Dollar trades generally lower today after cautious comments from Fed officials. But New Zealand Dollar is even weaker as markets are preparing themselves for a dovish RBNZ rate statement later in the week. At the same time, weak China data is weighing on Aussie. Canadian Dollar also continues to pare back recent gains and as oil consolidates ahead of the release of the OPEC/non-OPEC meeting statement. Euro, Yen and Sterling are so far the relatively firmer ones, with Euro having an upper hand. The economic calendar is rather light for today and trading could remain subdued in summer mood.

Fed Bullard: Current interest rate appropriate over the near term

St. Louis Fed President James Bullard said that he is "ready to get going in September" regarding unwinding Fed’s balance sheet". But he emphasized that it is going to be "very slow" and there won’t be a lot of impact on the markets. On the other hand, Bullard believes that "the current level of the policy rate is likely to remain appropriate over the near term." Minneapolis Fed President Neel Kashkari said that "inflation has been coming up short, a little low, relative to our two percent target." And, "it actually matters that investors believe the Fed can achieve its goals, because then if there’s a future crisis and we really need people to believe in us, we’ve earned and established that credibility."

Brexit bill a hot topic this week

The size of the Brexit "divorce bill" has suddenly become a hot topic this week after the Sunday Telegraph reported that UK is ready to pay GBP 36b to EU. It was then denied by various UK officials. Also, it’s reported that Prime Minister Theresa May has quickly ruled that out as she was warned by Tory MPs that the GBP 36b amount could not get through parliament. There are talks in that EU’s position for the Brexit bill is EUR 60b while UK’s bottom line is close to EUR 30b. And eventually, the so called "landing zone" is at around "EUR 40b". The third round of Brexit talks will be held in the week of August 28. And it’s uncertain whether any progress could be made at that meeting.

Former BoJ Iwata urged halving asset purchase to JPY 40T annually

In Japan, former BoJ Deputy Governor Kazumasa Iwata said that the central bank’s current price forecasts are too optimistic. And based on recent batch of weak inflation data, it would be challenging to hit 1% inflation. Regarding the asset purchases under the yield curve control framework, Iwata said that "the BOJ should slow its annual bond buying to around 40 trillion yen ($362 billion) from the current 80 trillion yen" to make the program more "sustainable". Also, once inflation can stay around 1%, BoJ should "modify its long-term interest rate target".

Australia business conditions jumped to 9 year high

Australia NAB business confidence jumped to 12 in July, up from 8. Business conditions index rise 1 point to 15, hitting the highest level since early 2008. The business conditions index also sit at three times the long-run average of 5. NAB chief economist Alan Oster noted that "the persistent strength in employment conditions has made us a little more optimistic about the near-term outlook for the labor market." And the result was consistent with annual job growth of around 240k. Nonetheless, "price and wage measures in the survey generally weakened again in the month, partly a reflection of elevated rates of underemployment." For RBA, the "signs of inflation pressures remain elusive."

China trade data point to downward trend

From China, trade surplus widened to USD 46.7b in July. Exports rose 7.2% yoy, slowest pace since February and notably lower than 11.3% yoy rise in the prior month. Exports growth was also well below market expectation of 10.9% yoy. Imports rose 11.0% yoy, slowest since December and sharply lower from 17.2% yoy in the prior month. Import growth was also well below market expectation of 16.6% yoy. Some economists noted that the trade data points to a downward trend in both external and domestic demand.

Elsewhere

Japan current account surplus widened to JPY 1.52T in June. UK BRC retail sales monitor rose 0.9% yoy in July. Swiss unemployment rate, German trade balance and Canada housing starts are the main featured today.

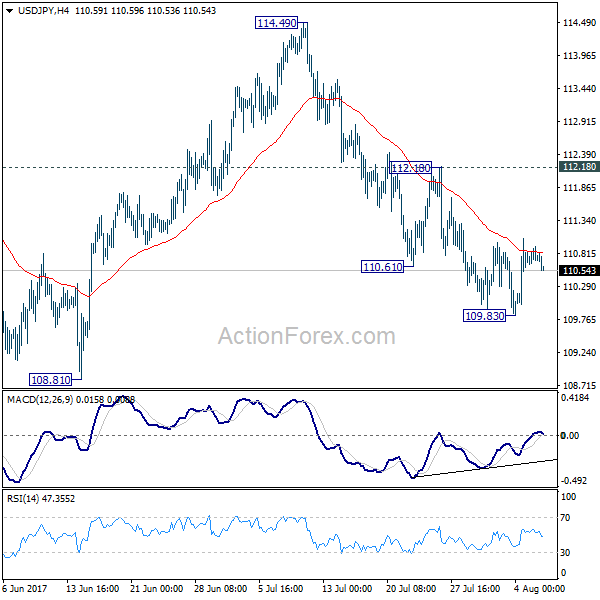

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.60; (P) 110.76; (R1) 110.88; More….

USD/JPY’s recovery was limited by 4 hour 55 EMA and retreated. But it’s staying above 109.83 temporary low and intraday bias stays neutral first. The consolidation from 109.83 might extend and another rise cannot be ruled out. But after all, near term outlook stays bearish as long as 112.18 resistance holds and deeper fall is expected. Break of 109.83 will target 108.81 support first. Break there will resume whole correction from 118.65 and target 61.8% retracement of 98.97 to 118.65 at 106.48. Nonetheless, break of 112.18 resistance will dampen our bearish view and turn focus back to 114.49 resistance instead.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, down side should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jul | 0.90% | 0.60% | 1.20% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.52T | 1.51T | 1.40T | |

| 1:30 | AUD | NAB Business Confidence Jul | 12 | 9 | 8 | |

| 2:00 | CNY | Trade Balance (USD) Jul | 46.7B | 45.3B | 42.8B | |

| 2:00 | CNY | Trade Balance (CNY) Jul | 321.2B | 292B | 294B | |

| 5:00 | JPY | Eco Watchers Survey Current Jul | 49.7 | 50 | ||

| 5:45 | CHF | Unemployment Rate Jul | 3.20% | 3.20% | ||

| 6:00 | EUR | German Trade Balance (EUR) Jun | 22.3B | 20.3B | ||

| 12:15 | CAD | Housing Starts Jul | 206K | 213K | ||

| 14:00 | USD | JOLTS Job Openings Jun | 5.66M | 5.67M |