The markets are generally rather steady today, awaiting weekly close. Major European indices are mixed in tight range. US futures point to mildly higher open, arguing that yesterday’s selloff might not extend for now. Commodity currencies are generally firmer today while Dollar and Yen are the weakest. Stronger than expected US CPI readings are ignored. Sterling appears to be stabilizing for now, as EU indicates that it will wait for the Brexit negotiation deadline before taking another step.

In Europe, currently, FTSE is up 0.29%. DAX is down -0.07%. CAC is up 0.06%. Germany 10-year yield is down -0.038 at -0.467. Earlier in Asia, Nikkei rose 0.74%. Hong Kong HSI rose 0.78%. China Shanghai SSE rose 0.79%. Singapore Strait Times dropped -0.08%. Japan 10-year JGB yield dropped -0.0065 to 0.024.

US CPI accelerated to 1.3% yoy, core CPI rose to 1.7% yoy

US CPI rose 0.4% mom in August, above expectation of 0.3% mom. CPI core rose 0.4% mom, above expectation of 0.2% mom. Annually, headline CPI accelerated to 1.3% yoy, up from 1.0% yoy, beat expectation of 1.2% yoy. CPI core accelerated to 1.7% yoy, up from 1.6% yoy, beat expectation of 1.6% yoy.

ECB Lagarde: No complacency! Our accommodative monetary policy needs the support of fiscal policy

ECB President Christine Lagarde said in a press conference today, “this current moment is coined by this uneven, incomplete and asymmetric recovery that we have observed in the third quarter after a very catastrophic second quarter.”

“No complacency! Our accommodative monetary policy needs the support of fiscal policy, and none of us can afford complacency in the present time,” she urged.

ECB Lane: Recent appreciation of euro exchange rate dampens inflation outlook

In a blog post, ECB Chief Economist Philip Lane said “recent appreciation of the euro exchange rate dampens the inflation outlook.” “Headline inflation is expected to remain persistently low over the medium term, notwithstanding a gradual pick-up over the projection horizon.”

“Inflation remains far below the aim and there has been only partial progress in combating the negative impact of the pandemic on projected inflation dynamics,” he added. “Moreover, the outlook remains subject to high uncertainty and the balance of risks continues to be tilted to the downside.”

From Germany, CPI was finalized at -0.1% mom, 0.0% yoy in August.

UK GDP grew 6.6% in July, still -11.7% lower than pre-pandemic levels

UK GDP grew 6.6% mom in July, just slightly below expectation of 6.7% mom. It’s the third consecutive of increase in GDP. But only around half of the pandemic loss was recovered so far. Also, monthly GDP in July was -11.7% lower than the pre-pandemic levels seen in February.

ONS director of economic statistics Darren Morgan said: “While it has continued steadily on the path towards recovery, the UK economy still has to make up nearly half of the GDP lost since the start of the pandemic…. All areas of manufacturing, particularly distillers and car makers, saw improvements, while housebuilding also continued to recover. However, both production and construction remain well below previous levels.”

Looking at some details, index of services rose 6.1% mom in July. Index of production rose 5.2% mom. Manufacturing rose 6.3% mom. Construction rose 17.6% mom. Agriculture rose 1.1% mom.

New Zealand BusinessNZ manufacturing dropped back to 50.7 on lockdown return

New Zealand BusinessNZ Manufacturing PMI dropped sharply to 50.7 in August, down from 59.0. Looking at some details, productions dropped form 61.8 to 51.1. Employment improved from 46.9 to 49.0. New orders tumbled from 67.5 to 54.0.

BusinessNZ’s executive director for manufacturing Catherine Beard said, “After two months of playing catch-up, the level 3 lockdown placed on New Zealand’s largest population and economic region meant the sector would experience another hit. While results in other parts of the country led to the national result keeping its head above water, the latest results show how fragile and short the recovery can be.”

BNZ Senior Economist, Doug Steel said that “an outcome above the 50 breakeven mark – indicating a modicum of growth occurred in the month – is arguably a commendable result given more than a third of the country moved into alert level 3 for more than half of the month.”

EUR/USD Mid-Day Outlook

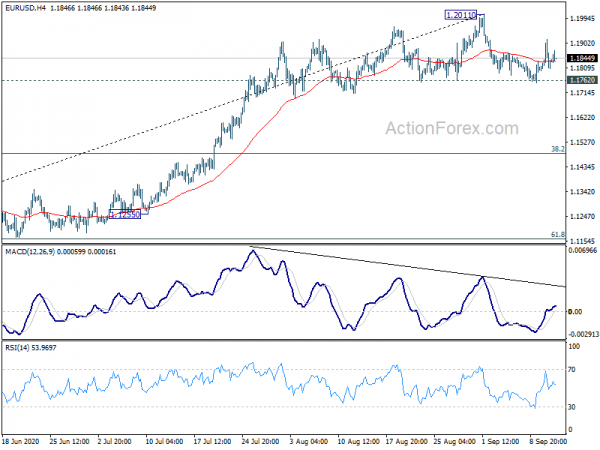

Daily Pivots: (S1) 1.1772; (P) 1.1844; (R1) 1.1888; More…..

EUR/USD is staying in consolidation from 1.2011 and intraday bias remains neutral for the moment. With 1.1762 support intact, further rise is expected. Firm break of 1.2011 will resume the rally from 1.0635 towards 1.2555 key level. Nevertheless, sustained break of 1.1762 should confirm short term topping and turn bias to the downside for 38.2% retracement of 1.0635 to 1.2011 at 1.1485.

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Aug | 50.7 | 66.8 | 58.8 | 59 |

| 23:50 | JPY | PPI Y/Y Aug | -0.50% | -0.50% | -0.90% | |

| 23:50 | JPY | BSI Large Manufacturing Conditions Index Q3 | 0.1 | -52.3 | ||

| 06:00 | EUR | Germany CPI M/M Aug F | -0.10% | -0.10% | -0.10% | |

| 06:00 | EUR | Germany CPI Y/Y Aug F | 0.00% | 0.00% | 0.00% | |

| 06:00 | GBP | GDP M/M Jul | 6.60% | 6.70% | 8.70% | |

| 06:00 | GBP | Manufacturing Production M/M Jul | 6.30% | 5.00% | 11.00% | |

| 06:00 | GBP | Manufacturing Production Y/Y Jul | -9.40% | -10.50% | -14.60% | |

| 06:00 | GBP | Industrial Production Y/Y Jul | -7.80% | -8.70% | -12.50% | |

| 06:00 | GBP | Industrial Production M/M Jul | 5.20% | 4.10% | 9.30% | |

| 06:00 | GBP | Index of Services 3M/3M Jul | -8.10% | -19.20% | -19.90% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Jul | -8.6B | -7.4B | -5.1B | -6.6B |

| 12:30 | USD | CPI M/M Aug | 0.40% | 0.30% | 0.60% | |

| 12:30 | USD | CPI Y/Y Aug | 1.30% | 1.20% | 1.00% | |

| 12:30 | USD | CPI Core M/M Aug | 0.40% | 0.20% | 0.60% | |

| 12:30 | USD | CPI Core Y/Y Aug | 1.70% | 1.60% | 1.60% | |

| 12:30 | CAD | Capacity Utilization Q2 | 70.30% | 81.10% | 79.80% | |

| 13:00 | GBP | NIESR GDP Estimate | -7.90% |