Asian markets are trading in mixed most, decoupling from strong rally from the US on Friday. The forex markets are also steady. Yen is trading broadly higher and could be riding on the rebound against Dollar to strengthen elsewhere. Dollar is the currently the second strongest for today but it’s merely licking last week’s wounds. Commodity currencies are mildly lower for now, digesting last week’s gains. The economic calendar is light today with US and Canada on holiday, but volatility could still kicks in with political news.

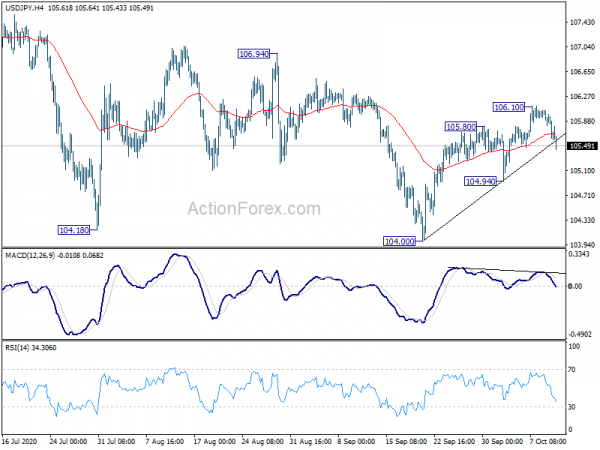

Technically, USD/JPY is an interesting one to watch today as it’s getting more likely that rebound from 104.00 has completed, with break of a near term trend line. Further rise will remain in favor as long as 104.94 support holds. But a firm break there would bring retest of 104.00. In that case, we’d have to see if that triggers selloff its Dollar itself, or more general decline in Yen crosses.

In Asia, currently, Nikkei is down -0.31%. Hong Kong HSI is up 2.03%. China Shanghai SSE is up 2.27%. Singapore Strait Times is up 0.56%. Japan 10-year JGB yield is down -0.0054 at 0.029.

ECB Lane: It’s not a satisfactory inflation outlook

ECB Chief Economist Philip Lane said in a WSJ interview that inflation outlook not satisfactory and the central bank would decide on the next move on a “meeting by meeting” basis. Even if inflation does climb to 1.3% in 2022 as in ECB’s projections, it would stay well below the 2% target. There ares speculations that ECB could expand the PEPP program by year end.

“The current inflation level remains far away from our goal,” Lane said . “We don’t think that is a satisfactory inflation outlook.” “I wouldn’t focus on any one meeting… It’s not the case that we only look at the formal projection rounds.”

Lane also noted that the next phase of the economy is “going to be tougher”. “The big question, and this is why there is so much uncertainty, is: how quickly can the current dynamic, with rising cases, be stabilized.””Some of that uncertainty will be resolved this autumn,” he added. “We will know the fiscal plans, we will know more about the pandemic.”

ECB Visco: Monetary policy must remain expansive for a long time

ECB Governor Council member Ignazio Visco told Il Corriere della Sera newspaper, “price changes tend to be very low, if not negative, and a gap has been created with our goal of price stability, with effects that can be dangerous”. Because of this, monetary policy “monetary policy must be expansive and remain so for a long time”.

Currently, ECB is adopting a price target of “below of close to 2%”. Visco said it’s “vague and difficult to understand.” He’s in favor of a change to a medium term symmetrical 2% target.

Visco, also the governor of the Bank of Italy, expects the Italian economy to recovery with around 5% growth next year. But he warned of a prolonged decline in demand and policymakers must “do everything to reduce uncertainty.

Separately, Italian Health Minister Roberto Speranza said on Sunday that the country is preparing for fresh restrictions as new coronavirus cases surged again. Though, he added, “now we need a change of pace, and to intervene with measures, not comparable to those adopted in the past, which could allow us to put the contagion under control and avoid tougher measures later on.”

Japan’s corporate goods price deflation worsens

Japan’s corporate goods price index dropped further to -0.8% yoy in September, down from -0.6% yoy, missed expectation of -0.5% yoy. Wholesales prices also dropped -0.1% mom, indicating risk of upstream deflation. “With the global economy still reeling from the pandemic’s pain, the pace of its recovery remains modest. That will weigh on Japan’s wholesale inflation,” a BOJ official told a briefing.

