Dollar and Yen are generally weak in Asian, after being pressure overnight with a return to risk-on markets. US stocks were lifted on as Treasury Secretary Steven Mnuchin “made a lot of progress in a lot of areas” with House Speaker Nancy Pelosi on fresh stimulus. Yet, there was also conflicting message from Senate Majority Mitch McConnell that the two sides remain “far apart”. The rises in US indices were actually not to convincing, as they only closed around the mid-point of yesterday’s range. Focuses will temporary turn back from politics to economic data again.

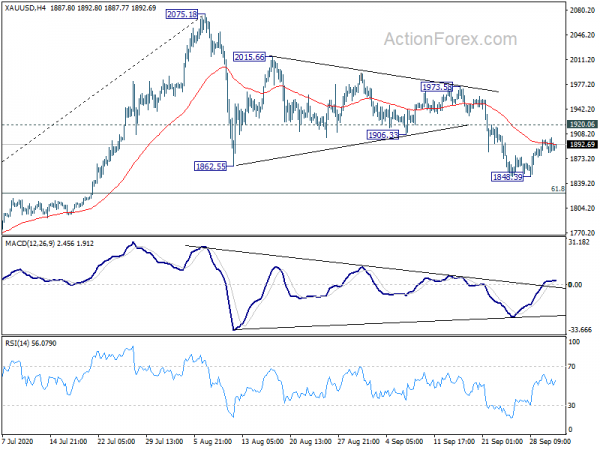

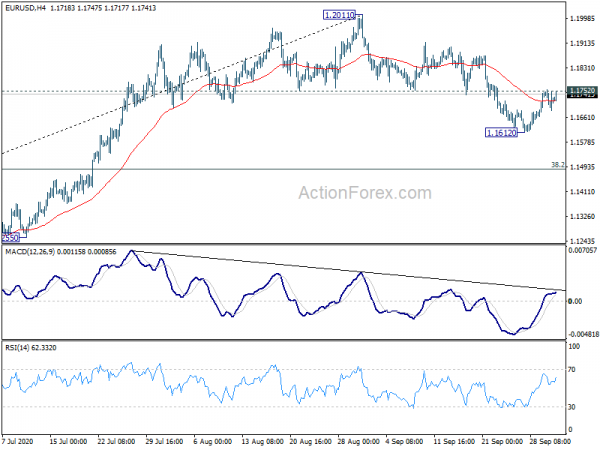

Technically, there are increasing sign that Dollar has already completed its near term rebound. Yet, we’d still prefer to see a clear break of 1.1752 resistance in EUR/USD to give us more confidence for this case. Similarly, EUR/JPY would also need to take out 124.31 resistance decisively if markets are genuinely returning to risk-on mode. Ideally, for more Dollar weakness, we should see Gold sustaining above 4 hour 55 EMA cleanly, with some upside acceleration through 1920.06 resistance.

In Asia, currently, Nikkei is flat. 10-year JGB yield is down -0.005 at 0.015. Singapore Strait Times is up 1.25%. China and Hong Kong are on holiday. Overnight, DOW rose 1.20%. S&P 500 rose 0.83%. NASDAQ rose 0.74%. 10-year yield rose 0.032 to 0.677.

Japan Tankan large manufacturers index improved from 11-yr low

Japan BoJ Tankan Large Manufacturers Index rose to -27 in Q3, up from , -34, but missed expectation of -23. Large Manufacturing Outlook rose to -17, up from -27, matched expectations. Large Non-Manufacturing Index rose to -12, up from -17, missed expectation of -9. Non-manufacturing outlook rose to -11, up from -14, missed expectation of -9. All industry capex rose 1.4%, slightly above expectation of 1.3%.

The improvement in large manufacturers’ mood was welcomed considering that the index just hit the lowest level in 11 years in Q2. But the bounce is disappointing with pandemic uncertainty persisting. There are increasing calls for additional fiscal stimulus from new Prime Minister Yoshihide Suga. Ruling coalition party leader Natsuo Yamaguchi indicated earlier that the government is considering addition large-scale spending package.

Japan PMI manufacturing finalized at 47.7, downturn lost intensity

Japan PMI Manufacturing was finalized at 47.7 in September, up from August’s 47.3. That’s the highest level since February, but it’s, nonetheless, still a contractionary reading. There were slower falls in output and new orders while business expectations continue to recover.

Tim Moore, Economics Director at IHS Markit, said: “Subdued business conditions persisted across the Japanese manufacturing sector in September, but there were signs that the downturn has lost intensity. The latest declines in output and new orders were the slowest since the first quarter of 2020 and much softer than seen earlier in the pandemic. Some manufacturers noted that a turnaround in export sales to clients elsewhere in Asia had helped to offset some of the demand weakness across Europe and the United States.

“The most encouraging aspect of the latest survey was a sustained rebound in business optimism from the low point seen during April. More than twice as many manufacturers plan to boost production in the next 12 months as those that forecast a decline, which pushed the survey measure of business expectations to its highest since May 2018.”

