Global stocks surge sharply as investors seem to be very optimistic on the result out of US elections. Major European indices are currently up around 2% while DOW future is up 400 pts. Dollar is sold off sharply, together with Yen and Swiss Franc. Australian Dollar left RBA’s rate cut behind and lead the chart on strong risk appetite. New Zealand Dollar and Euro are currently the next strongest.

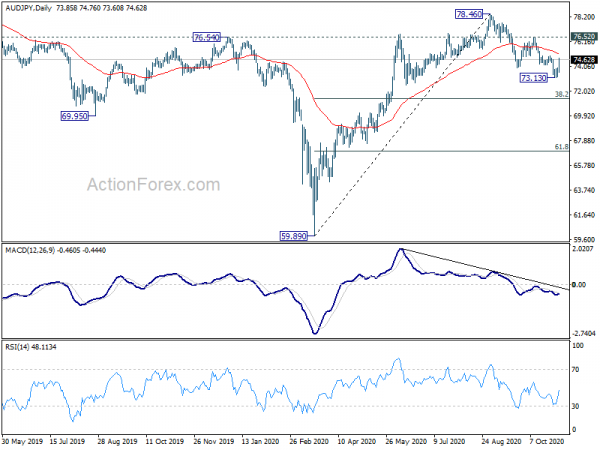

Technically, while Dollar suffers steep selling today, EUR/USD is kept well below 1.1880 resistance so far. GBP/USD is held below 1.3175 resistance too. Even the stronger AUD/USD is held below 0.7157 near term resistance. There is no clear confirmation of Dollar’s reversal yet. At the same time, we’ll also watch AUD/JPY for sign of full return of risk-on markets. Firm break of 55 day EMA (now at 75.13) will be the first signal. Break of 76.52 resistance would be seen as a confirmation.

In Europe, currently, FTSE is up 2.04%. DAX is up 1.86%. CAC is up 2.01%. German 10-year yield is up 0.0120 at -0.625. Earlier in Asia, Hong Kong HSI rose 1.96%. China Shanghai SSE rose 1.27%. Singapore Strait Times rose 2.21%.

EU to consider legal actions as UK missed response deadline

EU confirmed today that it received not response from the UK regarding the breach of the Brexit Withdrawal Agreement due to the Internal Market Bill. EU is now considering legal actions.

“We sent a letter of formal notice on 1 October to the UK for breaching its obligations under the Withdrawal Agreement.,” European Commission Spokespersona Daniel Ferrie said. As you know it had until the end of the month to submit its observations to that letter. To date I can confirm that the EU has received no reply from the UK. Therefore we are considering next steps, including issuing a reasoned opinion.”

Ferrie added: “More generally I would recall the EU is fully committed to achieving the full, timely and effective implementation of the Withdrawal Agreement within the remaining time available. That’s why we started the infringement procedure on 1 October. “This dispute will have to be resolved.”

Swiss CPI ticked up to -0.6% yoy in Oct

Swiss CPI came in at 0.0% mom in October, matched expectations. Annually, CPI improved to -0.6% yoy, up from -0.8% yoy, matched expectations.

FSO said: “The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each other overall. Prices for clothing and footwear increased, as well as those for glasses and contact lenses. In contrast, prices for combined offers for fixed-line and mobile communication, as well as those for other fruits (melons and grapes) decreased.”

RBA Lowe: We’re not out of firepower, but negative rate still extraordinarily unlikely

In the post meeting press conference, RBA Governor Philip Lowe said “it would be incorrect to conclude that we are out of firepower” after today’s package of easing measures. He emphasized the central bank still has a “range of tools”, including ” further liquidity provision, asset purchases and transactions in the foreign exchange market.”

Still, negative rate policy is “extraordinarily unlikely”. “There is little to be gained from lowering the policy rate into negative territory,” he added. “While a negative rate might lead to a helpful depreciation of the Australian dollar, it could impair the supply of credit to the economy and lead some people to save more, rather than spend more.”

RBA cut rate to 0.1%, to purchase AUD 100B of bonds of 5- to 10-yr maturity

RBA announced a package of policy action today, as widely expected. The package includes:

- Cut in cash rate target to 0.1%

- Cut in 3-year AGS yield target to around 0.1%

- Cut in Term Funding Facility interest rate to 0.1%

- Cut in Exchange Settlement balances rate to 0%

- Purchase of AUD 100B of government bonds of maturities of around 5 to 10 years over the next six months.

The central bank acknowledged that recent data have been “a bit better than expected” and “near-term outlook is better than it was three months ago”. But “recovery is still expected to be bumpy and drawn out and the outlook remains dependent on successful containment of the virus.”

Q3 GDP is expected to report positive growth. But it will “take some time to reach the pre-pandemic level of output”. GDP is projected to grow around 6% over the year to June 2021, and 4% in 2022. Unemployment rate is projected to peak at a little below 8 per cent, rather than the 10 per cent expected previously. Unemployment rate is expected to drop be to around 6% at the end of 2022.

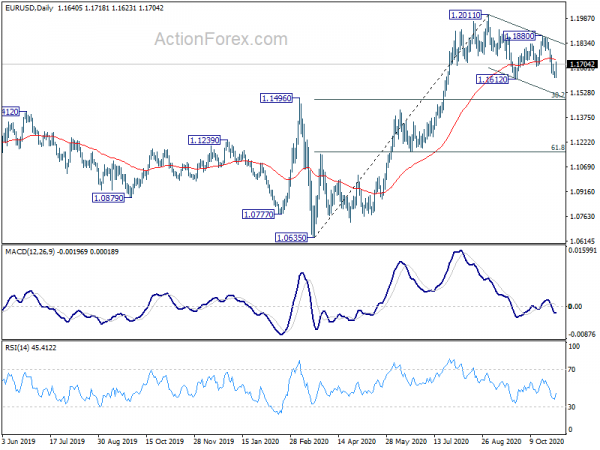

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1622; (P) 1.1639; (R1) 1.1656; More…..

EUR/USD rebounds notably today but stays well below 1.1880 resistance. Intraday bias remains neutral first. Further fall remains in favor. On the downside, firm break of 1.1612 support will resume the corrective decline from 1.2011, for 38.2% retracement of 1.0635 to 1.2011 at 1.1485. However, firm break of 1.1880 will turn bias back to the upside for 1.2011 resistance instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:30 | AUD | RBA Rate Decision | 0.10% | 0.10% | 0.25% | |

| 7:30 | CHF | CPI M/M Oct | 0.00% | 0.00% | 0.00% | |

| 7:30 | CHF | CPI Y/Y Oct | -0.60% | -0.60% | -0.80% | |

| 15:00 | USD | Factory Orders M/M Sep | 0.80% | 0.70% |