Yen softens mildly in quiet Asian session, accompanied by the rebound in Nikkei, as markets digest Prime Minister Shinzo Abe’s resignation. Dollar is also paring some of last week’s steep losses. But overall, major pairs a crosses are bounded in very tight range. Economic data from Japan and China are ignored. New Zealand Dollar also pays little attention to lockdown easing. Focuses are on the busy calendar ahead, with RBA rate decision tomorrow as the first main event.

Technically, 1.1965 resistance in EUR/USD, 0.9009 support in USD/CHF and 105.10 support in USD/JPY would be the focuses for now. They will determine whether Dollar could find some breathing space elsewhere, or the selloff would accelerate. Also, traders could turn to crosses with EUR/GBP extending the decline from 0.9175 towards 0.8864 support. EUR/AUD could also edge towards 1.6033 low.

In Asia, Nikkei closed up 1.12%. Hong Kong HSI is up 0.18%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.05%. Japan 10-year JGB yield is down -0.0088 at 0.050.

Japan industrial production rose record 8.0% mom, still way off pre-pandemic level

According data from Japan’s Ministry of Economy, Trade and Industry, industrial production grew 8.0% mom in July, well above expectation of 5.0% mom. That’s also the quickest jump on record since 1978. Manufacturers are expect output to grow further by 4.0% mom in August, and further by 1.9% in September. However, METI expects output to remain below pre-pandemic level for some time. Over the year, production was down -16.1% yoy.

On the other hand, retail sales dropped -2.8% yoy in July, much worse than expectation of -1.7% yoy. Housing starts dropped -11.4%, better than expectation of -13.7% yoy. Consumer confidence edged down to 29.3, down from 29.5, missed expectation of 29.4.

As Prime Minister Shinzo Abe is stepping down, it’s reported that the ruling LDP will vote on September 14 to select a new leader.

New Zealand ANZ business confidence dropped to -41.8, activity dropped to -17.5

New Zealand ANZ Business Confidence dropped to -41.8 in August, down from July’s -31.8, but was revised slightly up from Aug preliminary reading of -42.4. Confidence is particularly weak in agriculture at -80.6, with services at -43.3, retail at -33.3, manufacturing at -37.3, and construction at -16.1.

Own activity outlook also dropped back to -17.5, down form July’s -8.9, worse than preliminary reading of -17.0. Retail was worst at -27.5, followed by agriculture at -22.6, manufacturing at -19.4, services at -13.9 and construction at -12.1.

ANZ added, “The recent re-emergence of COVID-19 is disheartening, and has taken a real toll on businesses, particularly in Auckland. However, it appears that firms are looking through it to some extent, in that intentions and expectations saw relatively modest falls compared to the first half of the month.”

From Australia, TD securities inflation rose 0.1% mom in August. Private sector credit dropped -0.1% mom in July. Company gross operating profits rose 15.0% qoq in Q2.

China PMI manufacturing edged down to 51.0 in Aug

The official Chinese PMI Manufacturing edged down to 51.0 in August, from 51.1, slightly below expectation of 51.1. PMI Non-Manufacturing, on the other hand, rose to 55.2, up from 54.2, above expectation of 54.0.

Zhao Qinghe a senior statistician with the NBS noted, “demand continues to recover, and the supply-demand cycle is gradually improving” with new order index rising for the 4th month to 52.0. trade also improved with new export orders rising 0.7 to 49.1.

However, “some companies in Chongqing and Sichuan reported an impact from the heavy rains and floods, resulting in a prolonged procurement cycle for raw materials, reduced orders and a pullback in factory production.”

Dollar looks into ISMs and NFP; Aussie awaits RBA and GDP

It’s a rather busy and important week ahead. US ISM manufacturing and non-manufacturing, as well as non-farm payrolls will be featured. Dollar will need something really impressive to turn the corner around. Fed will also release Beige Book economic report.

Australian Dollar, which has been the strongest recent, will face a lot tests too. RBA is generally expected to keep monetary policy unchanged, and sound non-committal to further stimulus measures. Australia Q2 GDP is another highlight too while PMIs from China could trigger some volatilities for the Aussie.

