Dollar is back trading as the weakest one for the week as it’s earlier rally attempt faded quickly. Though, Euro and Swiss Franc are not too far behind as the next weakest. Yen is also paring some of this week’s gain but remains generally firm. New Zealand Dollar is surprisingly the strongest one for the weak so far. Sterling is the second strongest as it quickly pared back post BoE losses. Overall, there is no clearly commitment in a direction in the forex markets.

Technically, NASDAQ is worth a watch today as it’s back pressing this week’s low after the -1.27% decline overnight. Further fall could sent the index firmly through 55 day EMA. That could confirm the start of a correction to rise from 6631.42 to 12074.06, and target 38.2% retracement at 9994.97, which is close to 10000 handle. That might result in further decline in Yen pairs in generally. In particular, that might finally drag USD/JPY through 104.18 low.

In Asia, Nikkei is up 0.17%. Hong Kong HSI is up 0.47%. China Shanghai SSE is up 1.44%. Singapore Strait Times is down -0.10%. Japan 10-year JGB yield is down -0.0031 at 0.011. Overnight, DOW dropped -0.47%. S&P 500 dropped -0.84%. NASDAQ dropped -1.27%. 10-year yield dropped -0.003 at 0.684.

UK retail sales rose 0.8% in Aug, 4% above pre-pandemic level

UK Retail sales rose 0.8% mom in August, above expectations of 0.7% mom. Over the year, sales rose 2.8% yoy, below expectation of 3.0% yoy. That’s the fourth consecutive month of growth, resulting in an increase of 4.0% comparing with February’s pre-pandemic level.

CBI: 46% UK firms would cut jobs or not hire in 12 months

UK CBI found in a survey that 51% of firms are expecting to maintain or increase their permanent recruitment in the coming 12 months. At the same time, 46% are planning to either reduce permanent recruitment of not recruit at all. The balance of +5% was sharply lower than +56% in the survey last ear.

Matthew Fell, CBI Chief UK Policy Director, said: “The UK labour market has been under heavy stress since the outset of the Covid-19 crisis and, although the economy has started to re-open, pressure on firms remains acute… We are seeing a two-speed recovery. While some firms are already looking at creating new jobs, most others are in survival mode.”

Japan CPI core dropped to -0.4%, lowest in nearly four years

Japan CPI core (all items less fresh food) dropped to -0.4% yoy in August, down from 0.0% yoy, matched expectations. It’s the lowest readings in nearly four years, matching the low seen in November 2016. All item CPI slowed to 0.2% yoy, down form 0.3% yoy. CPI core-core (all items less fresh food and energy) turned negative to -0.1% yoy, down form 0.4% yoy. Downward pressure is generally expected on prices, which might send core CPI to as low as -1.0% later this year.

Separately, according to a telephone poll by Kydo news 66.4% of the public support new Prime Minister Yoshihide Suga’s cabinet. A survey by Nikkei newspaper and TV Tokyo showed 74% support. Suga is generally expected to follow most a large part of Abenomics as his economic policies.

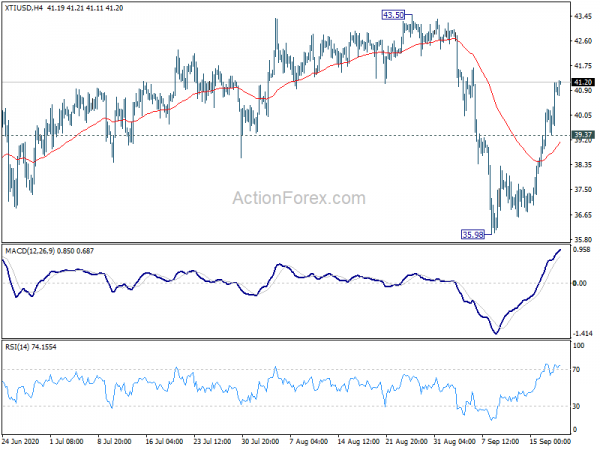

WTI extends rebound as OPEC+ urged full conformity on production cuts

Oil prices surged overnight after OPEC+ urged members to conform with production cuts in an online meeting yesterday. “The JMMC reiterated the critical importance of adhering to full conformity and compensating overproduced volumes as soon as possible,” OPEC officials said.

