Movements in the forex markets in reaction to the US elections were relatively indecisive, comparing to the strong risk-on moves in the stocks. There is no clear follow through selling in Dollar and Yen so far, while commodity currencies are struggling to extend gains. Focuses will now turn to BoE monetary policy decision first, where QE expansion is expected. Fed will take the spotlight later in the day but it’s more likely a non-event than not.

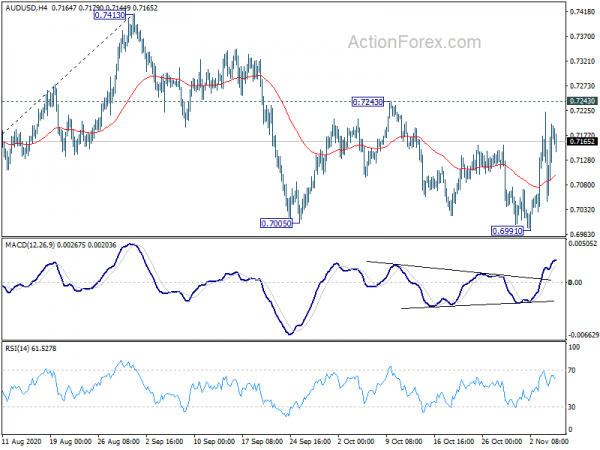

Technically, we’re continue to keep an eye on 104.00 support in USD/JPY. Sustained break there will confirm resumption of whole decline from 111.71. Any downside acceleration toward 101.18 support could spillover of selloff in Dollar elsewhere. As for other Dollar pairs, 1.1880 resistance in EUR/USD and 0.7243 resistance in AUD/USD would carry some significance.

In Asia, currently, Nikkei is up 1.34%. Hong Kong HSI is up 2.72%. China Shanghai SSE is up 0.95%. Singapore Strait Times is up 2.19%. Japan 10-year JGB yield is down -0.178 at 0.021. Overnight, DOW rose 1.34%. S&P 500 rose 2.21%. NASDAQ rose 3.85%. 10-year yield dropped -0.114 to 0.768.

NASDAQ and S&P 500 ready to resume record run, riding on election results

The US stock markets responded to US elections result in very bullish way. NASDAQ, in particular, shone with 3.85% gain while S&P 500 also added 2.21% overnight. Both indices are set to resume the record runs.

NASDAQ’s consolidation from 12074.06 looked completed with three waves to 10822.557, after breaching 55 day EMA twice. Retest of 12074.06 could bee seen soon, probably next week. Sustained break there would confirm resumption of the long term up trend. Next medium term target is tentatively seen as at 61.8% projection of 6631.42 to 12074.06 from 10822.57 at 14186.12.

Similar picture is seen in S&P 500. Consolidation form 3588.11 could have completed with three waves to 3233.94. Upside breakout could be seen soon. Firm break of 3588.11 will confirm resumption of long term up trend. Next target is seen as at 61.8% projection of 2191.86 to 3588.11 from 3233.94 at 4096.82.

Hong Kong HSI surges on optimism over US-China relations

Hong Kong stocks responded exceptionally well to US election results, which could an indication on optimism over US-China relations going forward. This week’s rally suggests that rise from 23124.25 is the third led of the pattern from 21139.16. Test of 26782.61 resistance should be seen next. Firm break there will confirm resumption of the whole rise from 21139.16.

Nevertheless, the price actions from 21139.26 are still rather corrective looking. Firm break of 55 week EMA would be a sign of medium term reversal. Yet, the key resistance level lies in long term channel resistance (now at around 27500). Reactions to this resistance could reflect the real development in US-China relations, after the initial honey moon period.

New Zealand ANZ business confidence ticked lower to -15.6, activity outlook also steady

Preliminary reading of New Zealand ANZ Business Confidence in November showed slight improvement to -15.6, up from October’s -15.7. Own Activity outlook dropped slightly to 4.6, down from 4.7. Looking at some details, export inte3ntions improved from -3.5 to 0.0. Investment intentions dropped from 1.9 to -3.3. Employment intentions rose from -2.5 to -1.4. Inflation expectations rose from 1.38 to 1.55.

