Sterling is a focus today in otherwise relatively quiet markets. Brexit jitters triggered much volatility in the Pound. But it’s staying in range as, after all, negations between UK and EU will still continue next week, probably with some intensifications. As for the week, Australian Dollar remains the weakest one, followed by Sterling, Yen is the strongest, followed by Dollar. US stocks futures point to slightly higher open. But renewed selloff in equities could push Dollar and Yen to stronger weekly closes.

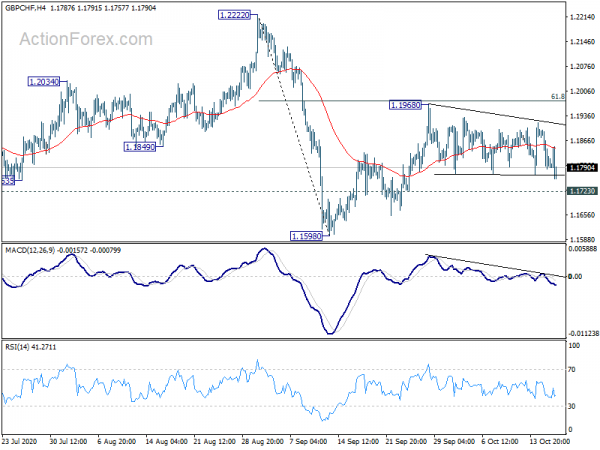

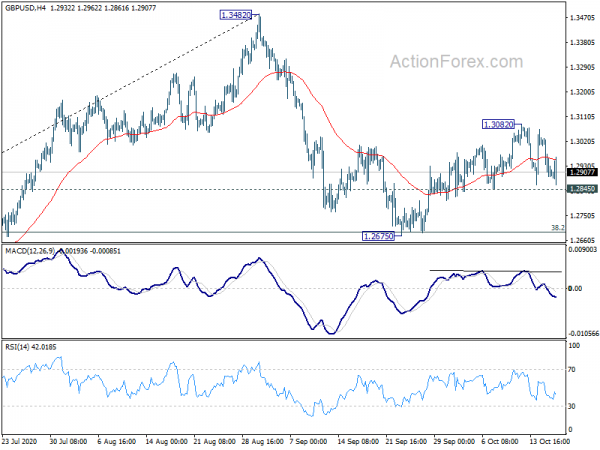

Technically, after all volatility, GBP/USD is holding above 1.2845 minor support. EUR/GBP is held below 0.9162 minor resistance. GBP/JPY is back above 135.66 minor support after brief breach. GBP/CHF is also holding well above 1.1723 minor support after a brief dip. Outlook isn’t too bad for the Pound yet, even though it’s vulnerable.

In Europe, currently, FTSE is up 1.41%. DAX is up 1.20%. CAC is up 1.69%. Germany 10-year yield is down -0.0106 at -0.618. Earlier in Asia, Nikkei dropped -0.41%. Hong Kong HSI rose 0.94%. China Shanghai SSE rose 0.13%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield rose 0.0001 to 0.023.

US retails rose 1.9% in Sep, ex-auto sales up 1.5%

US retail sales rose 1.9% mom to USD 549.3B in September, much better than expectation of 0.5% mom. Ex-auto sales also rose 1.5% mom, above expectation of 0.5% mom. Ex-gasoline sales 1.9% mom. Ex-auto and gasoline sales rose 1.5% mom.

Industrial production dropped -0.6% mom in September versus expectation of 0.4% mom. Capacity utilization rose 0.1% to 7.15%.

UK Johnson to EU: Come here if there’s some fundamental change of approach

UK Prime Minister Boris Johnson said the country should now get ready to leave EU without a new free trade deal. “Unless there’s a fundamental change of approach, we should go for the Australia solution.” Though, Johnson is not completely walking away from negotiations, as he added, “what we’re saying to them is come here, come to us, if there’s some fundamental change of approach.”

Earlier, Foreign Secretary Dominic Raab said the U.K. is “disappointed and surprised” that the EU had watered down its commitment to intensifying the trade talks. “We have been told that it must be the U.K. that makes all of the compromises in the days ahead. That can’t be right in a negotiation so we are surprised by that.”

EU von der Leyen: Our team will go to London next week to intensify negotiations

Around an hour after Johnson’s comments on Brexit negotiations, European Commission President Ursula von der Leyen said “The EU continues to work for a deal, but not at any price”. “As planned, our negotiation team will go to London next week to intensify these negotiations,” she said on Twitter.

EU summit chairman Charles Michel also said, “we are determined to get a deal but not at any price.” “The level playing field, fisheries and governance are very important topics for the EU.”

ECB Rehn: Recovery best described as a truncated square root

ECB Governing Council member Olli Rehn said, “some recent indicators, especially from the service sector, have been somewhat disappointing, which amplifies the downside risk to the economic recovery.” He added. “The shape of the recovery in my view could be best described as a truncated square root.”

Rehn also noted Fed’s change to average inflation targeting. He said, “while price level targeting as suggested by (Former Fed Chair) Ben Bernanke or average inflation targeting is open to criticism from the point of view of communication, in this context is nevertheless worth exploring in depth,”

He’s preferring a single-point inflation target rather than “below but close to 2%”. “This would also imply that we would accept inflation overshooting the point target or undershooting the point target for a period of time, as long as we’re on path to converging to our medium term, symmetric price stability target.”

