Dollar recovers in early US session, with help from better than expected job data. Yet, it remains the weakest one for the week at this point. Buying momentum for the greenback doesn’t warrant a reversal yet. The forex markets are mixed for now, with mild weakness in Sterling and Euro. Stock markets are treading water, awaiting fresh developments, in particular the last Presidential debate before US election. Global treasury yields are also nearly flat in tight range.

Technically, Gold is back heading back towards 1900 after failing 1933 resistance. Break of 1900 will be a further indication of stabilization of Dollar. Though, EUR/USD will need to break through 1.1688 support to confirm completion of the rebound from 1.1612. Otherwise, a test on 1.2011 high is still more likely than not.

In Europe, currently, FTSE is down -0.26%. DAX is down -0.35%. CAC is down -0.19%. German 10-year yield is up 0.0037 at -0.581. Earlier in Asia, Nikkei dropped -0.70%. Hong Kong HSI rose 0.13%. China Shanghai SSE dropped -0.38%. Singapore Strait Times rose 0.11%. Japan 10-year JGB yield rose 0.0003 to 0.036.

US initial jobless claims dropped to 787k, continuing claims down to 8.4m

US initial jobless claims dropped -55k to 787k in the week ending October 17, better than expectation of 860k. Four-week moving average of initial claims dropped -21.5k to 811.3k.

Continuing claims dropped -1024k to 8373k in the week ending October 10. Four-week moving average of continuing claims dropped -1094k to 10086k.

BoE Haldane: Ensuring a tool in the toolbox is remotely the same as deploying

BoE Chief Economist Andy Haldane said while the central bank is doing the work to ensure a tool is in the tool box, “that is not remotely the same as saying that we are about to deploy that tool.” He added, “that will depend on the balance of costs and benefits”. The comments suggested that BoE is not near to using negative interest rates for the moment.

On the economy, Haldane said household spending has been “remarkably resilient” through the coronavirus pandemic. Also, spending had suffered relatively little from a second wave over the summer.

Germany Gfk consumer climate dropped to -3.1, recovery come to a standstill

Germany Gfk Consumer Climate for November dropped to -3.1, down from -1.7, missed expectation of -2.5. Economic expectations dropped from 24.1 to 7.1. Income expectations dropped from 16.1 to 9.8. Propensity to buy edged slightly lower from 38.4 to 37.0.

“The rapid increase in infection rates is leading to a tightening of restrictions brought on by the pandemic. Fear of a second lockdown, should infections get out of control in the coming winter months, is also increasing,” explains Rolf Bürkl, GfK Consumer Expert.

“As a result, the in parts significant recovery we saw in consumer sentiment at the start of the summer has come to a standstill and is causing the consumer climate to plummet once more. An increase in propensity to save in October has also contributed to this.”

RBNZ Robbers: We’re progressing the work for additional instruments

RBNZ Assistant Governor Simone Robbers said in a speech that the central bank recognized the “possible need for further monetary stimulus”. Thus, they’re “progressing” the work to deploy additional instruments, including Funding for Lending Programme (FLP), a negative OCR, and purchases of foreign assets.

She also noted there is still a “high degree of uncertainty around the economic outlook”. It is ” possible that bank resilience will be tested in the coming months as loan losses rise materially from current low levels”. She also urged financial institutions to play a role here and they should be “reassessing how they are supporting the recovery and best serving their customers”

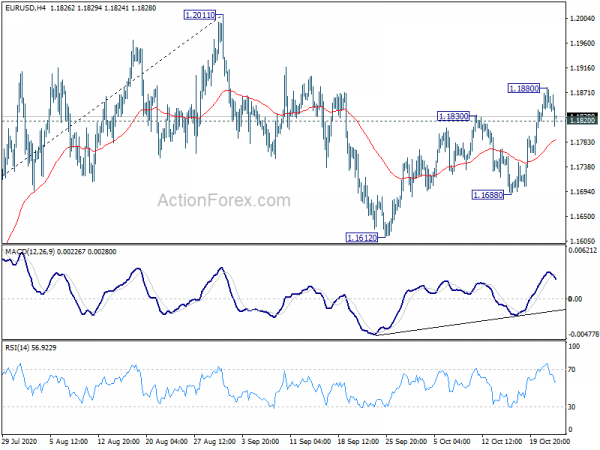

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1827; (P) 1.1854; (R1) 1.1886; More…..

A temporary top is formed at 1.1880 in EUR/USD with today’s retreat and intraday bias is turned neutral first. Further rise is expected as long as 1.1688 support holds. Break of 1.1880 will target a test on 1.2011 high. Nevertheless, break of 1.1688 will likely resume the correction from 1.2011, and turn bias to the downside for 1.1612 and below.

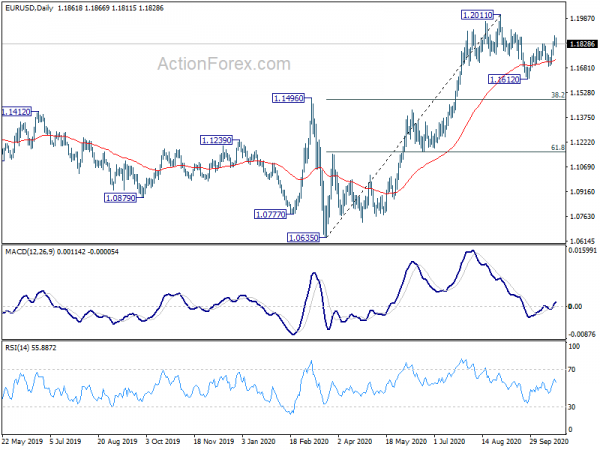

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Gfk Consumer Confidence Nov | -3.1 | -2.5 | -1.6 | |

| 11:00 | GBP | CBI Industrial Order Expectations Oct | -34 | -48 | ||

| 12:30 | USD | Initial Jobless Claims (Oct 16) | 787K | 860K | 898K | 842K |

| 14:00 | USD | Existing Home Sales Sep | 6.16M | 6.00M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Oct P | -15 | -14 | ||

| 14:30 | USD | Natural Gas Storage | 52B | 46B |