Yen surges broadly together with Swiss Franc as there are renewed focus on the tension between US and North Korea. US President warned overnight that North Korea "best not make any more threats to the United States". And, Trump said that "they will be met with fire, fury and, frankly, power the likes of which this world has never seen before." That’s in response to North Korea’s claim that it’s ready to give US a "severe lesson". And North Korea claim that it’s examining plans to strike US territory Guam. Analysts perceived Trump’s response as aggressive. The comments sent DOW down to closed -0.15% lower at 22085.34, comparing to intraday high at 22179.11. USD/JPY breached 109.83 and is resuming recent decline from 114.49.

Professionals less optimistic on Trump’s tax reforms

Politics aside, there is little news about Trump’s economic policies. And businesses are getting less optimistic on the tax reform that Trump has yet to start to push through legislation. According to a survey by Deloitte Tax LLP, 3100 tax, finance and business professionals were surveyed. Under half of the respondents saw the tax reform as a main economic driver ahead. And nearly 40% predicted corporate income tax rate to end up at 25%, much higher that the 15% that Trump targets to drive to. 74% were doubtful or not confident that a comprehensive tax reform bill would be enacted within 2017. And, less that 19% were confidence or somewhat confident that it’s going to happen this year.

Dollar lifted by JOLTS temporarily

Dollar rebounded overnight as latest data showed further tightening in the labor market. The Labor Department said that job openings rose 461k to 6.2m in June. That’s a record high since the series began back in 2000. Growth in job market has been healthy for a while as indicated be job related data this year. The key to determine whether Fed would hike again by the end of lies on inflation data. CPI to be released on Friday will be a more important event to watch. The Dollar index hit as high as 93.87 as rebound from 92.54 resumed. But it’s still limited well below 94.28 near term resistance. Nonetheless, Dollar was clearly firm against Sterling and Canadian. EUR/USD also breached last week low at 1.1727 while AUD/USD broke 0.7877 support. The greenback is only weaker against Yen and Swiss Franc.

On the data front, Japan M2 rose 4.0% yoy in July. China CPI slowed to 1.4% yoy in July, PPI was unchanged at 5.5% yoy. Australia Westpac consumer confidence dropped -1.2% in August, home loans rose 0.5% in June. Looking ahead, US non-farm productivity and and unit labor costs are the main feature for the rest of the day.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 142.87; (P) 143.66; (R1) 144.16; More

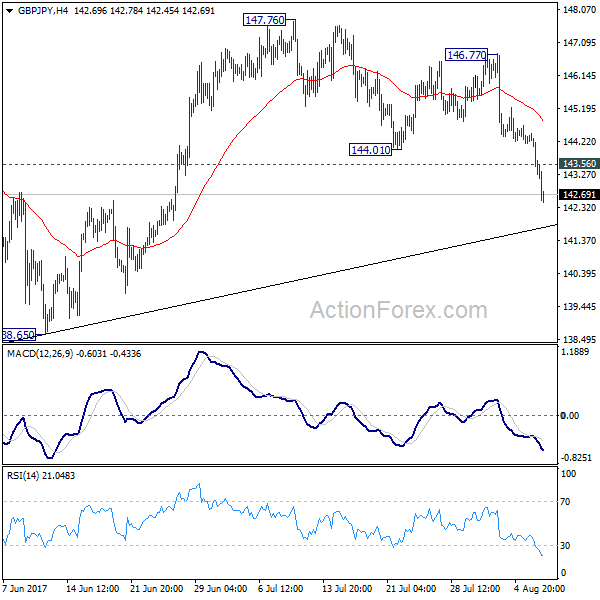

GBP/JPY’s decline accelerates after breaking 144.01 and reaches as low as 142.51 so far. Intraday bias remains on the downside for trend line support (now at 141.87). Further break there will target 135.58/138.65 support zone. As GBP/JPY is seen as staying in consolidation pattern from 148.42, we’d expect strong support from 135.58 to contain downside. On the upside, above 143.56 minor resistance will turn intraday bias neutral first. But break of 146.77 is needed to signal completion of the fall from 147.76. Otherwise, near term outlook will now be cautiously bearish.

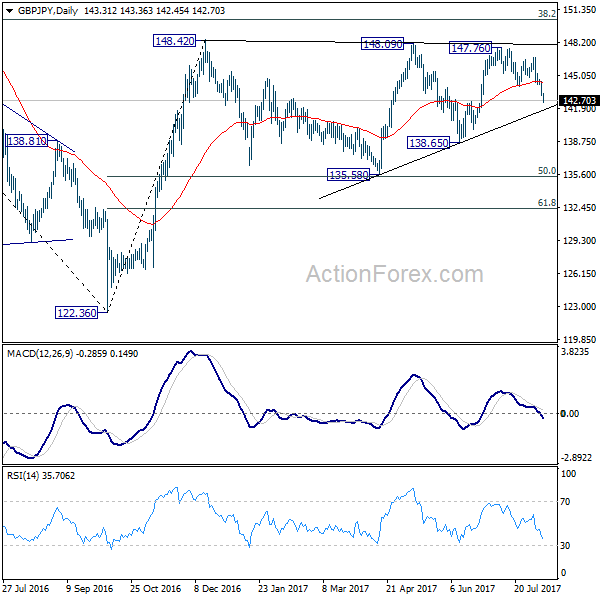

In the bigger picture, rise from medium term bottom at 122.36 is expected to continue to 38.2% retracement of 196.85 to 122.36 at 150.43. Decisive break there will carry long term bullish implications and pave the way to 61.8% retracement at 167.78. In case the sideway pattern from 148.42 extends, we’d be looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jul | 4.00% | 3.90% | 3.90% | |

| 0:30 | AUD | Westpac Consumer Confidence Aug | -1.20% | 0.40% | ||

| 1:30 | CNY | CPI Y/Y Jul | 1.40% | 1.50% | 1.50% | |

| 1:30 | CNY | PPI Y/Y Jul | 5.50% | 5.60% | 5.50% | |

| 1:30 | AUD | Home Loans Jun | 0.50% | 1.50% | 1.00% | 1.10% |

| 6:00 | JPY | Machine Tool Orders Y/Y Jul P | 31.10% | |||

| 12:30 | CAD | Building Permits M/M Jun | -1.90% | 8.90% | ||

| 12:30 | USD | Non-Farm Productivity Q2 P | 0.80% | 0.00% | ||

| 12:30 | USD | Unit Labor Costs Q2 P | 1.10% | 2.20% | ||

| 14:00 | USD | Wholesale Inventories Jun F | 0.60% | 0.60% | ||

| 14:30 | USD | Crude Oil Inventories | -1.5M | |||

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |