Yen remains generally firm as Asian session as deep risk aversion carries forward from US markets. Concerns over coronavirus vaccine development was a major factor weighing on sentiments. Dollar turns softer, digesting yesterday’s gains, but remains generally firm. Sterling continues to trade as the weakest one and selloff is continuing on no-deal Brexit worries. A focus now will turn to Euro, which looks rather vulnerable against Dollar and Yen. Traders might not want to wait till ECB meeting later in the week to trigger a selloff.

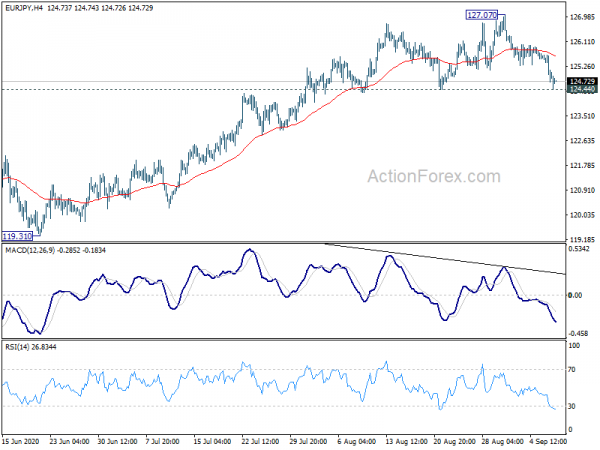

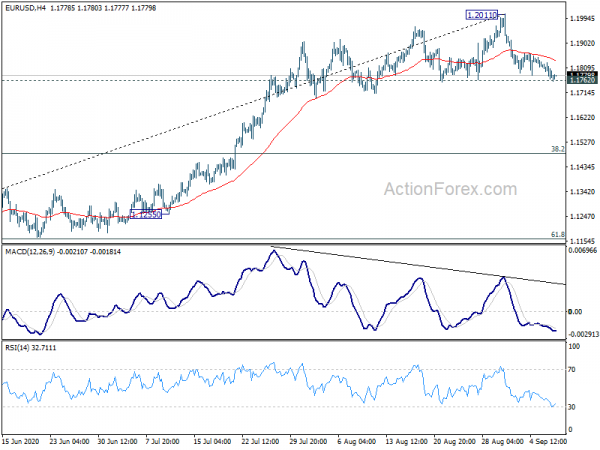

Technically, the case of a Dollar reversal is building up. USD/CAD, following GBP/USD and USD/CHF, breaks 1.3239 resistance which indicates short term bottoming. That’s helped by the free fall in oil price too. Now, the focus is on EUR/USD, which is pressing 1.1762 support. Firm break there should also confirm short term topping and the start of a correction downwards. At the same time, EUR/JPY is also pressing 124.44 support. Break would likely bring deeper fall to correct whole rise from 114.42.

In Asia, currently, Nikkei is down -1.26%. Hong Kong HSI is down -0.97%. China Shanghai SSE is down -1.07%. Singapore Strait Times is down -0.53%. Japan 10-year JGB yield is down -0.0060 at 0.032. Overnight, DOW dropped -2.25%. S&P 500 dropped -2.78%. NASDAQ dropped -4.11%. 10-year yield dropped -0.037 to 0.684.

Stocks tumbled as AstraZeneca pauses vaccine trial, NASDAQ holding on to 10789 support

Now, there’s finally a strong reason that could explain the deep selloff in the stock market that started late last week. AstraZeneca Plc said it has paused a late-stage trial of one of the coronavirus vaccine candidate, due to an “unexplained illness in one of the trials. The company said that’s “routine action” while the illness is investigated, “ensuring we maintain the integrity of the trials”. Also, “in large trials, illnesses will happen by chance but must be independently reviewed to check this carefully.”

All major US indices ended sharply lower, with DOW down -2.25%, S&P 500 down -2.8%, NASDAQ down -4.11%. NASDAQ is still holding on to key near term fibonacci level for now, 23.6% retracement of 6631.42 to 12074.06 at 10789.59, which is close to 55 day EMA. As long as this support holds, price actions from 12074.06 will likely develop into a brief near term consolidation only, and the record run will resume sooner rather than later. Though, firm break will suggest that deeper correction is underway to 38.2% retracement at 9994.97, at least.

