Commodity currencies follow Asian markets slightly higher today, with support from solid economic data from China. On the other hand, Euro and Swiss Franc are softer on concerns over record coronavirus infections and return to lockdown. Additionally, Euro could face more pressure if recent steep decline in German yields continue. Dollar is also a touch lower as traders turn cautious with uncertainty over US Presidential election in mind. After all, the markets are bounded in very tight range so far and the picture could easily change, drastically.

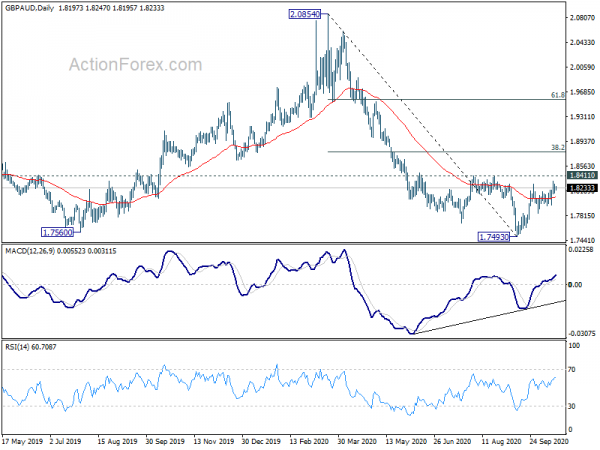

Technically, Australian Dollar could be a focus this week. Clear weakness was seen as expectations of imminent RBA easing built up. 1.6586 resistance in EUR/AUD is a key level. Sustained break there would firstly pave the way for stronger, sustainable near term rally. Secondly, that could also hint of more broad based weakness in Aussie elsewhere. Ideally, if EUR/AUD break 1.6586, we should see AUD/USD break s 0.7005 support and GBP/AUD breaks 1.8411 resistance at around the same time.

In Asia, currently, Nikkei is up 1.19%. Hong Kong HSI is up 0.85%. China Shanghai SSE is down -0.21%. Singapore Strait Times is up 0.61%. Japan 10-year JGB yield is up 0.0050 at 0.028.

China Q3 GDP growth missed expectations, but Sep data shine

China’s GDP grew 4.9% yoy in Q3, accelerated from Q2’s 3.2% qoq. Though, that fell short of expectation of 5.2% yoy. On a quarter-on-quarter basis, GDP rose 2.7% qoq, slowed from Q2’s 11.5% qoq.

September’s data were upbeat, nevertheless. Retail sales rose 3.3% yoy, speaking up from August’s 0.5% yoy and beat expectation of 1.8% yoy. Industrial production rose 6.9% yoy, up from August’s 5.6% yoy and beat expectation of 5.8% yoy. Fixed asset investment rose 0.8% ytd yoy, turned positive.

Suggested reading on China: China’s GDP Growth Missed Consensus. Strong Activity Data Support Renminbi’s Outlook

Kuroda: BoJ’s framework already quite similar to Fed’s average inflation targeting

BoJ Governor Haruhiko Kuroda said the central bank already has a framework that’s “quite similar” the Fed’s average inflation targeting. That is, to allow inflation to overshoot the 2% target. “We have no intention to change our inflation targeting policy and forward guidance,” he added.

On the economy, he remained fairly upbeat. “Japan’s economic activity is gradually bottoming out” as exports, output and private consumption pick up, Kuroda noted. “The lessons learnt from the current crisis will contribute to strengthening (Japan’s) growth potential”.

BoJ will announce monetary policy decision again on October 29. Most analysts expect no change but some argue that BoJ could extend the time frame of the pandemic measures beyond next March. Also, there might be a slight downward revision in growth outlook to reflect that the world is still facing risks of returning to lockdown.

Japan’s export contraction improved in Sep, but imports still weak

In September, Japan’s exports dropped -4.9% yoy to JPY 6.06T. That’s the first single-digit decline in seven months, and a large improvement from August’s -14.8% drop. Though, imports remained weak and dropped -17.2% yoy to JPY 5.38T.

In seasonally adjusted terms, exports rose 4.5% mom while imports rose 2.5% mom. Trade surplus widened slightly to JPY 0.48%, up fro JPY 0.36%. That’s notably smaller than expectation of JPY 0.85T.