ECB Visco: We have to avoid too early withdrawals of policies

ECB Governing Council member Ignazio Visco said, policies have to remain extremely accommodating on the fiscal side as well as on the monetary side as we’re prepared to do for the euro area as a whole… We are here to consider the risks of stop and go and we will have to avoid too early withdrawals of policies. ”

Also a Governing Council member, Francois Villeroy de Galhau reiterated the Pandemic Emergency Purchase Programme will “run until the crisis phase is over, and at least until next June.” “Given the uncertain situation today, it would be a mistake to decide an end date now” he added.

Eurozone exports dropped -12.2% yoy, imports dropped -13.5% yoy in Aug

Eurozone exports of goods to the rest of the world dropped -12.2% yoy to EUR 156.3B in August. Imports dropped -13.5% yoy to EUR 141.6B. Eurozone record a EUR 14.7B trade surplus in goods. Intra Eurozone trade dropped -4.6% yoy to EUR 129.2B.

In seasonably adjusted term, Eurozone exports rose 2.0% mom while imports rose 0.4% mom. Trade surplus widened to EUR 21.9B, beat expectation of EUR 18.1B.

Eurozone CPI finalized at -0.3% yoy in Sep, EU at 0.3% yoy

Eurozone CPI was finalized at -0.3% yoy in September, down from August’s -0.2% yoy. The highest contribution to the annual Eurozone inflation rate came from food, alcohol & tobacco (+0.34%), followed by services (+0.24%), non-energy industrial goods (-0.08%) and energy (-0.81%).

EU CPI was finalized at 0.3% yoy, down from August’s 0.4% yoy. The lowest annual rates were registered in Greece (-2.3%), Cyprus (-1.9%) and Estonia (-1.3%). The highest annual rates were recorded in Poland (3.8%), Hungary (3.4%) and Czechia (3.3%). Compared with August, annual inflation fell in thirteen Member States, remained stable in seven and rose in seven.

New Zealand BusinessNZ manufacturing rose to 54, growth not enough to recoup previous losses

New Zealand BusinessNZ Performance of Manufacturing Index rose to 54.0 in September, up from 41.0. Looking at some details, production rose from 51.6 to 56.5. Employment turned back to expansion, rose from 49.2 to 51.6. New orders surged sharply from 54.2 to 58.1.

BNZ Senior Economist, Doug Steel said that “although the September PMI pushed above its long-term average of 53.0, it should not be confused with above average activity levels. Rather, it indicates growth off the low base set earlier in the year. Growth has not yet been enough to recoup previous loses, but some progress is being made”.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2853; (P) 1.2942; (R1) 1.2992; More…

Intraday bias in GBP/USD remains neutral for the moment. Another rise is mildly in favor with 1.2845 minor support intact. On the upside, above 1.3082 will resume the rebound from 1.2675 for 1.3482 resistance. Nevertheless, break of 1.2845 will indicate that fall from 1.3482 is not over. Intraday bias will be turned back to the downside for 38.2% retracement of 1.1409 to 1.3482 at 1.2690.

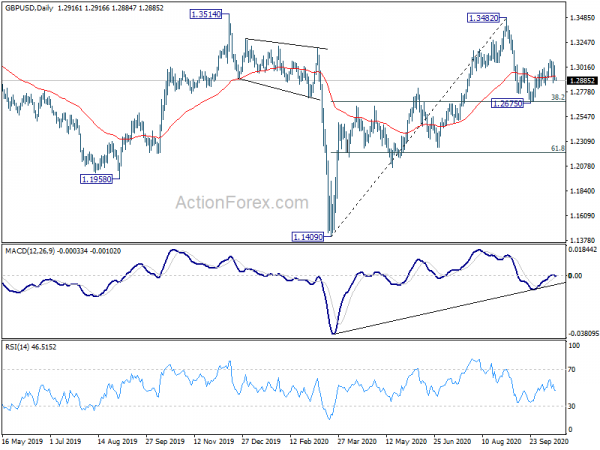

In the bigger picture, focus is back on 1.3415 key resistance now. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3312). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing Index Sep | 54 | 50.7 | 51 | |

| 09:00 | EUR | CPI Y/Y Sep F | -0.30% | -0.30% | -0.30% | |

| 09:00 | EUR | CPI Core Y/Y Sep F | 0.20% | 0.20% | 0.20% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | 21.9B | 18.1B | 20.3B | |

| 09:00 | EUR | Italy Trade Balance (EUR) Aug | 3.93B | 9.69B | ||

| 12:30 | CAD | Manufacturing Sales M/M Aug | -2.00% | -1.40% | 7.00% | 7.20% |

| 12:30 | USD | Retail Sales M/M Sep | 1.90% | 0.50% | 0.60% | |

| 12:30 | USD | Retail Sales ex Autos M/M Sep | 1.50% | 0.50% | 0.70% | 0.50% |

| 13:15 | USD | Industrial Production M/M Sep | -0.60% | 0.40% | 0.40% | |

| 13:15 | USD | Capacity Utilization Sep | 71.50% | 71.80% | 71.40% | |

| 14:00 | USD | Business Inventories Aug | 0.40% | 0.10% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Oct P | 81 | 80.4 |