Euro trades broadly higher in Asian session as it finally takes out near term resistance against Dollar and Yen. Swiss Franc is following the common currency closely as second strongest. Gold is also tracking the Euro higher too. Dollar and Yen continue to stay under broad based pressure. The limelight is currently off Australian Dollar as markets shrug off RBA monetary policy decisions, as well as the data released from Australia and China.

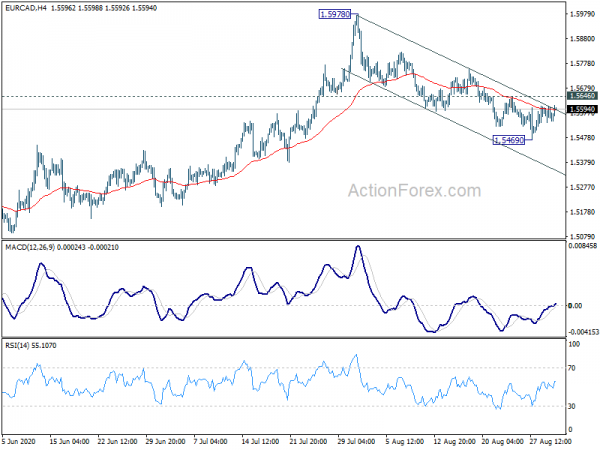

Technically, a question now is whether Euro buying will spread to other pairs. Levels to watch included 0.8974 minor resistance in EUR/GBP, 1.6297 minor resistance in EUR/AUD and 1.5646 minor resistance in EUR/CAD. 1.0849 resistance in EUR/CHF is also a key level but we’re not expecting a break there for now yet.

In Asia, currently, Nikkei is down -0.03%. Hong Kong HSI is up 0.08%. China Shanghai SSE is down -0.05%. Singapore Strait Times is down -0.61%. Japan 10-year JGB yield is down -0.0096 at 0.045. Overnight, DOW dropped -0.78%. S&P 500 dropped -0.22%. But NASDAQ rose 0.68% to 11755.45, new record. 10-year yield dropped -0.036 to 0.693, back below 0.7% handle.

RBA kept cash rate at 0.25%, expand and extend term funding facility

RBA left cash rate unchanged at 0.25% as widely expected. The target for 3-year AGS was also kept at 0.25%. On the other hand, it decided to increase the size of the Term Funding Facility to around AUD 200B. Also, the access to facility will also be extended. It also pledged to maintain “highly accommodative settings as long as is required”. It “will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.”

On the economy, RBA reiterated that the downside is “not as severe as earlier expected”. But recovery is “both uneven and bumpy” with outbreak in Victoria having a “major effect” of the state’s economy. Unemployment and underemployment “remain high” and it’s “likely to be some months” before a meaningful recovery in labor market takes place. Wages and price prices pressures also “remain subdued” and “likely to continue for some time”.

RBA also acknowledged that “US dollar has depreciated against most currencies over recent months. Given this and higher commodity prices, the Australian dollar has appreciated, to be around its highest level in nearly two years.”

Australia AiG manufacturing dropped to 49.3, Victoria in contraction too

Australia AiG Performance of Manufacturing Index dropped to 49.3 in August, down from July’s 53.5, back in contraction. The details are mixed as production dropped -3.0 to 53.4. Employment dropped -3.2 to 50.2. New orders dropped -6.1 to 46.6. Exports rose 10.8 to 52.2. Average wages rose 2.0 to 50..

There was large divergence between larger manufacturing states. Victoria’s PMI dropped by -9.3pts and back into contraction at 44.0. New South Wales PMI also dropped -5.2 pts to 51.0. But South Australia PMI Rose 3.3 pts to 65.3. Queensland PMI also rose 9.7 to 47.1.

Also released from Australia, building permits jumped 12.0% mom in July versus expectation of -0.5% mom. Current account surplus widened to AUD 17.7B in Q2 versus expectation of AUD 13.0B. From New Zealand, building permits dropped -4.5% mom in July.

Japan capital spending dropped -11.3% in Q2, unemployment rate ticked up to 2.9% in Jul

Japan’s capital spending dropped -11.3% in Q2, much worse than expectation of -4.0%. That’s also the worst decline since Q1 2010, as coronavirus pandemic hit manufacturing and services investments.

In July, unemployment rate ticked up to 2.9%, from 2.8%, better than expectation of 3.1%. Job-to-applicants ratio slipped for the seven consecutive month, from 1.11 to 1.08, lowest since April 2014.

Japan PMI manufacturing finalized at 47.2, moved closer to stabilization

PMI Manufacturing was finalized at 47.2 in August, up from July’s 45.2. Markit noted slowest falls in output and new orders since early 2020. Export sales also decline at weakest rate for seven months. There is modest drop in employment.

Annabel Fiddes, Economics Associate Director at IHS Markit, said: “The latest PMI data show that Japan’s manufacturing sector moved closer to stabilisation in August, as firms signalled weaker drops in output and orders… It is hoped that as economies around the world reopen and business operations normalise, this will feed through to firmer customer demand and a recovery of Japanese manufacturing activity in the months ahead.”

