Dollar rises against European majors an Yen as headline non-farm payrolls number came in not far from expectation. Encouragingly, unemployment rate dropped notably while participation rate also rose. Wage growth also some what picked up. DOW future also point to a mildly higher open. The greenback is set to end as the strongest one for the week, followed by Canadian Dollar and then Euro. Australian Dollar would be the weakest, followed by Yen.

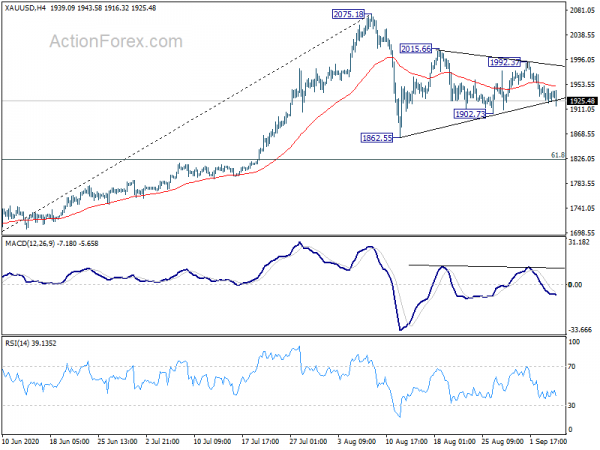

Technically, Dollar is still held below near term resistance against other major currencies. The key levels remain on 1.1762 support in EUR/USD. Gold’s break of near term trend line support is a positive sign for the Dollar. Further decline is now in favor to 1902.73 support. Break will raise the chance that the consolidation pattern from 2075.18 would extend through 1862.55.

In Europe, currently, FTSE is up 0.62%. DAX is up 0.09%. CAC is up 0.69%. Germany 10-year yield is up 0.0156 at -0.471. Earlier in Asia, Nikkei dropped -1.11%. Hong Kong HSI dropped -1.25%. China Shanghai SSE dropped -0.87%. Singapore Strait Times dropped -0.87%. Japan 10-year JGB yield rose 0.0046 to 0.040.

US non-farm payrolls rose 1371k, unemployment rate dropped to 8.4%

US Non-Farm payrolls employment grew 1371k in August, slightly below expectation of 1550k. Unemployment rate dropped sharply to 8.4%, down from 10.2%, beat expectation of 9.9%. Labor force participation rate also rose 0.3% to 61.7%. Average hourly earnings rose 0.4% mom, above expectation of 0.0% mom.

BLS said: “These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it. In August, an increase in government employment largely reflected temporary hiring for the 2020 Census. Notable job gains also occurred in retail trade, in professional and business services, in leisure and hospitality, and in education and health services.”

Canada employment rose 246k, unemployment rate dropped to 10.2%

Canada employment rose 246k in August, below expectation of 400k. Most of the growth were found in full-time jobs, which increase 206k. However, full time employment still just stood at 93.9% of pre-pandemic levels, compared with 96.1% for part-time work. Unemployment rate dropped slightly to 10.2%, down from 10.9%, better than expectation of 11.0%.

BoE Saunders: Quite likely additional easing will be appropriate

BoE MPC member Michael Saunders said it’s “quite likely that additional monetary easing will be appropriate in order to achieve a sustained return of inflation to the 2% target”. “My hunch is that risks lie on the side of weaker growth and a longer period of excess supply than forecast,” he added.

Regarding post-Brexit outlook, he said, “risks probably lie on the side of a thinner trade deal, a less-smooth transition, or more persistent Brexit-related uncertainty. More generally, global trade policy uncertainty remains high.”

UK PMI construction dropped to 54.6, speed of recovery lost momentum

UK PMI Construction dropped to 54.6 in August, down from July’s 58.1. Markit said subdued order books held back output growth. House building remained the best performing category. Business expectations reached six-month high on hopes of a boost from infrastructure work.

From Germany, factory orders rose 2.8% mom in July, well below expectation of 5.1% mom.

