Australia’s Dollar’s decline is resuming today as RBA minutes, as well ass comments from a top official solidify the case for imminent easing in November. Weaker risk sentiments also weigh on commodity currencies in general, after US stocks reversed initial gains to close sharply lower. Euro and Swiss Franc continue to lead the way higher. Dollar and Sterling are mixed for now, stuck in range. Political developments including US elections and Brexit negotiations might have to be cleared before traders commit to a direction.

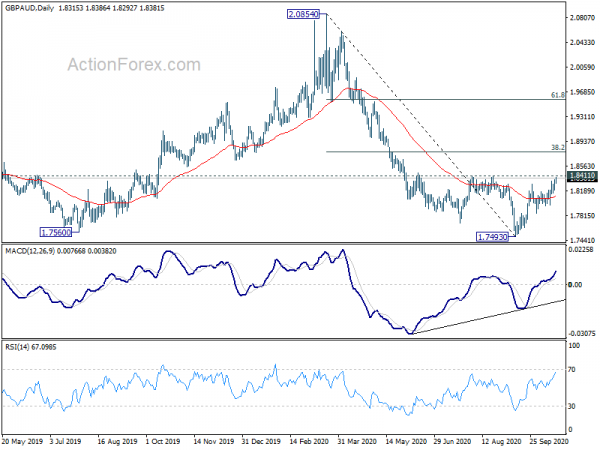

Technically, EUR/AUD’s firm break of 1.6586 resistance was a clear bearish sign for Aussie for the near term. We’re now waiting to see GBP/AUD breaking 1.8411 resistance to confirm underlying selling in Aussie. In the case, GBP/AUD would at least be correcting the fall from 2.0854 to 1.7493, with 38.2% retracement at 1.8777 as next near term target. Ideally, such a move should also be accompanied by break of 0.7005 support in AUD/USD and 73.97 support in AUD/JPY.

In Asia, currently, Nikkei is down -0.57%. Hong Kong HSI is down -0.08%. China Shanghai SSE is down -0.14%. Singapore Strait Times is down -0.70%. Japan 10-year JGB yield is up 0.0002 at 0.026. Overnight, DOW dropped -1.44%. S&P 500 dropped -1.63%. NASDAQ dropped -1.65%. 10-year yield rose 0.017 to 0.761.

RBA minutes confirm imminent easing

Minutes of RBA’s October meeting indicated that the board was already ready to push forward new easing measures. The announcement was delayed to November, partly for allowing the market to digest the Government’s budget, and partly for Governor Philip Lowe to outline the changes first.

In short, the minutes noted that members continued to “consider how additional monetary easing could support jobs as the economy opens up further”. They “discussed the options of reducing the targets for the cash rate and the 3-year yield towards zero, without going negative, and buying government bonds further along the yield curve”. They believed that “these options would have the effect of further easing financial conditions in Australia”.

Suggested readings on RBA:

- RBA Minutes Reveal Strong Conviction to Further Easing in November

- RBA: Minutes of the October Meeting Confirm Decision to Cut Rates on November 3

RBA Kent: Interest rates could all go a little lower

RBA Assistant Governor Christopher Kent’s comment in a webinar reinforced the case for further monetary easing at November 3 meeting. He noted that monetary easing could gain a bit more traction now as the economy was reopening, echoing previous comments by Governor Philip Low. Interest rates “could all go a little lower than they currently are”, referring to both the cash rate as well as the three-year yield target. While he declined to comment on whether RBA would extend the purchases of securities of longer maturity, he acknowledged that such a move could lower funding costs for both the governments and businesses.

Regarding fiscal position, Kent said that “debt of course will rise with deficits but that’s part of the very crucial fiscal support that we are seeing.” “The key is not to focus on the potential change in the ratings that come from rising debt. Instead focus on the fact that the rising debt is very manageable,” he added.

New Zealand NZIER business confidence improved to -40

New Zealand NZIER Business Confidence improved to -40 in Q3, up from -63. That is, a net 40% of firms surveyed expected deterioration in general business conditions, comparing to 63% a quarter ago. Own trading activity also turned position to +1, up from -37.