Australia Westpac consumer sentiment rose 18%, returning to more normal levels

Australia Westpac Consumer Sentiment surged 18% to 94.8 in September, up from 79.5. The index is now just -1.6% below the average over the six months prior to the emergence of COVID-19 in March. “Consumer confidence is returning to more normal levels, although the sensitivity to progress in managing the virus and the opening up of economies remains key to the outlook”

RBA will next meet on October 6, the same say as the government’s Federal Budget announcement. Westpac said “it is reasonable to expect further initiatives from the Reserve Bank to loosen monetary policy”. That approach will be “entirely appropriate” to complement the stimulatory budget.

New Zealand ANZ business confidence jumped to -26, firms looking through coronavirus re-emergence

Preliminary reading of ANZ Business Outlook survey showed marked improvement in business confidence , from -26.0 to -41.8. Own activity outlook also jumped form -17.5 to -9.9. ANZ said “firms are largely looking through the re-emergence of COVID-19 in the community”. Many activity indicators are also “at their highest levels since February”, even though still well down compared to pre-COVID days”.

ANZ added: “The New Zealand economy has a long way to go to navigate this crisis. Fiscal and monetary policy are certainly working their magic. But come year end, far fewer firms will be supported by wage subsidies, and the loss of tourists will be more sorely felt. But for now, things appear to be firmly in the “could be worse” basket.”

Also released, manufacturing sales dropped -12.2% in Q2. The main industry movements were: petroleum and coal products; down -33%, metal products, down -22%; transport equipment, machinery, and equipment, down -14%.

Elsewhere

Japan M2 rose 8.6% yoy in August versus expectation of 8.5% yoy. China CPI slowed to 2.4% yoy in August, down from 2.7% yoy, matched expectation. PPI climbed back to -2.0% yoy, up from -2.4% yoy, matched expectations.

Swiss will release unemployment rate in European session. But main focus will be on BoC rate decision, which the central bank is expected to stand pat.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1751; (P) 1.1790; (R1) 1.1813; More…..

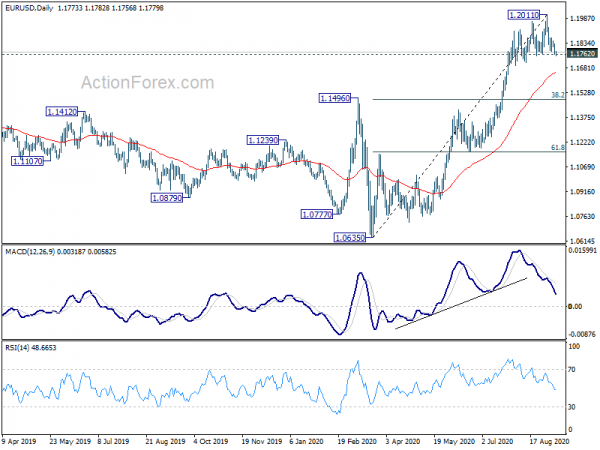

Immediately focus is now on 1.1762 support in EUR/USD. Decisive break there will confirm short term topping at 1.2011, on bearish divergence condition in 4 hour MACD. Intraday bias will be turned to be downside for 55 day EMA (now at 1.1652). Sustained break there will suggest that the decline is correcting whole rise from 1.0635, and target 1.0635 to 1.2011 at 1.1485. Nevertheless, rebound from current level, followed by 1.2011 resistance, will resume the rise from 1.0635 instead.

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q2 | -12.20% | -1.70% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Aug | 8.60% | 8.40% | 7.90% | |

| 0:30 | AUD | Westpac Consumer Confidence Sep | 18.00% | -9.50% | ||

| 1:00 | NZD | ANZ Business Confidence Sep P | -26 | -41.8 | ||

| 1:30 | CNY | CPI Y/Y Aug | 2.40% | 2.40% | 2.70% | |

| 1:30 | CNY | PPI Y/Y Aug | -2.00% | -2.00% | -2.40% | |

| 5:45 | CHF | Unemployment Rate Aug | 3.50% | 3.30% | ||

| 12:15 | CAD | Housing Starts Aug | 222K | 246K | ||

| 14:00 | CAD | BoC Rate Decision | 0.25% | 0.25% |