Dollar and Yen are back under notable selling pressure today. US investors are apparently ignoring continuing surge in global coronavirus infections, which broke 40m mark. Instead, there is renewed hope of fresh fiscal stimulus, as House Speaker Nancy Pelosi said a pre-election deal remains possible. Meanwhile, UK and EU are resuming Brexit talks. On the back, Chinese economic also painted some optimism. Though, commodity currencies seemed to be left behind as Euro and Sterling are the strongest ones.

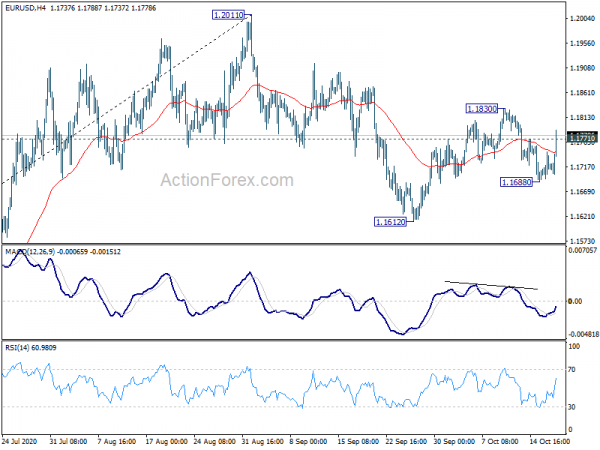

Technically, EUR/USD’s break of 1.1771 minor resistance invalidates near term bearish bearishness. Focus is back on 1.1830 minor resistance and break will bring retest of 1.2011 high. Similarly, break of 1.3082 resistance in GBP/USD could bring retest of 1.3482 high. Break of 0.9087 support in USD/CHF would bring retest of 0.8998 low. Ideally, a full fledged return of Dollar selloff should be accompanied by break of 1933.17 resistance. We’ll see if that happens.

In Europe, currently, FTSE is down -0.24%. DAX is down -0.16%. CAC is up 0.20%. German 10-year yield is up 0.0053 at -0.612. Earlier in Asia, Nikkei rose 1.11%. Hong Kong HSI rose 0.64%. China Shanghai SSE dropped -0.71%. Singapore Strait Times rose 0.42%. Japan 10-year JGB yield rose 0.0024 to 0.026.

ECB de Guindos: Countries want to avoid strict lockdowns as in March

ECB Vice President Luis de Guindos said recent economic data showed that economic recovery is losing momentum. He noted that EU countries are being hit by second wave of the coronavirus pandemic. But it “doesn’t look like countries want to impose strict lockdowns such as seen in March.”

He also said mergers can improve banks’ profitability. “Removing cost excesses, over-capacity is more necessary than it was before the pandemic. Consolidation is a tool, it is not a goal in itself, but can be helpful in cost savings, in removing over-capacity.”

EU Sefcovic: ready to work till last minute for a deal with UK

European Commission Vice President Maros Sefcovic said EU is “ready to work until the last minute for a good agreement” with UK for post Brexit relationship. Though he emphasized, “it has to be a fair agreement for both sides – we are not going to sign an agreement at any cost.”

UK Minister for the Cabinet Office Michael Gove told EU in the weekend that “the ball is in your court” for making a deal. He insisted that UK will be “flexing every muscle to be match fit for January 1” and that the Government will not be “squeezed or sandbagged into acquiescing to anyone else’s agenda”.

Kuroda: BoJ’s framework already quite similar to Fed’s average inflation targeting

BoJ Governor Haruhiko Kuroda said the central bank already has a framework that’s “quite similar” the Fed’s average inflation targeting. That is, to allow inflation to overshoot the 2% target. “We have no intention to change our inflation targeting policy and forward guidance,” he added.

On the economy, he remained fairly upbeat. “Japan’s economic activity is gradually bottoming out” as exports, output and private consumption pick up, Kuroda noted. “The lessons learnt from the current crisis will contribute to strengthening (Japan’s) growth potential”.