WTI extends the rebound from 35.98 to as high as 40.73 so far. Further rise is expected towards 43.50 resistance. At this point, we’re not expecting a firm break there. 43.75 is seen as a medium term top with subsequent price actions seen as developing into a sideway consolidation pattern. Break of 39.37 will start a third leg, a down leg, in the pattern.

Looking ahead

Germany will release PPI in European session while Eurozone will release current account. Later in the day, Canada retail sales will be the main focus, with wholesale sales. US will release current account and U of Michigan consumer sentiment.

EUR/USD Daily Outlook

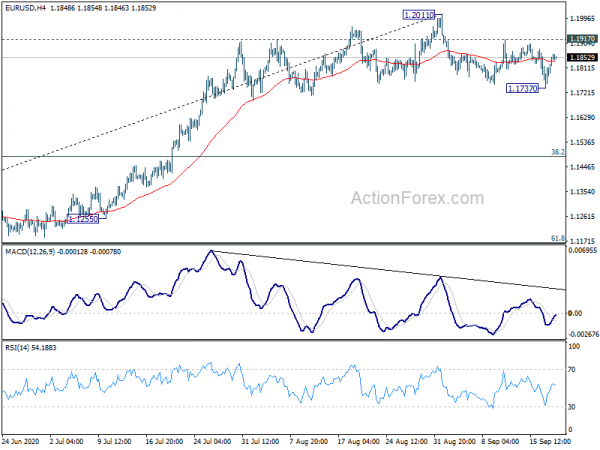

Daily Pivots: (S1) 1.1772; (P) 1.1813; (R1) 1.1887; More…..

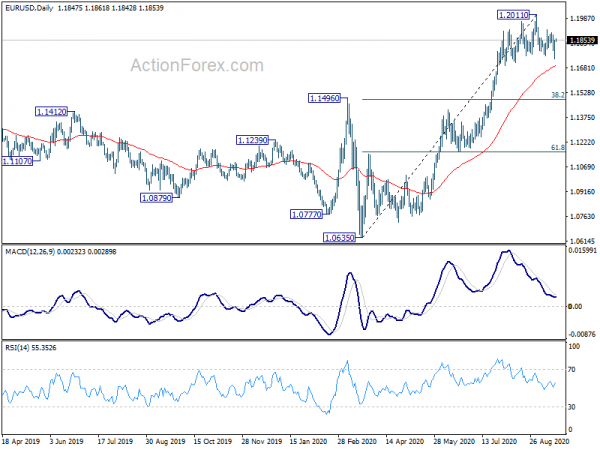

EUR/USD recovers notably after hitting 1.1737 and intraday bias is turned neutral. Further fall is still in favor as long as 1.1917 resistance holds. On the downside, break of 1.1737 support will reaffirm that case that it’s now in correction to rise from 1.6035. Intraday bias will be turned to the downside for 38.2% retracement of 1.0635 to 1.2011 at 1.1485. However, break of 1.1917 will revive near term bullishness and target 1.2011 instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Aug | -0.40% | -0.40% | 0.00% | |

| 06:00 | GBP | Retail Sales M/M Aug | 0.80% | 0.70% | 3.60% | 3.70% |

| 06:00 | GBP | Retail Sales Y/Y Aug | 2.80% | 3.00% | 1.40% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Aug | 0.60% | 0.40% | 2.00% | 2.10% |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Aug | 4.30% | 4.20% | 3.10% | |

| 06:00 | EUR | Germany PPI M/M Aug | 0.00% | 0.10% | 0.20% | |

| 06:00 | EUR | Germany PPI Y/Y Aug | -1.20% | -1.80% | -1.70% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Jul | 12.0B | 20.7B | ||

| 12:30 | CAD | Wholesale Sales M/M Jul | 3.40% | 18.50% | ||

| 12:30 | CAD | Retail Sales M/M Jul | 0.80% | 23.70% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jul | 0.50% | 15.70% | ||

| 12:30 | USD | Current Account (USD) Q2 | -158B | -104B | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 76 | 74.1 |