“This result supports our expectations of a V-shaped recovery in economic activity, as the New Zealand economy responds to the unprecedented amount of stimulus measures implemented by the Government and Reserve Bank,” NZIER said.

Looking ahead

Swiss will release trade balance in European session while Germany will release PPI. Eurozone current account will also be released. Later in the day, US housing starts and building permits will be featured.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6535; (P) 1.6603; (R1) 1.6721; More…

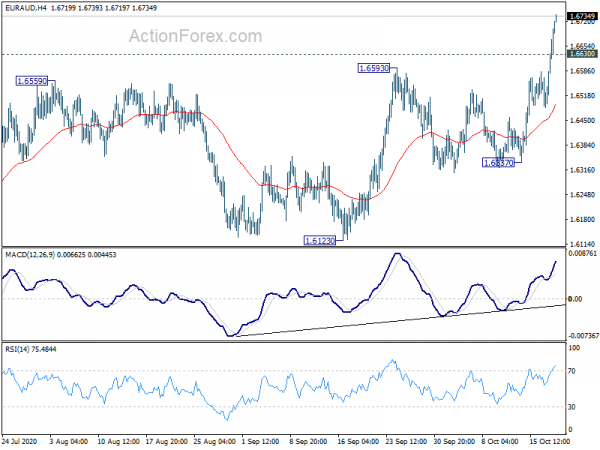

EUR/AUD’s rally continues today and reaches as high as 1.6739 so far. Intraday bias remains on the upside for 38.2% retracement of 1.9799 to 1.6033 at 1.7472. Reaction from there will reveal whether current rebound is just correcting the fall from 1.9799 to 1.6033, or reversing it. On the downside, below 1.6630 minor support will turn intraday bias neutral first. But near term outlook should stay bullish as long as 1.6337 support holds.

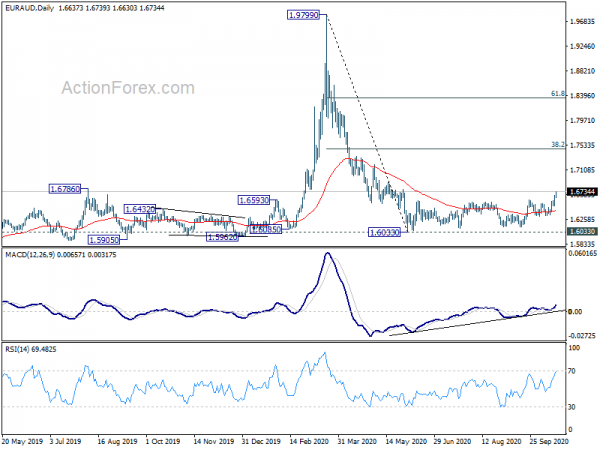

In the bigger picture, EUR/AUD is now back above 55 day EMA (now at 1.6463) with current rebound. The development argues that price actions form 1.9799 might be developing into a sideway pattern only. That is, medium term outlook is just neutral, and up trend from 1.1602 (2012 low) could resume at a later stage. On the downside, though, sustained trading below 55 week EMA would revive medium term bearishness for 61.8% retracement of 1.1602 to 1.9799 at 1.4733.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q3 | -40 | -63 | ||

| 0:30 | AUD | RBA Minutes | ||||

| 6:00 | CHF | Trade Balance (CHF) Sep | 4.32B | 3.58B | ||

| 6:00 | EUR | Germany PPI M/M Sep | -0.10% | 0.00% | ||

| 6:00 | EUR | Germany PPI Y/Y Sep | -1.40% | -1.20% | ||

| 8:00 | EUR | Eurozone Current Account (EUR) Aug | 17.2B | 16.6B | ||

| 12:30 | USD | Building Permits Sep | 1.52M | 1.48M | ||

| 12:30 | USD | Housing Starts Sep | 1.45M | 1.42M |