Dollar remains the strongest one for the week, followed by Yen, as risk aversion continue to dominate. The recovery attempts in European stocks appeared to have faded very quickly while DOW futures point another day of lower open. Sterling is relatively resilient, with some support from the new jobs support scheme announced by UK Finance Minister Rishi Sunak. But there is no sign of a clear rebound versus Dollar and Yen. Swiss Franc is mixed as markets shrug off SNB rate decision. On the other hand, Australian Dollar continues to lead other commodity currencies lower.

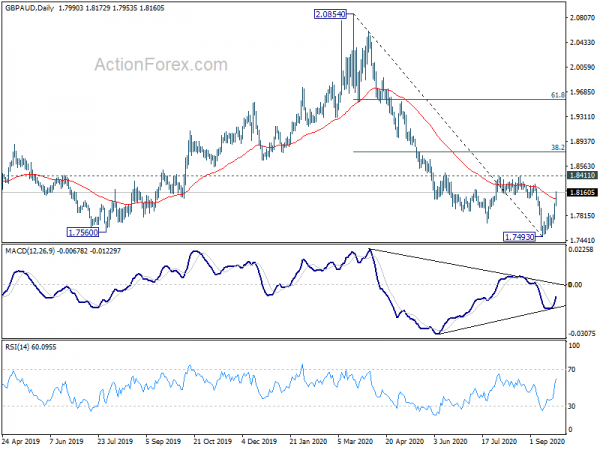

Technically, we’ll continue to watch 1.6586 resistance in EUR/AUD and 0.9409 support in AUD/CAD. Decisive break of these level indicate there selling pressure on the Aussie is there to stay for longer. On the other hand, 0.9067 support in EUR/GBP is level to pay attention to too. Firm break there will be an early sign of near term bearish reversal and would target 0.8866 support next. GBP/AUD, on the other hand, would be eyeing 1.8411 resistance and break could confirm completion of whole decline from 2.0854. These pairs would be very interactive in the coming days.

In Europe, currently, FTSE is down -0.74%. DAX is down -0.19%. CAC is down -0.46%. Germany 10-year yield is down -0.0199 at -0.520. Earlier in Asia, Nikkei dropped -1.11%. Hong Kong HSI dropped -1.82%. China Shanghai SSE dropped -1.72%. Singapore Strait Times dropped -1.22%. Japan 10-year JGB yield rose 0.0002 at 0.010.

US initial jobless claims rose 4k to 870k, above expectation

US initial jobless claims rose 4k to 870k in the week ending September 19, above expectation of 850k. Four-week moving average of initial claims dropped -35k to 878k. Continuing claims dropped -167k to 12580k in the week ending September 12. Four-week moving average of continuing claims dropped -478k to 13041k.

SNB keeps negative rate at -0.75%, remains willing on FX intervention

SNB left sight deposit rate unchanged at -0.75% as widely expected. “In view of the fact that the Swiss franc is still highly valued, the SNB remains willing to intervene more strongly in the foreign exchange market, while taking the overall exchange rate situation into consideration.”.

On inflation outlook, which is subject to “unusually high uncertainty”, SNB expects inflation to stay negative this year at -0.6%. Inflation is then likely to “edge back to positive” in 2021 at 0.1%, and “increase slightly further” in 2022 at 0.2%.

SNB also noted that GDP is set to shrink by around -5% this year. But domestic economic activity has “picked up significantly since May”. That should be reflected in a “strong rise in GDP” in Q3. The positive development is “likely to continue in 2021. However, recovery will only be “partial for the time being”.

Suggested reading on SNB:

German Ifo edged higher to 93.4, economy stabilizing despite rising infection numbers

Germany Ifo Business Climate rose to 93.4 in September, up from 92.6, slightly below expectation of 93.8. Current Assessment rose to 89.2, up from 87.9, below expectation of 89.5. Expectations index rose to 97.7, up form 97.5, below expectation of 98.0. Ifo said: “The companies once again assessed their current situation as better than in the previous month. They also expect their business to recover further. The German economy is stabilizing despite rising infection numbers.”

Manufacturing has a noticeable increase from -5.6 to -0.2. However, Services dropped back from 7.7 to 6.9, fourth decline in a row. Trade turned positive, from -4.8 to 0.3. Construction also improved from 0.0 to 3.3.

BoJ minutes showed concern of coronavirus resurgence

Minutes of BoJ’s July 14/15 meeting showed policymakers are concerned with resurgence of coronavirus in Japan. A few board members noted, “infection numbers are increasing at a faster pace globally, so we need to be on alert of the possibility of a re-insurgence including in Japan”. Another member warned, “if infection numbers rise again, the timing of an economic recovery will be delayed.”

Overall, members agreed “the economy, with economic activity resuming, was likely to improve gradually from the second half of this year; however, the pace of improvement was expected to be only moderate while the impact of COVID-19 remained worldwide.”

New Zealand imports tumbled in Aug, exports showed contrasting movement

New Zealand exports rose 8.6% yoy in NZD 4.4B in August. Imports, on the other hand, dropped sharply by -16% yoy to NZD 4.8B. The monthly trade balance was a deficit of NZD -353M, slightly larger than expectations.

Imports were down from all top trading partners, including China, EU, Australia, USA and Japan. But there were contrasting movements in exports, up to China, USA and EU, but down to Australia and Japan.

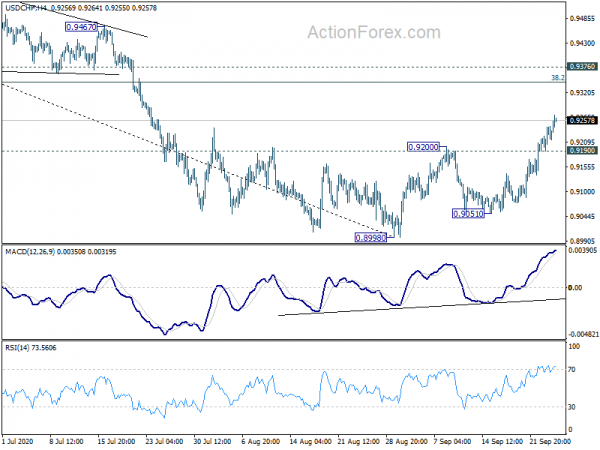

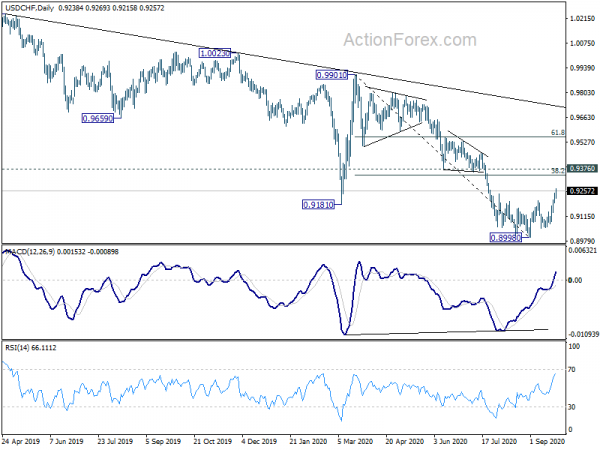

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9203; (P) 0.9224; (R1) 0.9257; More…

Intraday bias in USD/CHF remains on the upside as rebound from 0.8998 is in progress for 38.2% retracement of 0.9901 to 0.8998 at 0.9343. Sustained break there will pave the way to 61.8% retracement at 0.9556. On the downside, break of 0.9190 minor support will turn intraday bias neutral and bring some consolidations first.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). There is no clear sign of completion yet and on resumption, next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. Nevertheless, strong break of 0.9376 support turned resistance will be an early sign of trend reversal and turn focus back to 0.9901 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Aug | -353M | -350M | 282M | 447M |

| 23:50 | JPY | BoJ Minutes | ||||

| 07:30 | CHF | SNB Rate Decision | -0.75% | -0.75% | -0.75% | |

| 08:00 | EUR | ECB Monthly Bulletin | ||||

| 08:00 | EUR | Germany IFO Business Climate Sep | 93.4 | 93.8 | 92.6 | |

| 08:00 | EUR | Germany IFO Current Assessment Sep | 89.2 | 89.5 | 87.9 | |

| 08:00 | EUR | Germany IFO Expectations Sep | 97.7 | 98 | 97.5 | |

| 10:00 | GBP | CBI Realized Sales Sep | 11% | -10% | -6% | |

| 12:30 | USD | Initial Jobless Claims (Sep 18) | 870K | 850K | 860K | 866K |

| 14:00 | USD | Fed’s Chair Powell testifies | ||||

| 14:00 | USD | New Home Sales Aug | 890K | 901K | ||

| 14:30 | USD | Natural Gas Storage | 78B | 89B |