Yen and Dollar weaken in general as Asia markets recover on positive news on the situation of US President Donald Trump’s coronavirus infection. Australian and Canadian Dollars are firm, but there slightly overshadowed by the Swiss Franc. But after all, movements in the markets are relatively limited, with most pairs staying inside last week’s range. WTI crude oil, while recovering, it kept below 38 handle. Gold even decouples from Dollar weakness and dips back below 1900 handle. Overall, the moves in Asian session aren’t very decisive.

Technically, we’re continue to keep a close eyes on developments in Dollar and Yen. 1.1769 resistance in EUR/USD, 1.3007 resistance in GBP, 0.7209 resistance in AUD/USD and 1.3259 support in USD/CAD, need to be taken out to confirm near term downside bias in the greenback. On the other hand, 124.31 resistance in EUR/JPY, 137.00 resistance in GBP/JPY, and 76.11 resistance in AUD/JPY need to be taken out to indicate committed Yen selling. USD/JPY is also an interesting one to what. Could it break through 104.92 support or 105.80 resistance? Or stay stuck in range while others move?

In Asia, currently, Nikkei is up 1.20%. Hong Kong HSI is up 1.46%. Singapore Strait Times is up 0.52%. Japan 10-year JGB yield is up 0.0061 at 0.027. China is on holiday.

Asia rebounds on Trump’s health improvement, HSI capped by resistance

Major Asian markets open higher today on optimism regarding US President Donald Trump’s health condition. His doctors indicated that the coronavirus symptoms are resolving and improving. Trump could be discharged from hospital as soon as on Monday. Separately, Trump also left the hospital on Sunday evening and waved to his supports in a motorcade.

Hong Kong HSI is currently up 370 pts or 1.6% at the time of writing. But it still kept below 24167.78 support turned resistance. Another fall remains mildly in favor for retesting 21139.26 low. However, sustained break of 24167.78 will suggests completion of the pull back from 26782.61. In this case, the corrective rebound from 21139.26 should extend with another rising leg through 26782.61 in the near term.

Japan PMI services finalized at 46.9, recovery is far from secure

Japan PMI Services was finalized at 46.9 in September, up from August’s 45.0. While the reading signal further contraction in activity, the pace was slowest in the current eight-month sequence. PMI Composite was finalized at 46.6, up from 45.2.

Shreeya Patel, Economist at IHS Markit, said: “Japan continues to be impacted by the COVID-19 outbreak… There were some signs of stabilisation, however, with activity falling to the least extent since the pandemic began… “Optimism was also evident regarding the year-ahead outlook. Sentiment returned to positive territory amid hopes of rising demand in the next 12 months. Employment, meanwhile, dropped only marginally. Overall, there are signs of improvement in the sector, however recovery is far from secure.”

Australia NAB business conditions back to pre-Covid level, confidence still negative

Australia NAB Business Confidence improved to -4 in September, up from -8. Business Conditions also rose to 0, up from -6. Trading conditions turned positive, from -2 to 6. Profitability condition also turned positive, from -3 to 2. Employment condition rose from -14 to -6, but stayed negative.

Alan Oster, NAB Group Chief Economist “after some volatility in the last 2 months conditions are around the level seen pre-COVID. That said, they only lie at the threshold of improving/deteriorating and are well below average. Trading conditions and profitability are back in positive territory, which likely reflects the ongoing opening of the economy and the support provided by policy makers. Employment continues to lag, however, likely reflecting the fact activity has not yet fully recovered and firms remain cautious. Confidence increased in the month, building on the gains of last month, and is now well above the trough in March. That said, it remains negative and likely fragile.”

A big week in Australia. Fed and ECB minutes featured too

Australia is one of the major focuses this week. RBA is now widely expected to keep interest rate unchanged at 0.25%. Down the road, RBA is expected to lower overnight case rate, as well as three year yield to 0.1.%. Yet, the central wold more likely let the markets digest the fiscal measures to be announced by the government’s budget this week first. The markets will look for indications that RBA is ready to move in November.

Other focuses include meeting minutes of Fed and ECB. Some data will also be closely watched, including US ISM services and jobless claims Eurozone investor confidence, UK GDP and productions, and New Zealand business confidence. Here are some highlights for the week:

- Monday: Eurozone PMI services final, Sentix investor confidence, retail sales; UK PMI services; US PMI services, ISM non-manufacturing.

- Tuesday: RBA rate decision, Australia trade balance, AiG construction; Germany factory orders; UK PMI construction; Canada trade balance; US trade balance.

- Wednesday: Australia AiG services; Japan leading indicators; Germany industrial production; France trade balance; Italy retail sales; Swiss foreign currency reserves; Canada Ivey PMI; FOMC minutes.

- Thursday: New Zealand ANZ business confidence; China Caixin PMI services; Swiss unemployment rate; Germany trade balance; ECB minutes; Canada housing starts; US unemployment claims.

- Friday: Japan average cash earnings, household spending; UK GDP, productions, trade balance; France industrial production; Italy industrial production; Canada employment.

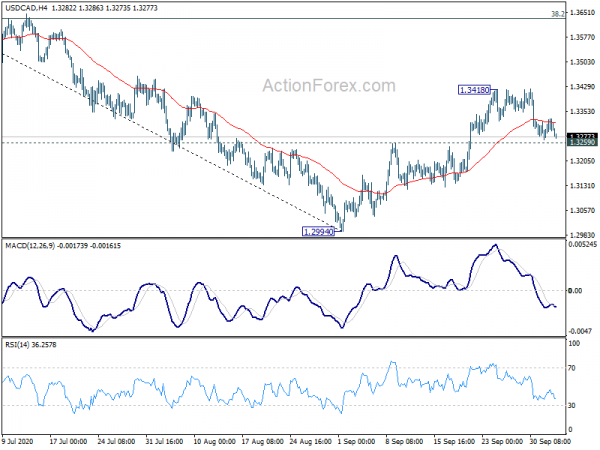

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3278; (P) 1.3305; (R1) 1.3332; More….

Intraday bias in USD/CAD remains neutral for the moment. Further rise is mildly in favor with 1.3259 resistance turned support intact. On the upside, break of 1.3418 will resume the rebound from 1.2994. Such rebound is seen as a correction to whole fall from 1.4667 and should then target 38.2% retracement of 1.4667 to 1.2994 at 1.3633. Nevertheless, on the downside, sustained break of 1.3259 will argue that the rebound is completed and turn bias back to the downside for retesting 1.2994 low.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Sustained break of 61.8% retracement of 1.2061 to 1.4667 at 1.3056 will target a test on 1.2061 (2017 low). But we’d expect loss of downside momentum as it approaches this key support. On the upside, firm break of 1.3715 resistance will argue that this falling leg has completed and turn focus back to 1.4667/89 resistance zone.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | TD Securities Inflation M/M Sep | 0.10% | 0.10% | ||

| 07:45 | EUR | Italy Services PMI Sep | 49.3 | 47.1 | ||

| 07:50 | EUR | France Services PMI Sep F | 47.5 | 47.5 | ||

| 07:55 | EUR | Germany Services PMI Sep F | 49.1 | 49.1 | ||

| 08:00 | EUR | Eurozone Services PMI Sep F | 47.6 | 47.6 | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Oct | -10.5 | -8 | ||

| 08:30 | GBP | Services PMI Sep F | 55.1 | 55.1 | ||

| 08:30 | GBP | BoE’s Haldane speech | ||||

| 09:00 | EUR | Retail Sales M/M Aug | 2.40% | -1.30% | ||

| 13:45 | USD | Services PMI Sep F | 54.6 | 54.6 | ||

| 14:00 | USD | ISM Services PMI Sep | 56 | 56.9 |