Elsewhere, Japan industrial production and retail sales, Eurozone CPI and unemployment, Canada employment will also catch some attention. here are some highlights for the week:

- Monday: Japan industrial production, retail sales, consumer confidence, housing starts; China PMIs; New Zealand ANZ business confidence; Germany CPI; Swiss retail sales; Canada IPPI and RMPI.

- Tuesday: Australia AiG manufacturing, building approvals, current account, RBA rate decision; New Zealand building permits; Japan capital spending, PMI manufacturing final. China Caixin PMI manufacturing; Swiss PMI manufacturing; Eurozone PMI manufacturing final, CPI flash, unemployment rate; Germany unemployment; UK mortgage approvals, M4 money supply, PMI manufacturing final; Canada PMI manufacturing; US ISM manufacturing.

- Wednesday: New Zealand terms of trade; Australia GDP; Japan monetary base; Germany retail sales; Eurozone PPI; Canada labor productivity; US ADP employment, factory orders, Fed’s Beige Book.

- Thursday: Australia AiG construction, trade balance; China Caixin PMI services; Swiss CPI; Eurozone PMI services final, retail sales; UK PMI services final. Canada trade balance; US jobless claims, non-farm productivity; trade balance; ISM non-manufacturing.

- Friday: Australia retail sales; Germany factory orders; UK PMI construction; Canada employment, Ivey PMI; US non-farm payrolls.

USD/JPY Daily Outlook

Daily Pivots: (S1) 104.72; (P) 105.83; (R1) 106.47; More...

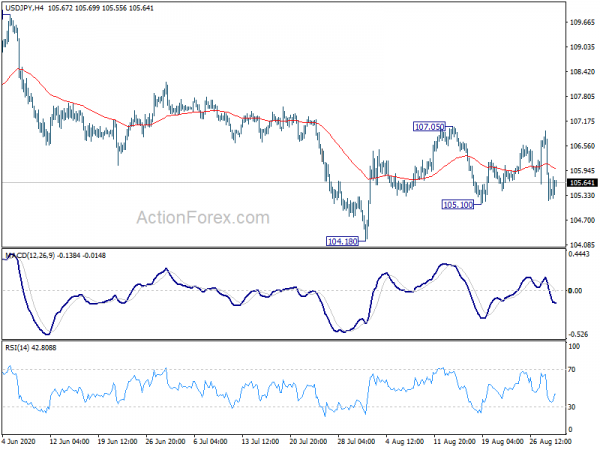

Intraday in USD/JPY remains neutral as it’s still bounded in range of 105.10/107.05. Further decline is in favor as long as 107.05 resistance holds. Break of 105.10 will bring retest of 104.18 support first. Further break will resume whole decline from 111.71. On the upside, break of 107.05 will revive the case of near term reversal and bring stronger rally.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jul P | 8.00% | 5.00% | 1.90% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | -2.80% | -1.70% | -1.30% | |

| 1:00 | CNY | Manufacturing PMI Aug | 51 | 51.1 | 51.1 | |

| 1:00 | CNY | Non-Manufacturing PMI Aug | 55.2 | 54 | 54.2 | |

| 1:00 | AUD | TD Securities Inflation M/M Aug | 0.10% | 0.90% | ||

| 1:00 | NZD | ANZ Business Confidence Aug | -41.8 | -42.4 | ||

| 1:30 | AUD | Private Sector Credit M/M Jul | -0.10% | 0.20% | -0.20% | |

| 1:30 | AUD | Company Gross Operating Profits Q/Q Q2 | 15.00% | -6.00% | 1.10% | 1.40% |

| 5:00 | JPY | Housing Starts Y/Y Jul | -11.40% | -13.70% | -12.80% | |

| 5:00 | JPY | Consumer Confidence Index Aug | 29.3 | 29.4 | 29.5 | |

| 6:30 | CHF | Real Retail Sales Y/Y Jul | 0.90% | 1.10% | ||

| 12:00 | EUR | Germany CPI M/M Aug P | -0.20% | -0.50% | ||

| 12:00 | EUR | Germany CPI Y/Y Aug P | 0.20% | -0.10% | ||

| 12:30 | CAD | Industrial Product Price M/M Jul | 0.50% | 0.40% | ||

| 12:30 | CAD | Raw Material Price Index Jul | 6.90% | 7.50% |