Dollar recovers broadly today as the markets are calmed down from the concerns over US-North Korea tensions. Meanwhile, Yen and Swiss Franc also soften mildly as a result. There was no further drastic development regarding the tension during the weekend. Chinese President Xi Jinping had a telephone call with US President Donald Trump on Saturday and urged a peaceful resolution to the issue, and all sides to avoid words or actions that escalate the tensions. Focus will temporary turn back to minutes of Fed, RBA and ECB, as well as a large number of global economic data. But markets will also keep one eye on the US-North Korea development.

Japan GDP grew fastest in more than two years

Japan GDP grew 1.0% qoq in Q2, much higher than expectation of 0.6% qoq, more than triple of Q1’s 0.3% qoq. On annualized balance, GDP grew 4% in the period, much higher than Q1’s 1.5% annualized. The quarterly rate was the fastest pace in more than two years. That’s also the sixth straight quarter of expansion as recovery gathered steam. Strong domestic demand, which grew 1.3% qoq, is seen as an encouraging sign of the recovery while private consumption also grew 0.9%. That’s more than enough to offset the -0.5% qoq fall in exports of goods and services. GDP deflator dropped less than expected by -0.4% yoy.

China data showed deeper slowdown

China retails sales grew 10.4% yoy in July, down from 11% a month ago. The market had anticipated a milder moderation to 10.8%. Industrial production expanded 6.4% yoy in July, decelerating from 7.6% in the prior month. The slowdown is much sharper than consensus. Urban fixed asset investment expanded 8.3% in the first 7 months of the year, slowing from 8.6% in the first half of the year. The market had anticipated a steady growth of 8.6%. The slowdown in economic activities in China has been widely expected as the government pledged to deleverage in at attempted to defend and prevent systematic risks. However the dataflow in July suggests that the slowdown came in deeper than expected.

Hammond and Fox published joint Brexit article

In UK, Chancellor of Exchequer Philip Hammond and International Trade Secretary Liam Fox released a joint article on Brexit over the weekend. They reiterated that UK will definitely leave EU in March 2019. And, they emphasized any trade deal will not be the "back door" to stay in EU. But they emphasized that a "time-limited" transition period would "further our national interest and give business greater certainty". One of the key takeaways from the article is that Hammond and Fox appeared to be trying to settle their differences regarding Brexit. And that raised the prospect of a more united cabinet on the issue.

New Zealand retail sales jumped on sporting events

New Zealand retail sales rose strongly by 2.0% qoq versus expectation of 0.7% qoq. Core retail sales rose 2.1% qoq, above expectation of 0.7% qoq. Sporting events were the main drivers in the strong growth. More than 28000 people attended the World Masters Game back in April. And there were 23000 visitors from UK and Ireland for the Lions rugby series in June. But these event driven figures won’t alter RBNZ’s neutral stance.

Fed, RBA and ECB minutes to highlight a busy week

For the rest of today, Eurozone industrial production is the only feature in the calendar. Three central banks will release meeting minutes this week including Fed, RBA and ECB. Fed is generally expected to start unwinding the balance sheet in September. But the focus is on Fed official’s mind regarding a December rate hike. On the other hand, markets would like to get more confirmation on whether ECB would announce a tapering plan in September or October meeting.

In addition to that UK will release a string of key data including CPI, employment a retail sales. Sterling has been under pressure against Euro after last month’s CPI disappointment. Further downside supply in UK inflation data will drag the Pound lower. From Eurozone, GDP will be the main focus for confirming underlying strength in the recovery. From US a large batch of data will be released with main focus on retail sales. Other data to watch include Australia employment and Canada CPI.

Here are some highlights for the week ahead:

- Tuesday: RBA minutes; German GDP; Swiss PPI; UK CPI and PPI; US retail sales, Empire state manufacturing, import prices, business inventories, NAHB housing market index

- Wednesday: Australia wage price index; Eurozone GDP, Italy GDP; UK employment; US housing starts and building permits; FOMC minutes

- Thursday: New Zealand PPI; Australia employment; Japan trade balance; UK retail sales; Eurozone trade balance, CPI final, ECB meeting accounts; US jobless claims, Philly Fed survey, industrial production, leading indicators.

- Friday: German PPI, Eurozone current account; Canada CPI; US U of Michigan sentiment

EUR/JPY Daily Outlook

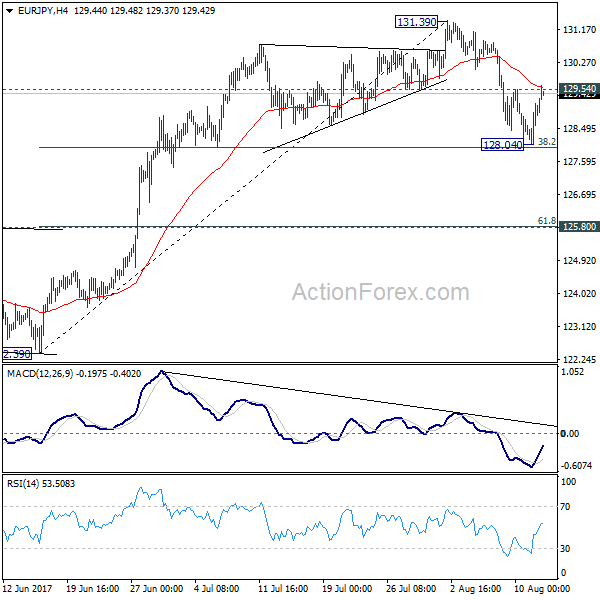

Daily Pivots: (S1) 128.33; (P) 128.74; (R1) 129.44; More…

EUR/JPY’s recovery from 128.04 extends higher today. Breach of 129.54 minor resistance argues that pull back from 131.39 has completed at 128.04, supported by 38.2% retracement of 122.39 to 131.39 at 127.95 as expected. Intraday bias is turned back to the upside for retesting 131.39. But break there is needed to confirm up trend resumption. Otherwise, we’d likely see more consolidation first. On the downside, sustained break of 127.95, however, will bring deeper decline to 125.80 cluster support (61.8% retracement at 125.82) before completing the correction.

In the bigger picture, the down trend from 149.76 (2014 high) is completed at 109.03 (2016 low). Current rally from 109.03 should be at the same degree as the fall from 149.76 to 109.03. Further rise is expected to 61.8% retracement of 149.76 to 109.03 at 134.20. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. Medium term outlook will remain bullish as long as 124.08 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q2 | 2.00% | 0.70% | 1.50% | 1.60% |

| 22:45 | NZD | Core Retail Sales Q/Q Q2 | 2.10% | 0.70% | 1.20% | 1.50% |

| 23:50 | JPY | GDP Q/Q Q2 P | 1.00% | 0.60% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | -0.40% | -0.50% | -0.80% | |

| 2:00 | CNY | Retail Sales Y/Y Jul | 10.40% | 10.80% | 11.00% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jul | 8.30% | 8.60% | 8.60% | |

| 2:00 | CNY | Industrial Production Y/Y Jul | 6.40% | 7.10% | 7.60% | |

| 9:00 | EUR | Eurozone Industrial Production M/M Jun | -0.50% | 1.30% |