Australia retail sales rose 3.2% in Jul, Victoria reported the only fall

Australia retail sales rose 3.2% mom in July, slightly below expectation of 3.3% mom. All state and territories reported growth in sales, except Victoria which was down -2.1% mom due to stage four lockdown.

“Turnover in clothing, footwear and personal accessory retailing (7.1 per cent) and cafes, restaurants, and takeaway food services (4.9 per cent) rose across the country, with the exception of Victoria, where the reintroduction of Stage 3 stay-at-home restrictions in July partially offset these rises. As was the case in April, restrictions led to significant falls in these industries in Victoria” said Director of Quarterly Economy Wide Surveys Ben James.

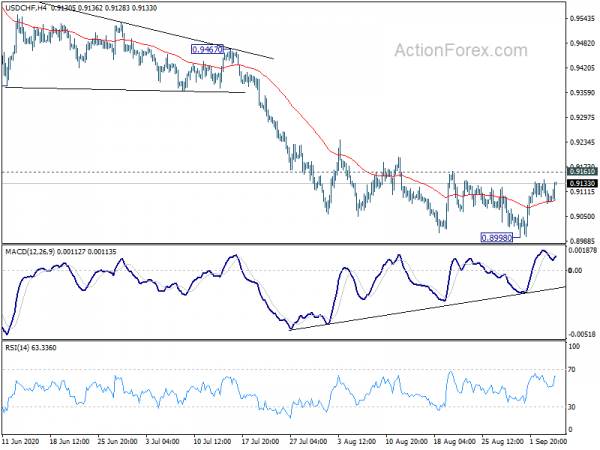

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9071; (P) 0.9106; (R1) 0.9130; More…

USD/CHF is drawing support from 4 hour 55 EMA, but stays below 0.9161 resistance. Intraday bias remains neutral first. On the downside, break of 0.8998 temporary low will resume larger down trend to 100% projection of 1.0237 to 0.9181 from 0.9901 at 0.8845. Nevertheless, sustained break of 0.9161 will confirm short term bottoming, and turn bias to the upside for stronger rebound, to 55 day EMA (now at 0.9231) and above.

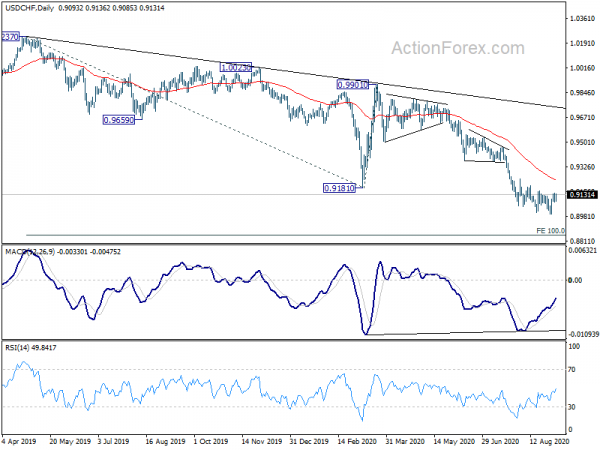

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low), which is still extending. Sustained trading below 100% projection of 1.0342 to 0.9186 from 1.0237 at 0.9081 will pave the way to 138.2% projection at 0.8639. On the upside, break of 0.9376 resistance is needed to be the first sign of medium term bottoming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Jul | 3.20% | 3.30% | 3.30% | |

| 06:00 | EUR | Germany Factory Orders M/M Jul | 2.80% | 5.10% | 27.90% | |

| 08:30 | GBP | Construction PMI Aug | 54.6 | 58.9 | 58.1 | |

| 12:30 | USD | Nonfarm Payrolls Aug | 1371 K | 1550K | 1763K | 1734K |

| 12:30 | USD | Unemployment Rate Aug | 8.40% | 9.90% | 10.20% | |

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.40% | 0.00% | 0.20% | 0.10% |

| 12:30 | CAD | Net Change in Employment Aug | 245.8K | 400.0K | 418.5K | |

| 12:30 | CAD | Unemployment Rate Aug | 10.20% | 11.00% | 10.90% | |

| 14:00 | CAD | Ivey PMI Aug | 65.0 | 65.2 |