Australian Dollar tumbles broadly today and it’s trading as the weakest one so far. The decline partly follows worse than expected Q2 GDP data, and partly as profit taking on recent strong rise. Selloff against New Zealand Dollar the latter to be the strongest one. On the other hand, Dollar also recovers in general, digesting recent steep losses. Traders also turn cautious ahead of more important data from the US, with ADP private employment today, ISM services tomorrow, and non-farm payrolls on Friday.

Technically, as for Dollar, current recovery is seen generally as a corrective move for the moment. At least, breaks of 0.9161 resistance in USD/CHF, 1.1325 resistance in USD/CAD and 1.1762 support in EUR/USD are needed to be the first signs of short term bottoming. EUR/CAD’s rejection by 1.5646 resistance gives a bit a favor to Dollar against Euro. We’ll also see if EUR/CAD would break through 1.5469 to resume the corrective decline from 1.5978.

In Asia, currently, Nikkei is up 0.21%. Hong Kong HSI is down -0.46%. China Shanghai SSE is down -0.34%. Singapore Strait Times is down -0.37%. Japan 10-year JGB yield is down -0.0030 at 0.042. Overnight, DOW rose 0.76%, still on track to test 29568.57 record high. S&P 500 rose 0.75% to 3526.65 record. NASDAQ also rose 1.39% to 11939.66 record. 10-year yield dropped -0.021 to 0.672,

Australia GDP contracted record -7.0% in Q2, significant fall in household spending

Australia GDP contracted -7.0% qoq in Q2, worst than expectation of -6.0% qoq. That’s the largest quarterly decline on record since 1959. Combined with Q1’s -0.3% qoq decline, technical recession is confirmed for the country. Looking at some details, private demand detracted -7.9% from GDP, driving by -12.1% decline in household final consumption expenditure. Services spending dropped -17.6% too. Net trade contributed 1.0% to GDP. Public demand contributed 0.6%.

After the release, Treasurer Josh Frydenberg said “Today’s national accounts confirm the devastating impact on the Australian economy from COVID-19… Our record run of 28 consecutive years of economic growth has now officially come to an end. The cause? A once-in-a-century pandemic.”

Nevertheless, “Australia’s economic performance sits among the top of those developed nations as a result of our health and our economic plan to fight the virus,” he added. “Our priority has and will continue to be saving lives and ensuring that Australia’s healthcare system has the capacity to test, trace and treat coronavirus cases.”

RBNZ Orr actively preparing a package of additional monetary policy tools

RBNZ Governor Adrian Orr said in a speech that the early policy actions on the pandemic, including significant reduction in the Official Cash Rate, and introduction of the Large Scale Asset Purchases, “have been effective in lowering interest rates across the board, and ensuring there is plentiful liquidity in the financial system.”

He added that RBNZ is “actively preparing a package of additional monetary policy tools to use if needed”. The tools include “negative wholesale interest rates, further quantitative easing, direct lending to banks, and ongoing forward guidance about our intentions.” While some of the tools are “unfamiliar to many New Zealanders,” he noted, “they are used widely internationally”.

Released from New Zealand, terms of trade index rose 2.5% in Q2, above expectation of 0.6%.

