrial production rose 0.5% mom, matched expectations. Manufacturing production rose 0.2% mom, below expectation of 0.9% mom. For Q3, GDP grew 15.5% qoq, below expectation of 15.8% qoq.

Still, comparing with February’s pre-pandemic levels, GDP is still down -8.2%. Index of services was down -8.8%. Index of production was down -5.6%. Manufacturing was down -8.1%. Construction was down -7.4%. Agriculture was down -0.7%.

Also from UK, goods trade deficit widened slightly to GBP -9.3B in September versus expectation of GBP -8.8B.

BoE Bailey: No precise date in mind on finishing negative rates study

BoE Governor Andrew Bailey said he didn’t have a “precise date in mind” regarding when to publish the findings regarding the consultation with banks on interest rates. “There’s a great deal of work we have to do with the banks, particularly to work out what’s doable and what needs to be fixed,” he added.

Also, in the current environment, policymakers were “talking about all the tools that could possibly be in the box”. But for the UK, “UK, there isn’t a great call, I think at the moment, for doing more yield curve control at the short end… so I don’t think it’s something that I would see frankly a great need for at the moment.”

BoJ Adachi: It’s difficult to envision a post-COVID-19 economy

Bank of Japan board member Seiji Adachi said in a speech that it’s “difficult to envision a post-COVID-19 economy, at least for the time being”. The “process of making drastic changes to the socioeconomic structure can be painful”. It’s worth considering whether monetary might act as a “sort of safety net” for, or a “means of directly promoting” reforms.

Also, he added, “if the pace of economic recovery is much slower than expected, it is not possible to completely rule out the risk that firms’ positive stance toward the outlook will be lost or that corporate bankruptcies and discontinuation of businesses will increase”. Thus, “it remains necessary in the COVID-19 era to maintain an accommodative monetary policy stance while carefully monitoring economic developments.”

Japan PPI dropped -2.1% yoy in October, matched expectations. Machine orders dropped sharply by -4.4% mom in September versus expectation of -1.1% mom. Tertiary industry index rose 1.8% mom in September.

RBNZ Hawkesby sees less stimulus required

RBNZ Assistant Governor Christian Hawkesby said today that there is no change in forward guidance that OCR will stay at 0.25% until March 2021. Though, “less stimulus is required than we thought in August”, even though a “substantial amount” is still needed. Negative rates is a policy tool for the central bank is needed. But Hawkesby added that it’s less likely if banks use the cheap loans from the new FLP program.

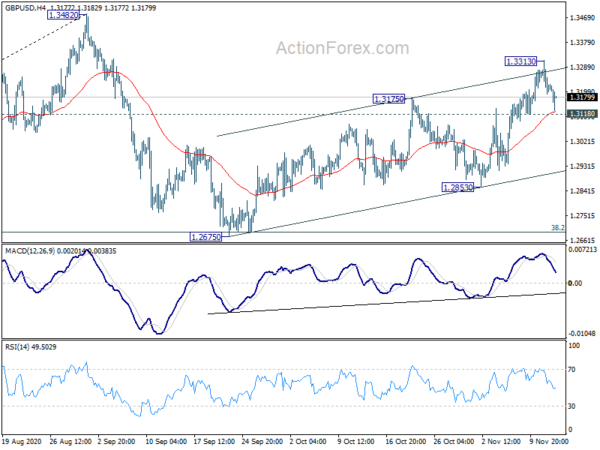

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3171; (P) 1.3243; (R1) 1.3294; More…

Intraday bias in GBP/USD is turned neutral with a temporary top formed at 1.3313, after rejection by near term channel resistance. Though, with 1.3118 minor support intact, another rise mildly in favor. Break of 1.3313 will extend the rebound from 1.2675 to retest 1.3482 high. However, on the downside, break of 1.3118 minor support support will turn bias back to the downside for 1.2853 support instead.

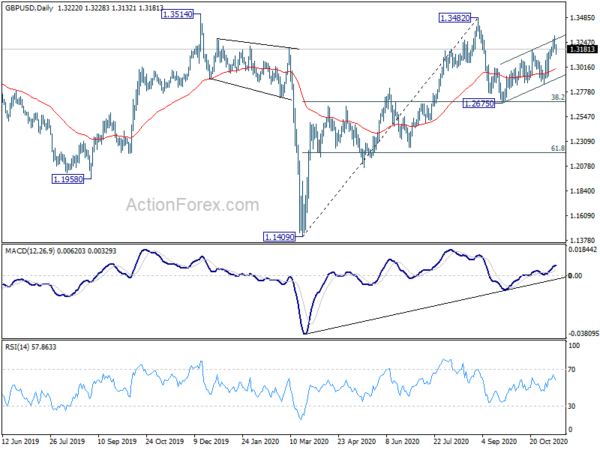

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3307). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Oct | -2.10% | -2.10% | -0.80% | |

| 23:50 | JPY | Machinery Orders M/M Sep | -4.40% | -1.10% | 0.20% | |

| 00:01 | GBP | RICS Housing Price Balance Oct | 68% | 55% | 61% | |

| 04:30 | JPY | Tertiary Industry Index M/M Sep | 1.80% | 0.80% | ||

| 07:00 | EUR | Germany CPI M/M Oct F | 0.10% | 0.10% | 0.10% | |

| 07:00 | EUR | Germany CPI Y/Y Oct F | -0.20% | -0.20% | -0.20% | |

| 07:00 | GBP | GDP M/M Sep | 1.10% | 1.10% | 2.10% | |

| 07:00 | GBP | GDP Q/Q Q3 P | 15.50% | 15.80% | -19.80% | |

| 07:00 | GBP | Goods Trade Balance (GBP) Sep | -9.3B | -8.8B | -9.0B | |

| 07:00 | GBP | Index of Services 3M/3M Sep | 14.20% | 14.60% | 7.10% | |

| 07:00 | GBP | Manufacturing Production M/M Sep | 0.20% | 0.90% | 0.70% | |

| 07:00 | GBP | Manufacturing Production Y/Y Sep | -7.90% | -7.40% | -8.40% | |

| 07:00 | GBP | Industrial Production M/M Sep | 0.50% | 0.50% | 0.30% | |

| 07:00 | GBP | Industrial Production Y/Y Sep | -6.30% | -6.00% | -6.40% | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | -0.40% | 0.90% | 0.70% | 0.60% |

| 13:15 | GBP | NIESR GDP Estimate (3M) Oct | 10.20% | 20.10% | 15.20% | 15.50% |

| 13:30 | USD | Initial Jobless Claims (Nov 6) | 709K | 745K | 751K | 757K |

| 13:30 | USD | CPI M/M Oct | 0.00% | 0.20% | 0.20% | |

| 13:30 | USD | CPI Y/Y Oct | 1.20% | 1.30% | 1.40% | |

| 13:30 | USD | CPI Core M/M Oct | 0.00% | 0.20% | 0.20% | |

| 13:30 | USD | CPI Core Y/Y Oct | 1.60% | 1.70% | 1.70% | |

| 16:00 | USD | Crude Oil Inventories | -2.0M | -8.0M |