Markets suddenly turned into a risk-off mode on the first October surprise. US President Donald Trump and wife Melania had tested positive for coronavirus. Both were going to quarantine with Trump’s scheduled cleared of all travels. Yen surges broadly as reaction. While Dollar follows higher, it’s quickly losing momentum and was overwhelmed by Yen. Commodity currencies are generally pressured with Aussie leading the way down. While focus will also be on US non-farm payroll report, Trump’s health condition would be much more market moving.

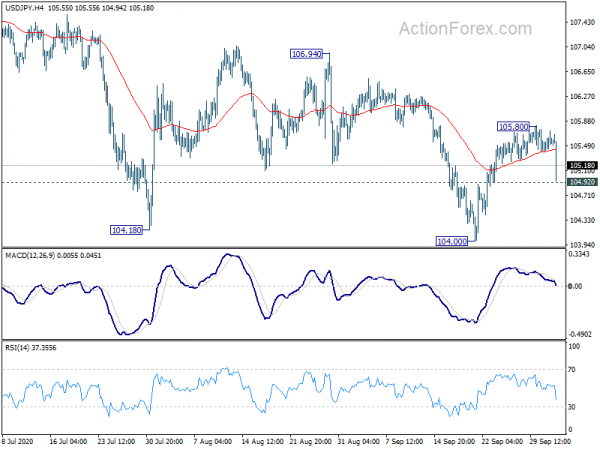

Technically, an immediate focus is on 104.92 minor support in UISD/JPY. Firm break there will indicate completion of rebound from 104.00 support and bring retest of this level. We’ll have to see the fall in USD/JPY would mainly drag down Yen crosses, or spread to other Dollar pairs. EUR/USD’s 1.1752 resistance will be closely watched to confirm underlying selling in Dollar. Also, Gold would taken on 1920.06 resistance and bring will likely bring further rise to 1973.58 resistance next, which could be reflected in Dollar weakness elsewhere.

In other markets, DOW future is currently down -380 pts. European stocks open lower on the news. Nikkei closed down -90.67%. Singapore Strait Times is down -0.49%. China and Hong Kong are on holiday. Overnight, DOW rose 0.13%. S&P 500 rose 0.53%. NASDAQ rose 1.42%.

Japan unemployment rate rose to 3% in Aug, highest since 2017

Japan unemployment rate rose to 3.0% in August, up from 2.9%, matched expectations. That the highest level since 3.1% in May 2017. Jobs-to-applicants ratio fell to 1.04, down from 1.08, hitting the lowest level since January 2014. Consumer confidence rose to 32.7 in September, up from 29.3, but missed expectation of 33.8.

The unemployment remained relatively low by global standard. Yet, there are concerns of further slowdown in recovery in the job markets, and unemployment rate could rise further. While worsening conditions call for more government support, Finance Minister Taro Aso insisted that he’s not considering a third extra budget at present, as funds in the second package wasn’t used up yet.

Australia retail sales dropped -4% mom in Aug, all industries fell

Australia retail sales dropped -4.0% mom in August 2020, more than reversing the 3.2% mom rise in July. Victoria, which faced stage 3 and 4 restrictions, dropped -12.6% mom. Decline was also recorded in New South Wales (-2.0%), Queensland (-1.1%), South Australia (-0.9%), Western Australia (-0.4%), and Tasmania (-0.2%). sales rose only in The Northern Territory (2.0%), and the Australian Capital Territory (0.7%)

All industries fell, including household goods retailing (-6.0%), other retailing (-5.1 per cent), clothing, footwear and personal accessory retailing (-10.5 per cent), cafes, restaurants and takeaway food services (-6.6%), and department stores (-8.9%) saw large falls. Food retailing (-0.2%) saw a minor fall.

BCC: Little sign of swift V-shaped recovery in UK

In BCC’s Quarterly Economic Survey, nearly half of UK firms (46%) reported decrease in domestic sales in Q3, down from 73.% in Q2. 27 of firms reported increase in domestic sales while 27% reported no change. Also, nearly half of firms (47%) reported decreases in export sales, down from 72% in Q2. 24% report3e3d increase in exports sales,.

Suren Thiru, Head of Economics at the British Chambers of Commerce (BCC), said: “Our latest survey indicates that underlying economic conditions remained exceptionally weak in the third quarter. While the declines in indicators of activity slowed as the UK economy gradually reopened, they remain well short of pre-pandemic levels with little sign of a swift ‘V’-shaped recovery.”

Looking ahead

Eurozone will release CPI flash in European session. But main focus will be on non-farm payrolls form the US. Michigan consumer sentiment and factory orders will also be released.

USD/JPY Daily Outlook

Daily Pivots: (S1) 105.40; (P) 105.57; (R1) 105.72; More...

Focus is back on 104.92 minor support with today’s sharp decline. Firm break there will indicate that rebound from 104.00 has completed. Intraday bias will be turned back to the downside for 104.00. Break there will resume larger down trend from 111.71. On the upside, though, break of 105.80 resistance will resume rebound form 104.00 to 106.94 resistance, to confirm completion of the near term down trend.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 resistance should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Aug | 3.00% | 3.00% | 2.90% | |

| 23:50 | JPY | Monetary Base Y/Y Sep | 14.30% | 11.90% | 11.50% | |

| 1:30 | AUD | Retail Sales M/M Aug | -4.00% | 3.20% | 3.20% | |

| 5:00 | JPY | Consumer Confidence Index Sep | 32.7 | 33.8 | 29.3 | |

| 9:00 | EUR | Eurozone CPI Y/Y Sep P | -0.10% | -0.20% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Sep P | 0.50% | 0.40% | ||

| 12:30 | USD | Nonfarm Payrolls Sep | 875K | 1371K | ||

| 12:30 | USD | Unemployment Rate Sep | 8.30% | 8.40% | ||

| 12:30 | USD | Average Hourly Earnings M/M Sep | 0.40% | 0.40% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index SepF | 78.9 | 78.9 | ||

| 14:00 | USD | Factory Orders M/M Aug | 1.50% | 6.40% |