China Caixin PMI manufacturing rose to 53.1, post-epidemic recovery continued

China Caixin PMI Manufacturing rose to 53.1 in August, up fro m52.8, above expectation of 51.3. Markit noted the sharpest increases in output and new orders since the start of 0211. New export work rises for the first time in 2020 to date. Employment also moves closer to stabilization.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the post-epidemic economic recovery in the manufacturing sector continued. Supply and demand expanded with the pickup in overseas demand. Backlogs of work continued to increase. Both quantity of purchases and stocks of purchased items also grew. Companies’ future output expectations remained strong, reflecting a positive outlook for the manufacturing sector for the year ahead.

“Employment remained an important focus. An expansion of employment relies on long-term improvement in the economy. Macroeconomic policy supports are essential, especially when there are still many uncertainties in domestic and overseas economies. Relevant policies should not be significantly tightened.”

Looking ahead

Eurozone will release PMI manufacturing final, unemployment rate and CPI flash. Germany and Italy will release unemployment. UK will release PMI manufacturing final, mortgage approvals and M4 money supply. Later in the day, Canada will release PMI manufacturing, US will release ISM manufacturing and construction spending.

EUR/USD Daily Outlook

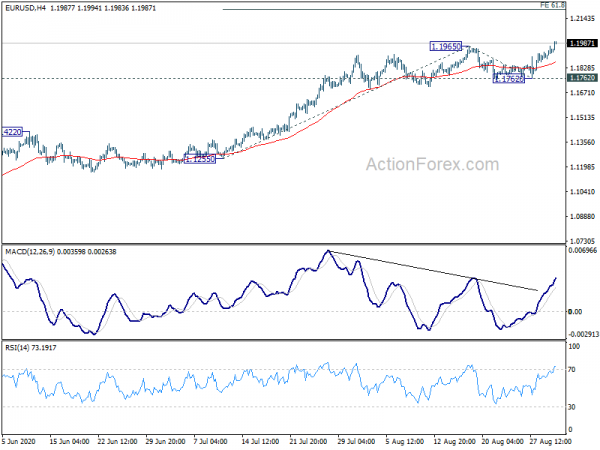

Daily Pivots: (S1) 1.1892; (P) 1.1929; (R1) 1.1974; More…..

EUR/USD’s rally finally resumed by taking out 1.1965 resistance. Intraday bias is back on the upside. Next near term target is 61.8% projection of 1.1255 to 1.1965 from 1.1762 at 1.2201. On the downside, break of 1.1762 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Mfg Index Aug | 49.3 | 53.5 | ||

| 22:45 | NZD | Building Permits M/M Jul | -4.50% | 0.50% | 0.70% | |

| 23:30 | JPY | Unemployment Rate Jul | 2.90% | 3.10% | 2.80% | |

| 23:50 | JPY | Capital Spending Q2 | -11.30% | 4.30% | 0.10% | |

| 0:30 | JPY | Manufacturing PMI Aug F | 47.2 | 46.6 | 46.6 | |

| 1:30 | AUD | Current Account Balance (AUD) Q2 | 17.7B | 13.0B | 8.4B | 9.0B |

| 1:30 | AUD | Building Permits M/M Jul | 12.00% | -0.50% | -4.90% | -4.20% |

| 1:45 | CNY | Caixin Manufacturing PMI Aug | 53.1 | 51.3 | 52.8 | |

| 4:30 | AUD | RBA Rate Decision | 0.25% | 0.25% | 0.25% | |

| 7:45 | EUR | Itay Manufacturing PMI Aug | 51.2 | 51.9 | ||

| 7:50 | EUR | France Manufacturing PMI Aug F | 49 | 49 | ||

| 7:55 | EUR | Germany Manufacturing PMI Aug F | 0 | 53 | ||

| 7:55 | EUR | Germany Unemployment Change Aug | -3K | -18K | ||

| 7:55 | EUR | Germany Unemployment Rate Aug | 6.50% | 6.40% | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Aug F | 51.7 | 51.7 | ||

| 8:00 | EUR | Itay Unemployment Rate Jul | 9.10% | 8.80% | ||

| 8:30 | GBP | Manufacturing PMI Aug F | 55.3 | 55.3 | ||

| 8:30 | GBP | Mortgage Approvals Jul | 55K | 40K | ||

| 8:30 | GBP | M4 Money Supply M/M Jul | 1.20% | 1.00% | ||

| 9:00 | EUR | Eurozone Unemployment Rate Jul | 8.00% | 7.80% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Aug P | 0.20% | 0.40% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Aug P | 1.00% | 1.20% | ||

| 13:30 | CAD | Manufacturing PMI Aug | 52.9 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 53.6 | 53.6 | ||

| 14:00 | USD | ISM Manufacturing PMI Aug | 54 | 54.2 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Aug | 52 | 53.2 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Aug | 48.3 | 44.3 | ||

| 14:00 | USD | Construction Spending M/M Jul | 0.70% | -0.70% |