BoJ will announce monetary policy decision again on October 29. Most analysts expect no change but some argue that BoJ could extend the time frame of the pandemic measures beyond next March. Also, there might be a slight downward revision in growth outlook to reflect that the world is still facing risks of returning to lockdown.

Japan’s export contraction improved in Sep, but imports still weak

In September, Japan’s exports dropped -4.9% yoy to JPY 6.06T. That’s the first single-digit decline in seven months, and a large improvement from August’s -14.8% drop. Though, imports remained weak and dropped -17.2% yoy to JPY 5.38T.

In seasonally adjusted terms, exports rose 4.5% mom while imports rose 2.5% mom. Trade surplus widened slightly to JPY 0.48%, up fro JPY 0.36%. That’s notably smaller than expectation of JPY 0.85T.

China Q3 GDP growth missed expectations, but Sep data shine

China’s GDP grew 4.9% yoy in Q3, accelerated from Q2’s 3.2% qoq. Though, that fell short of expectation of 5.2% yoy. On a quarter-on-quarter basis, GDP rose 2.7% qoq, slowed from Q2’s 11.5% qoq.

September’s data were upbeat, nevertheless. Retail sales rose 3.3% yoy, speaking up from August’s 0.5% yoy and beat expectation of 1.8% yoy. Industrial production rose 6.9% yoy, up from August’s 5.6% yoy and beat expectation of 5.8% yoy. Fixed asset investment rose 0.8% ytd yoy, turned positive.

Suggested reading on China: China’s GDP Growth Missed Consensus. Strong Activity Data Support Renminbi’s Outlook.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1692; (P) 1.1719; (R1) 1.1744; More…..

EUR/USD’s break of 1.1771 minor resistance dampens the original bearish view and suggests that rebound from 1.1612 hasn’t completed yet. Intraday bias is back on the upside for 1.1830 first. Break will pave the way for retesting 1.2011. On the downside, below 1.1688 should extend the correction from 1.2011 through 1.1612 to 38.2% retracement of 1.0635 to 1.2011 at 1.1485.

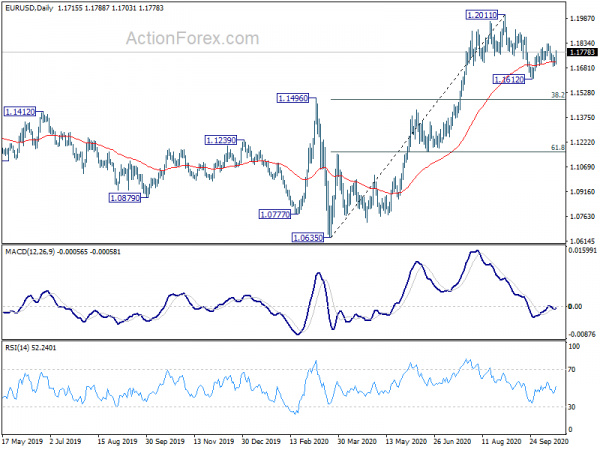

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Oct | 1.10% | 0.20% | ||

| 23:50 | JPY | Trade Balance (JPY) Sep | 0.48T | 0.85T | 0.35T | 0.36T |

| 2:00 | CNY | GDP Y/Y Q3 | 4.90% | 5.20% | 3.20% | |

| 2:00 | CNY | Retail Sales Y/Y Sep | 3.30% | 1.80% | 0.50% | |

| 2:00 | CNY | Industrial Production Y/Y Sep | 6.90% | 5.80% | 5.60% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Sep | 0.80% | 0.80% | -0.30% | |

| 12:30 | CAD | Wholesale Sales M/M Aug | 0.30% | 0.10% | 4.30% | 5.20% |

| 14:00 | USD | NAHB Housing Market Index Oct | 83 | 83 |