Australia AiG manufacturing dropped to 46.7, recovery prone to periodic setbacks

Australia AiG Performance of Manufacturing Index dropped to 46.7 in September, down from 49.3. Victoria reported the weakest result, down -6.4 to 37.6, due to stage four restrictions. But decline was also reported in New South Wales, down -6.7 to 44.3, and Queensland, down -3.8 to 43.3. Looking at some more details, production dropped -3.3 to 50.1. Employment dropped -2.5 to 47.7. New orders dropped -1.5 to 45.1. Exports dropped -5.7 to 46.5. Average wages rose 1.5 to 52.3.

Ai Group Chief Executive Innes Willox said: “The disappointing contraction of manufacturing and the slump in manufacturing employment in September is a timely reminder that recovery from the COVID-19 crisis, at least in its initial stages, will be tentative and prone to periodic setbacks… There is clearly a need for further fiscal stimulus in next week’s federal Budget to help rebuild the confidence that is needed to get businesses investing and households spending.”

Looking ahead

Swiss CPI and SVME will be released in European session. Eurozone will release PMI manufacturing final and PPI. UK will also release PMI manufacturing. Main focuses will be US data later in the day, including personal income and spending with PCE inflation, jobless claims, and ISM manufacturing index.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1686; (P) 1.1721; (R1) 1.1756; More…..

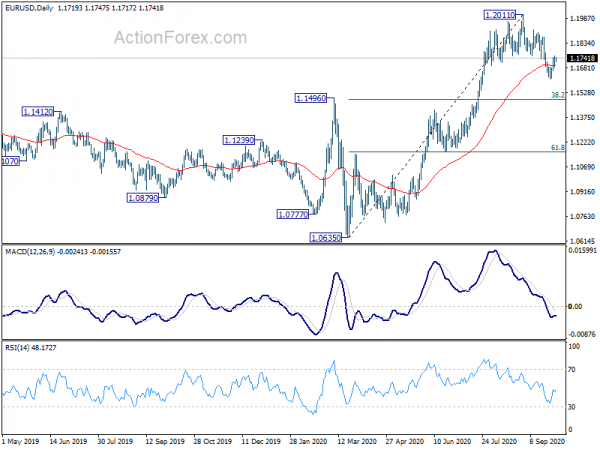

Intraday bas in EUR/USD remains neural with focus on 1.1752 support turned resistance. Decisive break there will argue that corrective pull back has completed. Intraday bias will be turned back to the upside for retesting 1.2011. On the downside, break of 1.1612 will extend the fall from 1.2011 short term top to 38.2% retracement of 1.0635 to 1.2011 at 1.1485 instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Mfg Index Sep | 46.7 | 49.3 | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q3 | -27 | -23 | -34 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q3 | -12 | -9 | -17 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q3 | -17 | -17 | -27 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q3 | -11 | -9 | -14 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 1.40% | 1.30% | 3.20% | |

| 00:30 | JPY | Manufacturing PMI Sep F | 47.7 | 47.3 | 47.3 | |

| 06:30 | CHF | Real Retail Sales Y/Y Aug | 4.50% | 4.10% | ||

| 06:30 | CHF | CPI M/M Sep | 0.00% | 0.00% | ||

| 06:30 | CHF | CPI Y/Y Sep | -0.70% | -0.90% | ||

| 07:30 | CHF | SVME PMI Sep | 53.4 | 51.8 | ||

| 07:45 | EUR | Italy Manufacturing PMI Sep | 53.5 | 53.1 | ||

| 07:50 | EUR | France Manufacturing PMI Sep F | 50.9 | 50.9 | ||

| 07:55 | EUR | France Manufacturing PMI Sep F | 56.6 | 56.6 | ||

| 08:00 | EUR | Italy Unemployment Aug | 10.20% | 9.70% | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 53.7 | 53.7 | ||

| 08:30 | GBP | Manufacturing PMI Sep F | 54.3 | 54.3 | ||

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 8.10% | 7.90% | ||

| 09:00 | EUR | Eurozone PPI M/M Aug | 0.70% | 0.60% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Aug | -2.10% | -3.30% | ||

| 11:30 | USD | Challenger Job Cuts Y.Y Sep | 116.50% | |||

| 12:30 | USD | Personal Income M/M Aug | -2.30% | 0.40% | ||

| 12:30 | USD | Personal Spending Aug | 0.70% | 1.90% | ||

| 12:30 | USD | PCE Price Index M/M Aug | 0.30% | |||

| 12:30 | USD | PCE Price Index Y/Y Aug | 1% | |||

| 12:30 | USD | PCE Core Price Index M/M Aug | 0.30% | 0.30% | ||

| 12:30 | USD | PCE Core Price Index Y/Y Aug | 1.40% | 1.30% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 25) | 850K | 870K | ||

| 13:30 | CAD | Manufacturing PMI Sep | 55.1 | |||

| 13:45 | USD | Manufacturing PMI Sep F | 53.5 | 53.5 | ||

| 14:00 | USD | ISM Manufacturing PMI Sep | 56 | 56 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Sep | 59 | 59.5 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Sep | 46.4 | |||

| 14:00 | USD | Construction Spending M/M Aug | 0.80% | 0.10% | ||

| 14:30 | USD | Natural Gas Storage | 66B |