Sterling remains generally weaker today, on Brexit concerns. But Swiss Franc is apparently worse for now, dropping through a near term support level against the greenback. On the other hand, Yen and Dollar stay firm in mixed Asian markets. Yen is not too troubled by data that showed deeper than estimated economic contraction in Q2. Instead, eyes are on who the next Japanese Prime Minister would be. Australian Dollar is attempting a rebound too but upside is capped by business conditions data.

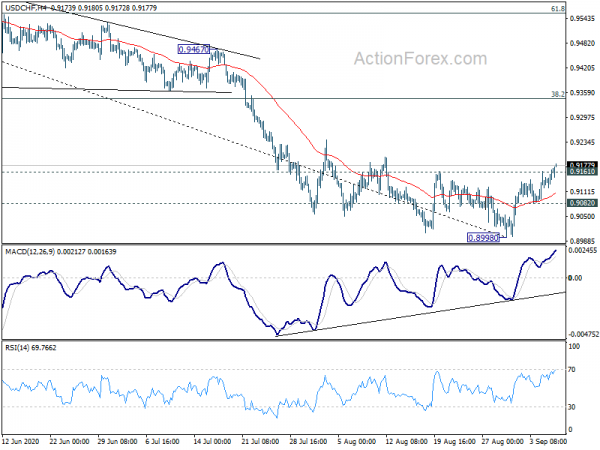

Technically, USD/CHF’s break of 0.9161 resistance suggests short term bottoming at 0.8998. The pair should be on track for a stronger rebound. But we’d still need to see more breakthrough in Dollar pairs to confirm the underlying momentum in the greenback. The levels to watch include 1.1762 support in EUR/USD, 1.3053 support in GBP/USD.

In Asia, currently, Nikkei is up 0.51%. Hong Kong HSI is down -0.57%. China Shanghai SSE is down -0.34%. Singapore Strait Times is up 0.30%. Japan 10-year JGB yield is down -0.00-37 at 0.038.

Australia NAB business conditions dropped to -6, as employment deteriorated

Australia NAB Business Confidence improved to -8 in August, up from -14. However, Business Conditions dropped to -6, down from 0. All conditions components deteriorated, with trading down from 1 to -2, profitability down from 1 to -3, employment down form -2 to -13.

Alan Oster, NAB Group Chief Economist said the weakness in conditions was “primarily driven by a deterioration in the employment index – suggesting that while the economy has generally begun to open up, the labour market is still weakening”. The deteriorations was also “broad-based across the states”, suggests that the “virus continues to pose a risk everywhere, not just states with significant containment measures in place”. Confidence also “remains fragile”, still negative. it will “continue to be impacted by news around the virus”

“Given the sheer magnitude of the fall in activity in Q2 and the subsequent lockdowns in Victoria, it’s is likely we will see a protracted recovery and a rise in the unemployment rate before it gets better. Policy makers have provided unprecedented support – but we think there will need to be more. This would help businesses and the economy recover more quickly and the focus can again return to growth”, Oster added.

Japan Q2 GDP contraction finalized at -7.9% qoq, -28.1% annualized

Japan Q2 GDP contraction was revised down to -7.9% qoq, from -7.8% qoq. In annualized term, GDP contracted -28.1% versus preliminary reading of -27.8%. GDP deflator was finalized at 1.3% yoy. In July, labor cash earnings dropped -1.3% yoy, versus expectation of -1.6% yoy. Household spending dropped -7.6% yoy, versus expectation of -3.7% yoy. Current account surplus narrowed to JPY 0.96T. Bank lending rose 6.7% yoy in August, versus expectation of 6.3% yoy.

Economy Minister Yasutoshi Nishimura said “the economy was in a severe state in April-June because we intentionally halted activity to contain the coronavirus “. Nevertheless “it has recently shown signs of picking up”.

“Some positive corporate spending to adapt to a new lifestyle is seen, such as capex to boost production capacity, spending on telecom equipment,” he added. On the other hand, “household income is rising so the economy likely to continue recovering but must watch impact on the renewed rise in infection numbers, hot temperatures on consumption.”