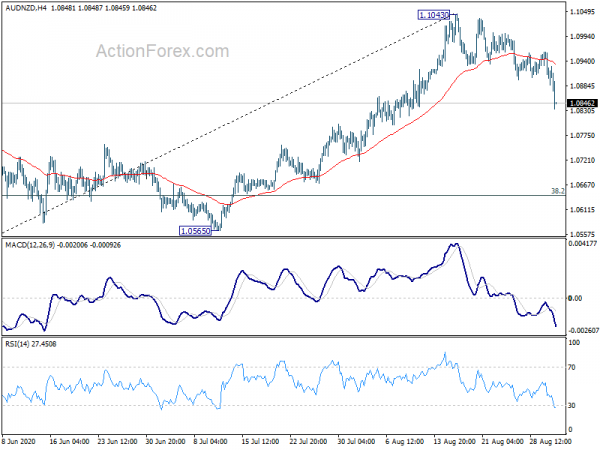

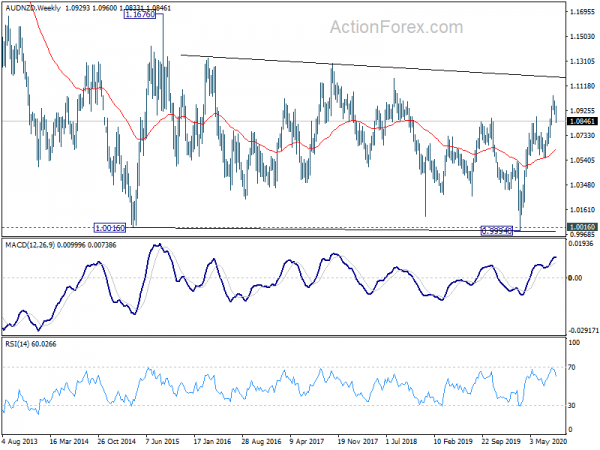

AUD/NZD extending correction towards 55 day EMA at 1.08

AUD/NZD’s pull back from 1.1043 short term top extends lower today, partly in reaction to disappointment over Australia GDP data. Deeper fall would be seen to 55 day EMA (now at 1.0806) and possibly below. It’s early to tell if the rebound from 0.9994 has completed, and how deeper the decline would be. Bearish divergence condition in daily MACD is a bearish sign. Also, 1.1043 is close to the edge of a long term range. Reaction to 38.2% retracement of 0.9994 to 1.1043 at 1.0642 will be crucial to determine the next move.

BoJ Wakatabe: Necessary to be vigilant against risk of decline in inflation

BoJ Deputy Governor Masazumi Wakatabe warned today that “it’s necessary to be vigilant against the risk of a decline in the inflation rate.” Temporary external shocks like the coronavirus pandemic could lead to persistent stagnation. And, “in order to address both upside and downside risks to prices, the BOJ must continue to strongly commit itself to achieving its price target.”

Additionally, he said the BoJ must “constantly have deep discussions” on improving its policy. “It’s necessary to give further consideration to what kind of monetary policy should be taken in the COVID-19 era, while referring to discussions being held at other central banks.”

Released from Japan, monetary base rose 11.5% yoy in August, above expectation of 11.4% yoy.

Looking ahead

Germany retail sales and Eurozone PPI will be released in European session. Later in the data, US ADP employment will be the major focus. Factory orders, crude oil inventories and Fed’s Beige Book will also be released.

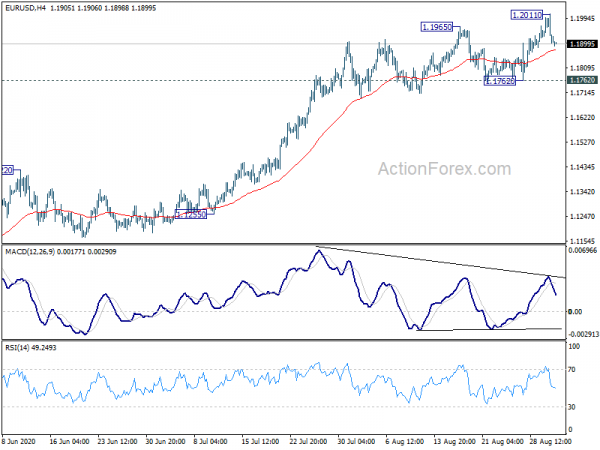

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1872; (P) 1.1942; (R1) 1.1981; More…..

A temporary top was formed at 1.2011 as EUR/USD quickly retreated from there, back into prior established range. Intraday bias is turned neutral first. Near term outlook will stay bullish as long as 1.1762 support holds. Break of 1.2011 will resume the whole rise from 1.0635. However, firm break of 1.1762 will confirm short term topping and turn bias to the downside for deeper pull back.

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | 2.50% | 0.60% | -0.70% | -.060% |

| 23:01 | GBP | BRC Shop Price Index Y/Y Jul | -1.60% | -1.30% | ||

| 23:50 | JPY | Monetary Base Y/Y Aug | 11.50% | 11.40% | 9.80% | |

| 1:30 | AUD | GDP Q/Q Q2 | -7.00% | -6.00% | -0.30% | |

| 6:00 | EUR | Germany Retail Sales M/M Jul | 0.50% | -1.60% | ||

| 9:00 | EUR | PPI M/M Jul | 0.50% | 0.70% | ||

| 9:00 | EUR | PPI Y/Y Jul | -3.90% | -3.70% | ||

| 12:15 | USD | ADP Employment Change Aug | 1250K | 167K | ||

| 14:00 | USD | Factory Orders M/M Jul | 5.00% | 6.20% | ||

| 14:30 | USD | Crude Oil Inventories | -4.7M | |||

| 18:00 | USD | Fed’s Beige Book |