The forex markets turned mixed in Asian session today as the boost from coronavirus vaccine faded quickly. The close in US stocks overnight was rather disappointing and DOW ended up just 2.95%. NASDAQ has indeed closed with -1.53% loss. In the currency markets, Yen is trying to recover but momentum is relatively weak. US and Canadian Dollar are currently the weaker ones, while Sterling and Kiwi are firm.

Technically, development in Dollar has been positive this week with the help from surging treasury yields. USD/JPY’s break of 105.34 resistance suggest short term bottoming. Nevertheless, Dollar still needs to overcome equivalent resistance at 0.9207 in USD/CHF. Furthermore 1.1791 minor support in EUR/USD, 1.3092 minor support in GBP/USD and 0.7221 minor support need taken out to violate near term bullishness in the pairs. As for stocks, 11394.20 in NASDAQ, the upper side of the first gap, needs to be defended well to maintain near term bullishness. Break will be an early sign of a bearishness development.

In Asia, currently, Nikkei is up 0.47%. Hong Kong HSI is up 0.80%. China Shanghai SSE is down -0.19%. Singapore Strait Times is up 2.66%. Japan 10-year JGB yield is up 0.0194 at 0.038. Overnight, DOW rose 2.95% to close at 29157.97, after hitting as high as 29933.83. S&P 500 rose 1.17%. NASDAQ dropped -1.53%. 10-year yield closed up 0.138 at 0.958, barely above 0.957 key resistance.

Fed Kaplan: Coronavirus trends are in the wrong direction

Dallas Fed President Robert Kaplan warned that the “trends are in the wrong direction” regarding coronavirus trends. He’s still expecting the economy to be around -2.5% smaller by year end, comparing to last year. Growth is expected to be around 3.5% next year. However, rising coronavirus spread could drag down growth this year and early next year.

Separately, Cleveland Fed President Loretta Mester said Fed Chair Jerome Powell will discuss with the Treasury to decide whether to extend the emergency lending programs beyond the end of the year. But in her view, “but in my view, if it were me, I would extend all of them,” Mester said. “The fact that they exist provides confidence to the markets.”

Japan mulls new stimulus package that attracts private investment

Japanese Economy Minister Yasutoshi Nishimura said the cabinet is instructed by Prime Minister Yoshihide Suga to compile a new stimulus package as soon as possible. In particular, Nishimura said, “we’ll want to consider government spending that will attract private investment.” Also, the measures will focus on shifting to a “green society”. For now, the size of the new package hasn’t been decided yet.

Finance Minister Taro Aso said the pace of recovery in private demand was fast, as seen in the automotive sector.

Released from Japan, bank lending rose 6.2% yoy in October, above expectation of 5.6% yoy. Current account surplus narrowed to JPY 1.35T, below expectation of JPY 1.79T.

Australia NAB business confidence jumped to 5, but remains fragile

Australia NAB Business Confidence jumped and turned positive to 5 in October, up from September’s -4. It’s also the highest reading since mid-2019. Business confidence recorded just slight improvement from 0 to 1. Looking at some details, trading conditions rose from 4 to 8. Profitability rose from 1 to 4. But employment remained negative, ticked higher from -6 to -5.

NAB said: “The survey continues to show that the economy has rebounded from the sharp fall in activity in H1 2020 and will likely continue to recover as the economy reopens. However, it will likely take some time for activity to fully recover, with capacity utilisation restored and the pipeline line of work replenished. The improvement in confidence is encouraging but remains fragile, and it will likely remain that way until a vaccine is available. In the interim, confidence will be an important factor for how quickly businesses expand employment and capex as demand normalises.”

Looking ahead

UK job data and Germany ZEW economic sentiment will be the main focuses in European session. France and Italy will release industrial output. US economic calendar continues to be empty today.

USD/CHF Daily Outlook

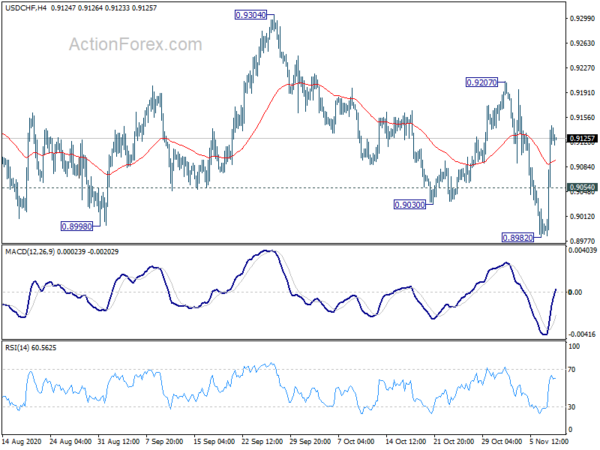

Daily Pivots: (S1) 0.9035; (P) 0.9089; (R1) 0.9194; More…

USD/CHF’s strong break of 0.9082 minor resistance suggests short term bottoming at 0.8982, after breaching 0.8998 support. Intraday bias is turned back to the upside for 0.9027 resistance. Decisive break there would be an early sign of bullish reversal and target 0.9304 resistance for confirmation. On the downside, below 0.9054 minor support will turn bias back to the downside for 0.8982 low instead.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. On resumption, next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. Nevertheless, strong break of 0.9304 resistance will be an early sign of trend reversal and turn focus back to 0.9901 key resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Oct | 6.20% | 5.60% | 6.40% | |

| 23:50 | JPY | Current Account (JPY) Sep | 1.35T | 1.79T | 1.65T | 1.66T |

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Oct | 5.20% | 6.10% | ||

| 0:30 | AUD | NAB Business Confidence Oct | 5 | -4 | ||

| 0:30 | AUD | NAB Business Conditions Oct | 1 | 0 | ||

| 1:30 | CNY | PPI Y/Y Oct | -2.10% | -2.00% | -2.10% | |

| 1:30 | CNY | CPI Y/Y Oct | 0.50% | 0.80% | 1.70% | |

| 5:00 | JPY | Eco Watchers Survey: Current Oct | 54.5 | 50.9 | 49.3 | |

| 7:00 | GBP | Claimant Count Change Oct | 78.8K | 28.0K | ||

| 7:00 | GBP | Claimant Count Rate Oct | 7.60% | |||

| 7:00 | GBP | ILO Unemployment Rate (3M) Sep | 4.80% | 4.50% | ||

| 7:00 | GBP | Average Earnings Excluding Bonus 3M/Y Sep | 1.50% | 0.80% | ||

| 7:00 | GBP | Average Earnings Including Bonus 3M/Y Sep | 1.00% | 0.00% | ||

| 7:45 | EUR | France Industrial Output M/M Sep | 0.30% | 1.30% | ||

| 9:00 | EUR | Italy Industrial Output M/M Sep | -1.10% | 7.70% | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Nov | 40 | 56.1 | ||

| 10:00 | EUR | Germany ZEW Current Situation Nov | -65 | -59.5 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Nov | 43.3 | 52.3 | ||

| 11:00 | USD | NFIB Business Optimism Index Oct | 104.3 | 104 |