Also from Japan, bank lending rose 6.4% yoy in September, below expectation of 7.5% yoy. Machinery orders rose 0.2% mom in August, well above expectation of -1.0% mom decline.

Politics risks to overshadow economic data this week

Politics will be the main focuses this week while economic data would take a back seat. US election and stimulus negotiations could be most market moving. Over the Atlantic, Brexit negotiations would continue while the mid-Oct deadline looms. Resurgence of coronavirus infections and the risks of more return to restriction would catch much attentions too.

On the data front, Germany ZEW, China trade balance, Australia employment, US inflation and retail sales will be mostly watched. Here are some highlights for the week:

- Monday: Japan PPI, machine orders; Swiss SECO economic forecasts.

- Tuesday: China trade balance; US BRC sales monitor, employment; Germany CPI final, ZEW economic sentiment; US CPI.

- Wednesday: Australia Westpac consumer sentiment; Eurozone industrial production; US PPI.

- Thursday: Australia employment; China CPI, PPI; Japan tertiary industry index; Swiss PPI; US Empires State manufacturing, Philly Fed manufacturing, jobless claims, import prices.

- Friday: New Zealand Business NZ manufacturing; Eurozone trade balance, CPI final; Canada manufacturing sales; US retail sales, industrial production, business inventories, U of Michigan sentiment.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 124.62; (P) 124.85; (R1) 125.19; More….

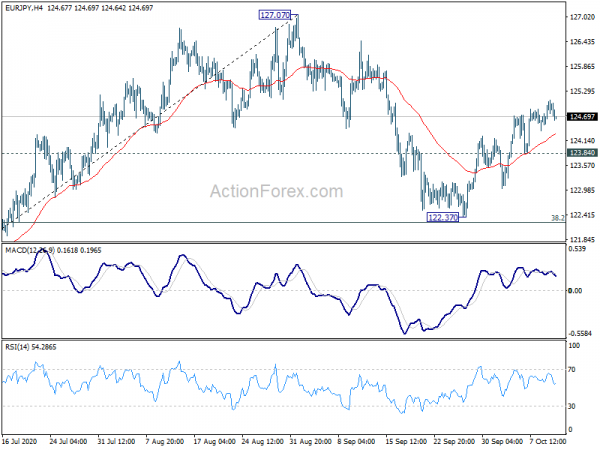

EUR/JPY continues to lose upside momentum as seen in 4 hour MACD. But with 123.84 minor support intact, further rise is still in favor to retest 127.07 high. Decisive break there will resume larger rally from 114.42. On the downside, however, break of 123.84 will turn bias back to the downside for 38.2% retracement of 114.42 to 127.07 at 122.23 instead.

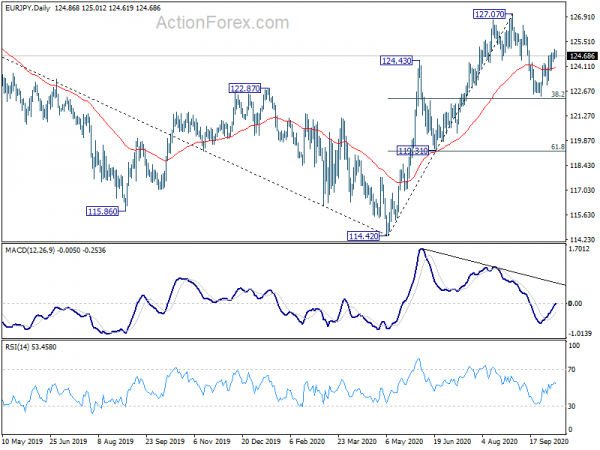

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 119.31 support holds. Break of 127.07 will target 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67 next. However, firm break of 119.31 will argue that the rise from 114.42 has completed and turn focus back to this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Sep | 6.40% | 7.50% | 6.70% | |

| 23:50 | JPY | PPI Y/Y Sep | -0.80% | -0.50% | -0.50% | -0.60% |

| 23:50 | JPY | Machinery Orders M/M Aug | 0.20% | -1.00% | 6.30% | |

| 5:45 | CHF | SECO Economic Forecasts | ||||

| 6:00 | EUR | Germany Wholesale Price Index M/M Sep | 0.20% | -0.40% | ||

| 6:00 | JPY | Machine Tool Orders Y/Y Sep P | -23.30% |