ANZ said, “now that the wage subsidy has wound up and the lost summer for tourism looms large, business resilience will be tested. But it’s fair to say the starting point looks much more positive than looked likely a few months ago.”

From Australia, exports of goods and services rose 4% mom to AUD 33.7B in September. Imports dropped -6% mom to AUD 28.1B . Trade surplus widened to AUD 5.63B, up from AUD 2.62B, above expectation of AUD 3.70B.

BoE and Fed to highlight the day

Looking ahead, two central bank meetings will be the main focuses today. BoE is generally expected to scale up the asset purchase target to GBP 845B. Fed is expected to keep monetary policy unchanged. Here are some suggested readings:

- BOE Preview – Expanding QE Size while Keeping Rate Unchanged at Record Low

- Bank of England Set to Boost QE as Lockdown and Brexit Cause Economic Havoc

- FOMC Preview – Fed to Discuss Asset Purchases Arrangement as Balance Sheet Surpasses US$ 7 Trillion

- Fed Meeting and NFP Eyed as Markets Digest Election

On the data front, UK will release construction PMI and Eurozone will release retail sales. US will release jobless claims and non-farm productivity.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7071; (P) 0.7123; (R1) 0.7218; More….

Intraday bias in AUD/USD remains neutral at this point. On the upside, sustained break of 0.7243 resistance should confirm completion of the consolidation pattern from 0.7413. Intraday bias will be turned back to the upside for retesting 0.7413 high first. On the downside, through, break of 0.6991 will resume the correction to 38.2% retracement of 0.5506 to 0.7413 at 0.6685.

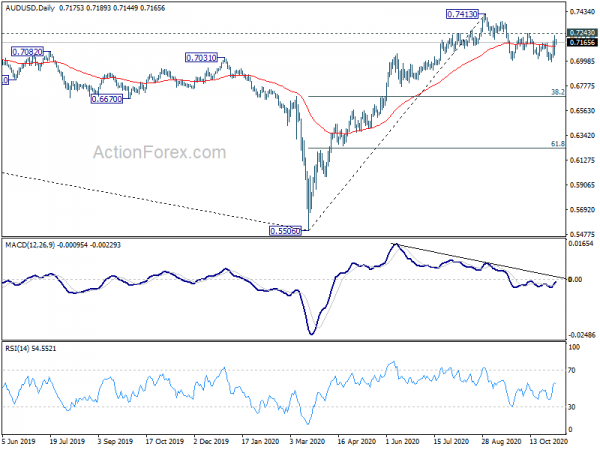

In the bigger picture, while rebound from 0.5506 was strong, there is not enough evidence to confirm bullish trend reversal yet. That is, it could be just a correction inside the long term down trend. Sustained trading back below 55 week EMA (now at 0.6927) will favor the bearish case and argue that the rebound has completed. Focus will be turned back to 0.5506 low. On the upside, break of 0.7413 will extend the rise from 0.5506 to 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Nov P | -15.6 | -15.7 | ||

| 00:30 | AUD | Trade Balance (AUD) Sep | 5.63B | 3.70B | 2.64B | 2.62B |

| 06:45 | CHF | SECO Consumer Climate Q4 | -12 | |||

| 07:00 | EUR | Germany Factory Orders M/M Sep | 2.60% | 4.50% | ||

| 07:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 07:00 | GBP | BoE Asset Purchase Facility | 845B | 745B | ||

| 07:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 07:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 09:30 | GBP | Construction PMI Oct | 55 | 56.8 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | -1.20% | 4.40% | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Oct | 185.90% | |||

| 13:30 | USD | Initial Jobless Claims (Oct 30) | 746K | 751K | ||

| 13:30 | USD | Nonfarm Productivity Q3 P | 3.60% | 10.10% | ||

| 13:30 | USD | Unit Labor Costs Q3 P | -10.00% | 9.00% | ||

| 15:30 | USD | Natural Gas Storage | -34B | 29B | ||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |