Sterling suffers renewed selling in generally quiet markets today. EUR/GBP is extending recent rise to as high as 0.9080 so far. GBP/USD is set to test on 1.3 handle. GBP/JPY is the biggest mover today as also affected by broad based rebound in yen. GBP/JPY’s break of 144.01 near term support now opens up deeper fall to trend line support at around 142.00. Staying in the currency markets, New Zealand Dollar remains the weakest one as markets anticipate a dovish RBNZ statement later in the week. Canadian Dollar is the second weakest one as WTI crude oil continues to struggle to regain 50 handle. Euro is maintaining its status as the strongest one for the week while Dollar is mixed.

Distorted ECB bond purchase drove down Italian German spread

According to data from ECB, the central bank snapped up EUR 9.6b of Italian bonds in July, hitting that highest level since the launch of QE back in March 2015. That’s also nearly EUR 1.5b above what the composition of the asset purchase dictates. On the other hand, purchase of German bonds stayed below the level on the capital key rules for the fourth straight months. It’s see as a trend recently that ECB is deviating from the capital key rules. And that’s one of the reasons that drove Italian-German spread down to the lowest level of the year. Released from Eurozone, German trade surplus widened to EUR 21.2b in June.

Swiss weakness more on policy divergence

From Swiss, unemployment rate was unchanged at 3.2% in July, in line with consensus. The Swiss Franc was the biggest loser last month and has only stabilized in past week or two. The broad-based selloff of Swiss franc of late has raised speculations of renewed SNB intervention. Yet, the latest release of FX reserve and sight deposit data suggest that it was unlikely the cause. We believe franc’s depreciation, especially against the euro was mainly driven by yield differential as the ECB is approaching tapering of its asset purchase program while the SNB maintained the pledge to fight against deflation. The recent risk-on mode in the financial market has also raised franc’s appeal as funding currency, thereby exacerbating its decline. More in CHF Weakness More On Policy Divergence Than Intervention, FX Reserve And Sight Deposit Suggested.

Dollar rebound limited by cautious Fed comments

Dollar’s rebound attempt is limited by cautious comments from Fed officials, and lack of economic data as drivers. St. Louis Fed President James Bullard said that he is "ready to get going in September" regarding unwinding Fed’s balance sheet". But he emphasized that it is going to be "very slow" and there won’t be a lot of impact on the markets. On the other hand, Bullard believes that "the current level of the policy rate is likely to remain appropriate over the near term." Minneapolis Fed President Neel Kashkari said that "inflation has been coming up short, a little low, relative to our two percent target." And, "it actually matters that investors believe the Fed can achieve its goals, because then if there’s a future crisis and we really need people to believe in us, we’ve earned and established that credibility."

Australia business conditions jumped to 9 year high

Australia NAB business confidence jumped to 12 in July, up from 8. Business conditions index rise 1 point to 15, hitting the highest level since early 2008. The business conditions index also sit at three times the long-run average of 5. NAB chief economist Alan Oster noted that "the persistent strength in employment conditions has made us a little more optimistic about the near-term outlook for the labor market." And the result was consistent with annual job growth of around 240k. Nonetheless, "price and wage measures in the survey generally weakened again in the month, partly a reflection of elevated rates of underemployment." For RBA, the "signs of inflation pressures remain elusive."

China trade data point to downward trend

From China, trade surplus widened to USD 46.7b in July. Exports rose 7.2% yoy, slowest pace since February and notably lower than 11.3% yoy rise in the prior month. Exports growth was also well below market expectation of 10.9% yoy. Imports rose 11.0% yoy, slowest since December and sharply lower from 17.2% yoy in the prior month. Import growth was also well below market expectation of 16.6% yoy. Some economists noted that the trade data points to a downward trend in both external and domestic demand.

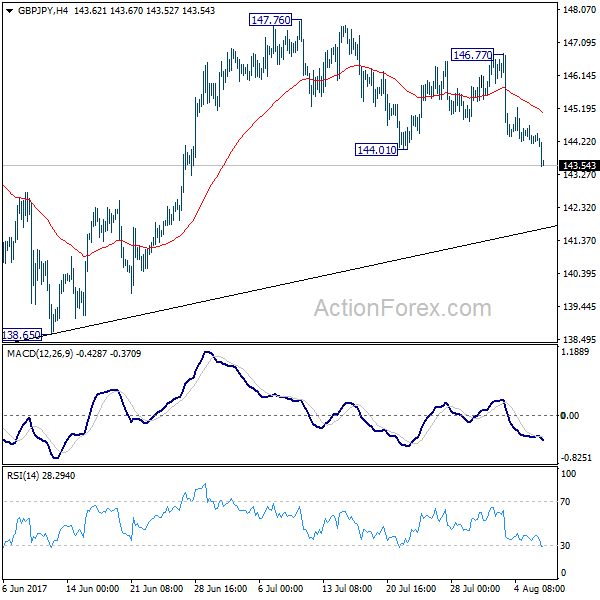

GBP/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.08; (P) 144.40; (R1) 144.62; More

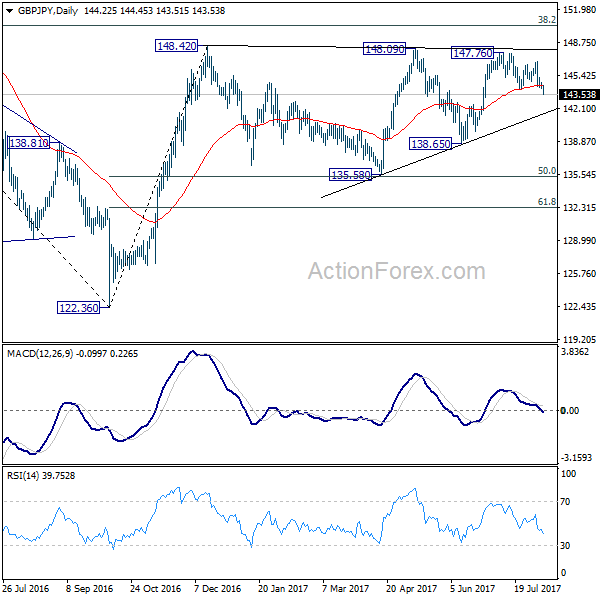

GBP/JPY drops to as low as 143.51 so far today. Break of 144.01 support confirms resumption of fall from 147.76 and intraday bias is now on the downside for trend line support (now at 141.87). Further break there will target 135.58/138.65 support zone. As GBP/JPY is seen as staying in consolidation pattern from 148.42, we’d expect strong support from 135.58 to contain downside. On the upside, break of 146.77 is needed to signal completion of the fall from 147.76. Otherwise, near term outlook will now be cautiously bearish even in case of recovery.

In the bigger picture, rise from medium term bottom at 122.36 is expected to continue to 38.2% retracement of 196.85 to 122.36 at 150.43. Decisive break there will carry long term bullish implications and pave the way to 61.8% retracement at 167.78. In case the sideway pattern from 148.42 extends, we’d be looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jul | 0.90% | 0.60% | 1.20% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.52T | 1.51T | 1.40T | |

| 01:30 | AUD | NAB Business Confidence Jul | 12 | 9 | 8 | |

| 02:00 | CNY | Trade Balance (USD) Jul | 46.7B | 45.3B | 42.8B | |

| 02:00 | CNY | Trade Balance (CNY) Jul | 321.2B | 292B | 294B | |

| 05:00 | JPY | Eco Watchers Survey Current Jul | 49.7 | 49.7 | 50 | |

| 05:45 | CHF | Unemployment Rate Jul | 3.20% | 3.20% | 3.20% | |

| 06:00 | EUR | German Trade Balance (EUR) Jun | 21.2B | 22.3B | 20.3B | |

| 14:00 | USD | JOLTS Job Openings Jun | 5.66M | 5.67M |