Dollar’s selloff continues today despite stronger than expected employment data. Though, selling focus has turned to against Euro and Swiss Franc. Australian Dollar is taking a breather, together with global stock markets. There is no doubt that Dollar will end as the worst performing one for the week, followed by Yen. Commodity currencies will stay end as the strongest ones.

Technically, EUR/USD break of 1.1880 resistance is another evidence of down trend resumption in Dollar. Further rise should now be seen to 1.2011 resistance for confirmation. USD/CHF has already taken the lead by breaking 0.8998 low. 0.7413 resistance in AUD/USD, and 1.2994 low in USD/CAD are the next levels to watch, probably next week.

In Europe, FTSE is up 0.13%. DAX is down -0.67%. CAC is down -0.56%. German 10-year yield is up 0.009 at -0.623. Earlier in Asia, Nikkei rose 0.91%. Hong Kong HSI rose 0.07%. China Shanghai SSE dropped -0.24%. Singapore Strait Times dropped -0.38%. Japan 10-year JGB yield rose 0.0009 to 0.022.

US NFP grew 638k in Oct, unemployment rate dropped to 6.9%

US non-farm payroll employment grew 638k in October, above expectation of 600k. Unemployment dropped sharply to 6.9%, down from 7.9%, well below expectation of 7.7%. Labor force participation rate also rose 0.3% to 61.7%. Average hourly earnings rose just 0.1% mom, below expectation of 0.2% mom.

Canadian job market grew 83.6k in October, above expectation of 59.0k. Most of the growth came from full-time work at 69k. Unemployment rate ticked down slightly by 0.1% to 8.9%.

From Europe, Italy retail sales dropped -0.8% mom in September, better than expectation of -1.4% mom. Swiss foreign currency reserves rose slightly to CHF 871k in October. France trade deficit narrowed to EUR -5.7B in September. Germany industrial production rose 1.6% mom in September, below expectation of 2.9% mom.

Released in Asia, Japan labor cash earnings dropped -0.9% yoy in September versus expectation of -1.1% yoy. Household spending dropped -10.2% yoy, versus expectation of -10.7% yoy.

RBA SoMP: Interest rates have been lowered as far as it makes sense

In the Statement on Monetary Policy, RBA noted that ” despite the somewhat better recent outcomes in Australia, the recovery was expected to be extended and bumpy”. Hence, “to further support the recovery and complement the significant support coming from fiscal policy, the board therefore decided to introduce a further package of measures.”.

The measures announced on Tuesday included reduction in cash rate target and 3-year AGS yield target to 0.10%. Bedsides, measures include purchases of AUD 100B of government bonds of maturities from 5 to 10 years for the next 6 months.

On interest rate, RBA said “interest rates have been lowered as far as it makes sense to do so in the current environment… The board considers that there is little to be gained from short-term interest rates moving into negative territory and continues to view a negative policy rate as extraordinarily unlikely.”

“At its future meetings, the board will be closely monitoring the impact of bond purchases on the economy and on market functioning, as well as the evolving recovery from the pandemic, including the outlook for jobs and inflation,” the statement noted.

In the new economic projections, RBA expected a shallower GDP contraction of -4% in the year ended 2020. But 2021 GDP rebound was kept unchanged at 5%. Unemployment rate would peak lower at 8% this year (versus 10%) and drop back to 6.5% by the end of 2021 (versus 6.5%). 2020 inflation was revised down to 0.50% then climb back to 1.0% in December 2021 (unchanged).

EUR/USD Mid-Day Outlook

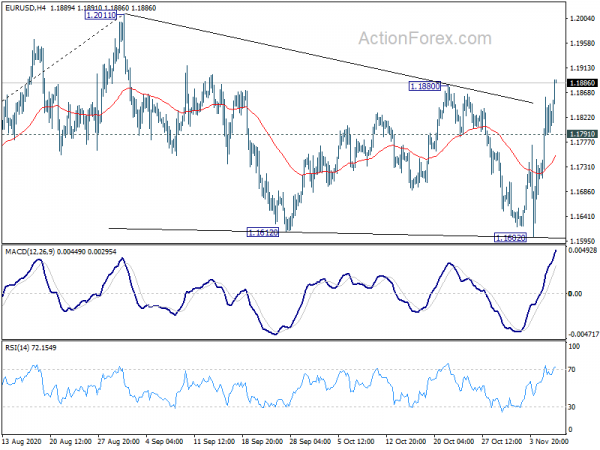

Daily Pivots: (S1) 1.1741; (P) 1.1800; (R1) 1.1890; More…..

EUR/USD’s rally continues today and hits as high as 1.1890 so far. Break of 1.1880 resistance adds to the bullish case that consolidation from 1.2011 has completed at 1.1602. Intraday bias remains on the upside for 1.2011 and break will resume larger rally from 1.0635. On the downside, though, below 1.1791 minor support will mix up the outlook and turn intraday bias neutral first.

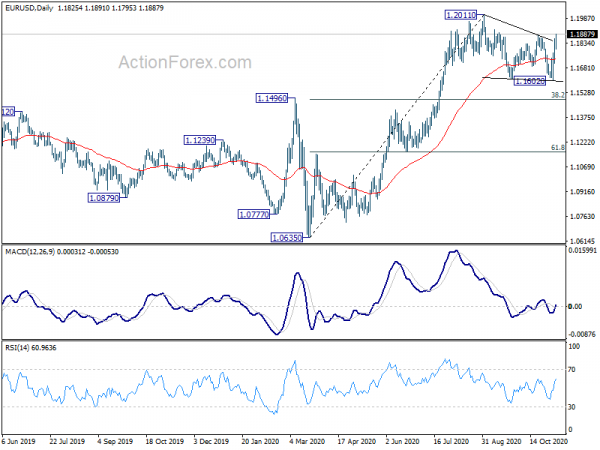

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Services Index Oct | 51.4 | 36.2 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Sep | -0.90% | -1.10% | -1.30% | |

| 23:30 | JPY | Overall Household Spending Y/Y Sep | -10.20% | -10.70% | -6.90% | |

| 00:30 | AUD | RBA Monetary Policy Statement | ||||

| 02:00 | NZD | RBNZ Inflation Expectations Q4 | 1.59% | 1.43% | ||

| 07:00 | EUR | Germany Industrial Production M/M Sep | 1.60% | 2.90% | -0.20% | 0.50% |

| 07:45 | EUR | France Trade Balance (EUR) Sep | -5.7B | -7.7B | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Oct | 871B | 874B | ||

| 09:00 | Italy | Retail Sales M/M Sep | -0.80% | -1.40% | 8.20% | |

| 13:30 | USD | Nonfarm Payrolls Oct | 638K | 600K | 661K | 672K |

| 13:30 | USD | Unemployment Rate Oct | 6.90% | 7.70% | 7.90% | |

| 13:30 | USD | Average Hourly Earnings M/M Oct | 0.10% | 0.20% | 0.10% | 0.00% |

| 13:30 | CAD | Net Change in Employment Oct | 83.6K | 59.0K | 378.2K | |

| 13:30 | CAD | Unemployment Rate Oct | 8.90% | 9.00% | 9.00% | |

| 15:00 | USD | Wholesale Inventories Sep F | -0.10% | -0.10% | ||

| 15:00 | CAD | Ivey PMI Oct | 55.2 | 54.3 |