ECB Lagarde: Stimulus cliff effects must be avoided

ECB President Christine Lagarde said the recovery from coronavirus pandemic “remains uncertain, uneven and incomplete”. Also, “new coronavirus-related restrictions currently being introduced across Europe will add to uncertainty for firms and households.”

Lagarde urged that “fiscal support and monetary policy support have to remain in place for as long as necessary and ‘cliff effects’ must be avoided.”

Separately, Governing Council member Klaas Knot said “At this moment, I don’t see any factors looming on the horizon that would make me think that interest rates will change significantly in the coming years”.

China GDP, RBA minutes, and PMIs to highlight the week

Coronavirus infection numbers and restriction measures, US election and Brexit talks would remain the major focuses of the week. These developments could trigger movements in all financial markets including stocks, bonds, currencies and gold, which would then have some interactions too.

As for central bank activities, RBA minutes will be a highlight, for more confirmation on monetary easing in November. Fed will also release Beige Book report. As for economic data, China GDP, productions and sales would be the initial focus of the week. Other data to watch include UK inflation, Canada CPI and retail sales and US jobless claims. Then, Friday will release a string of PMIs which would hints on sentiments as the world is preparing for another wave of coronavirus infections.

Here are some highlights for the week:

- Monday: Japan trade balance; China GDP, industrial production , retail sales, fixed asset investment; Canada wholesale sales; US NAHB housing index.

- Tuesday: RBA minutes; Swiss trade balance; Germany PPI; Eurozone current account; US building permits and housing starts.

- Wednesday: UK CPI, PPI, public sector net borrowing; Canada CPI, retail sales, new housing price index; Fed’s Beige Book.

- Thursday: Australia NAB business confidence; Germany Gfk consumer sentiment; UK CBI industrial orders expectations; Eurozone consumer confidence; US jobless claims, existing home sales.

- Friday: New Zealand CPI; Australia PMIs; Japan CPI, PMI manufacturing; UK retail sales, Gfk consumer confidence, PMIs; Eurozone PMIs; US PMIs.

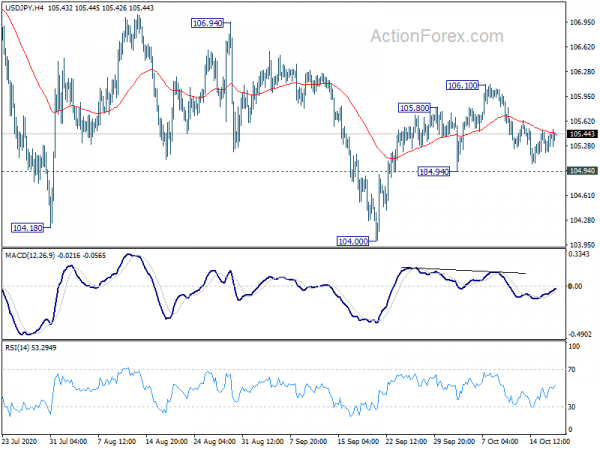

USD/JPY Daily Outlook

Daily Pivots: (S1) 105.25; (P) 105.35; (R1) 105.52; More...

Intraday bias in USD/JPY remains neutral for more consolidations. Another rise is still in favor with 104.94 support intact. On the upside, break of 106.10 will resume the rebound from 104.00 for 106.94 resistance. Sustained break there should confirm completion of the whole decline from 111.71. On the downside, break of 104.94 support will revive near term bearishness and target a test on 104.00 low instead.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 resistance should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Oct | 1.10% | 0.20% | ||

| 23:50 | JPY | Trade Balance (JPY) Sep | 0.48T | 0.85T | 0.35T | 0.36T |

| 2:00 | CNY | GDP Y/Y Q3 | 4.90% | 5.20% | 3.20% | |

| 2:00 | CNY | Retail Sales Y/Y Sep | 3.30% | 1.80% | 0.50% | |

| 2:00 | CNY | Industrial Production Y/Y Sep | 6.90% | 5.80% | 5.60% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Sep | 0.80% | 0.80% | -0.30% | |

| 12:30 | CAD | Wholesale Sales M/M Aug | 4.30% | |||

| 14:00 | USD | NAHB Housing Market Index Oct | 83 | 83 |