BoE Haldane a touch more optimistic than his MPC colleagues

BoE Chief Economist Andy Haldane said he was “probably a touch more optimistic” on the economy than his MPC colleagues. “Right now the prevailing narrative is a bit gloomier than I think is justified by the data,” he said. “I am, I hope, more open minded about what lies ahead both economically and policy wise.”

Haldane added that the “recovery isn’t being given enough credit”. The economy “has bounced back” because “the consumer has shown themselves to be incredibly resilient and adaptive and so too have businesses.” He also warned that pessimism surrounding the economy and job losses could “risk becoming self-fulfilling, and you’re then sucked down into some expectational vortex”.

Looking ahead

Germany trade balance, France trade balance and Italy retail sales will be released. Eurozone Q2 GDP revision will also be featured. US calendar will remain empty today.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9132; (P) 0.9151; (R1) 0.9181; More…

USD/CHF’s break of 0.9161 resistance should confirm short term bottoming at 0.8998, on bullish convergence condition in 4 hour MACD. Intraday bias is turned back to the upside for 55 day EMA (now at 0.9230) and above. Such rise is currently seen as a corrective move and hence, we’d pay attention to topping around 38.2% retracement of 0.9901 to 0.8998 at 0.9343. On the downside, below 0.9082 minor support will turn bias back to the downside for retesting 0.8998 low instead.

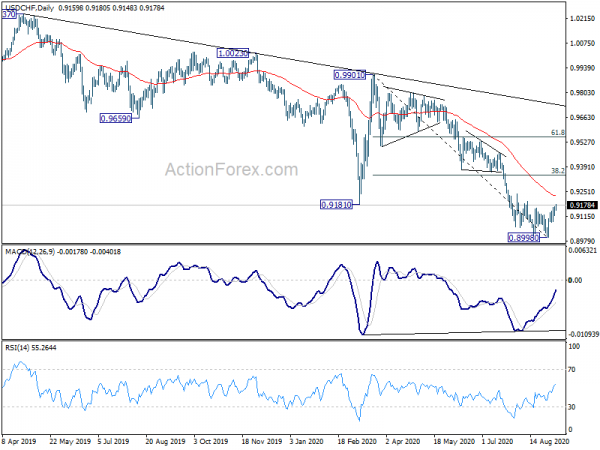

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low), which is still extending. Sustained trading below 100% projection of 1.0342 to 0.9186 from 1.0237 at 0.9081 will pave the way to 138.2% projection at 0.8639. On the upside, break of 0.9376 resistance is needed to be the first sign of medium term bottoming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Aug | 4.70% | 4.30% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | -1.30% | -1.60% | -2.00% | |

| 23:30 | JPY | Household Spending Y/Y Jul | -7.60% | -3.70% | -1.20% | |

| 23:50 | JPY | Bank Lending Y/Y Aug | 6.70% | 6.30% | 6.30% | 6.40% |

| 23:50 | JPY | GDP Q/Q Q2 F | -7.90% | -8.10% | -7.80% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | 1.30% | 1.50% | 1.50% | |

| 23:50 | JPY | Current Account (JPY) Jul | 0.96T | 1.44T | 1.05T | |

| 1:30 | AUD | NAB Business Confidence Aug | -8 | -14 | ||

| 1:30 | AUD | NAB Business Conditions Aug | -6 | 0 | ||

| 5:00 | JPY | Eco Watchers Survey: Current Aug | 41 | 41.1 | ||

| 6:00 | EUR | Germany Trade Balance (EUR) Jul | 14.9B | 14.5B | ||

| 6:45 | EUR | France Trade Balance (EUR) Jul | -7.0B | -8.0B | ||

| 8:00 | EUR | Italy Retail Sales M/M Jul | 1.10% | 12.10% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q2 F | -12.10% | -12.10% | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q2 F | -2.80% | -2.80% | ||

| 10:00 | USD | NFIB Business Optimism Index Aug | 98 | 98.8 |