Investors are rather calm just ahead of the pre-election weekend. European indices quickly pare back initial losses, while DOW future is down not as much before open. Dollar is also giving up some of this week’s gains, despite pretty solid personal income and spending data. On the other hand, Euro is just mixed, paying little attention to some better than expected Q3 GDP data. Trade will likely turn more subdued for the rest of the session.

In Europe, currently, FTSE is down -0.03%. DAX is down -0.20%. CAC is up 0.32%. Germany 10-year yield is up 0.0063 at -0.627. Earlier in Asia, Nikkei dropped -1.52%. Hong Kong HSI dropped -1.95%. China Shanghai SSE dropped -1.47%. Singapore Strait Times dropped -1.10%. Japan 10-year JGB yield rose 0.0107 to 0.040.

US personal income rose 0.9% in Sep, spending rose 1.4%, both well above expectations

US personal income rose 0.9% mom in September, or USD 170.3B, well above expectation of 0.5% mom. Spending rose 1.4% mom, or USD 201.4B, also well above expectation of 1.0% mom. Headline PCE price index accelerated to 1.4% yoy, up from 1.3% yoy, above expectation of 1.3% yoy. Core PCE price index also edged up to 1.5% yoy, up from 1.4% yoy, above expectation of 1.4% yoy.

Also released employment cost index rose 0.5% in Q3, matched expectations.

Canada GDP grew 1.2% mom in Aug, still -5% below pre-pandemic level

Canada GDP rose 1.2% mom in August, above expectation of 0.9% mom. That’s the fourth consecutive month of increase. Yet, overall economic activity was still about -5% below February’s pre-pandemic level. Goods-producing industries grew 0.5% mom while services-producing industries rose 1.5% mom. 15 of 20 industrial sectors posed increases while two were essentially unchanged.

Eurozone GDP grew 12.7% qoq in Q3, well above expectations

Eurozone GDP grew 12.7% qoq in Q3, well above expectation of 9.0% yoy. That’s also more than enough to cover the -11.8% qoq contraction in Q2. Besides, it’s the sharpest increase on record since 1995.

EU GDP grew 12.1% qoq. Among the Member States, for which data are available for the third quarter 2020, France (+18.2%) recorded the highest increase compared to the previous quarter, followed by Spain (+16.7%) and Italy (+16.1%). Lithuania (+3.7%), Cheeky (+6.2%) and Latvia (+6.6%) recorded the lowest increases. While a rebound was observed for all publishing countries compared to the second quarter, the year on year growth rates were still negative.

Eurozone CPI was unchanged at -0.3% yoy in October, matched expectations CPI core was also unchanged at 0.2% yoy. Unemployment rate rose 0.2% to 8.3% in September, matched expectations.

Germany GDP grew 8.2% qoq in Q3, still -4.2% below pre-pandemic level

Germany GDP grew 8.2% qoq in Q3, above expectation of 7.3% qoq. But that’s not enough to recovery the -9.7% qoq contraction in Q2. Also, when compared with Q4 of 2019, before the pandemic, GDP was still -4.2% lower.

Destatis said “growth was based on higher final consumption expenditure of households, higher capital formation in machinery and equipment and a sharp increase in exports.”

Released too, retail sales dropped -2.2% mom in September, below expectation of -0.5% mom.

France GDP grew 18.2% qoq in Q3, all domestic demand rebounded sharply

France GDP grew 18.2% qoq in Q3, better than expectation of 15.0% qoq. That’s more than enough to recover the -13.7% qoq contraction in Q2. Yet, GDP remained well below the level it had before the pandemic. Comparing to Q3 2019, GDP was -4.3% yoy lower.

All components of domestic demand rebounded sharply, with household consumption up 17.3% qoq. General government consumption expenditure rose 15.4% qoq. GFCF rose 23.3% qoq. Exports rose 23.2% qoq. Imports rose 16.0% qoq.

Also from France, CPI came in at -0.1% mom, 0.0% yoy, versus expectation of -0.2% mom, 0.1% yoy.

Swiss KOF dropped to 106.6, subdued outlook in view of pandemic and restrictions

Swiss KOF Economic Barometer dropped to 106.6 in October, down from 110.1, missed expectation of 107.0. KOF said, “the economic outlook for Switzerland is subdued in view of the pandemic situation and the restrictions that are likely to result from it.”

“The lower level of the KOF Economic Barometer in October is in particular due to negative developments of the indicator bundles of the economic sector other services, the accommodation and food service activities and foreign demand. In addition, indicators relating to the manufacturing sector also recorded a decline. By contrast, private consumption and the construction sector remained virtually stable relative to the previous month.” KOF added.

Also from Swiss, retail sales rose just 0.3% yoy in September, worse than expectation of 2.8% yoy.

GBP/USD Mid-Day Outlook

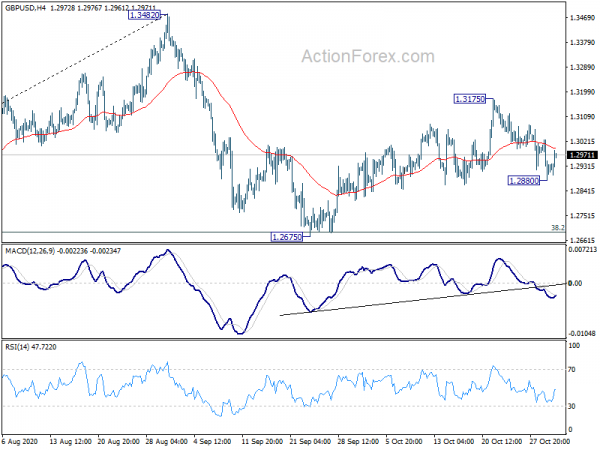

Daily Pivots: (S1) 1.2864; (P) 1.2945; (R1) 1.3008; More…

GBP/USD quickly recovered after breaching 1.2910 support to 1.2880. Intraday bias remains neutral first. On the downside, firm break of 1.2880 will argue that rebound from 1.2657 has completed. Intraday bias will be turned back to the downside for 38.2% retracement of 1.1409 to 1.3482 at 1.2690. On the upside, above 1.3175 will extend the rebound from 1.2675 and bring retest of 1.3482 high.

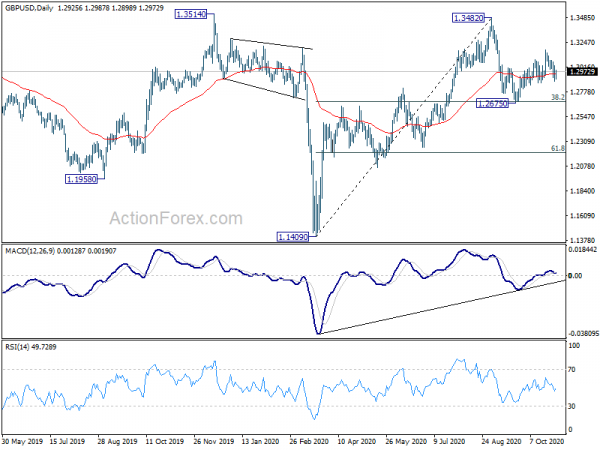

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3307). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Oct | -0.50% | -0.30% | 0.00% | |

| 23:50 | JPY | Industrial Production M/M Sep P | 4.00% | 3.20% | 1.00% | |

| 23:50 | JPY | Unemployment Rate Sep | 3.00% | 3.10% | 3.00% | |

| 00:30 | AUD | Private Sector Credit M/M Sep | 0.10% | 0.20% | 0.00% | |

| 00:30 | AUD | PPI Q/Q Q3 | 0.40% | 0.40% | -1.20% | |

| 00:30 | AUD | PPI Y/Y Q3 | -0.40% | -0.80% | -0.40% | |

| 05:00 | JPY | Housing Starts Y/Y Sep | -9.90% | -8.70% | -9.10% | |

| 06:30 | EUR | France GDP Q/Q Q3 P | 18.20% | 15.00% | -13.80% | |

| 07:00 | EUR | Germany Retail Sales M/M Sep | -2.20% | -0.50% | 3.10% | |

| 07:30 | CHF | Real Retail Sales Y/Y Sep | 0.30% | 2.80% | 2.50% | 4.00% |

| 07:45 | EUR | France CPI M/M Oct P | -0.10% | -0.20% | -0.60% | |

| 07:45 | EUR | France CPI Y/Y Oct P | 0.00% | 0.10% | 0.00% | |

| 08:00 | CHF | KOF Leading Indicator Oct | 106.6 | 107 | 113.8 | 110.1 |

| 09:00 | EUR | Italy Unemployment Sep | 9.60% | 10.10% | 9.70% | |

| 09:00 | EUR | Germany GDP Q/Q Q3 P | 8.20% | 7.30% | -9.70% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 12.70% | 9.00% | -11.80% | |

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 8.30% | 8.30% | 8.10% | |

| 10:00 | EUR | Eurozone CPI Y/Y Oct P | -0.30% | -0.30% | -0.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct P | 0.20% | 0.20% | 0.20% | |

| 12:30 | CAD | GDP M/M Aug | 1.20% | 0.90% | 3.00% | |

| 12:30 | CAD | Industrial Product Price M/M Sep | -0.10% | 0.10% | 0.30% | |

| 12:30 | CAD | Raw Material Price Index Sep | -2.20% | 0.30% | 3.20% | |

| 12:30 | USD | Personal Income M/M Sep | 0.90% | 0.50% | -2.70% | -2.50% |

| 12:30 | USD | Personal Spending Sep | 1.40% | 1.00% | 1.00% | |

| 12:30 | USD | PCE Price Index M/M Sep | 0.20% | 0.10% | 0.30% | |

| 12:30 | USD | PCE Price Index Y/Y Sep | 1.40% | 1.30% | 1.40% | 1.30% |

| 12:30 | USD | PCE Core Price Index M/M Sep | 0.20% | 0.10% | 0.30% | |

| 12:30 | USD | PCE Core Price Index Y/Y Sep | 1.50% | 1.40% | 1.60% | 1.40% |

| 12:30 | USD | Employment Cost Index Q3 | 0.50% | 0.50% | 0.50% | |

| 13:45 | USD | Chicago PMI Oct | 56.9 | 62.4 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Oct F | 81.2 | 81.2 |