Coronavirus vaccine optimism sent US stocks to record high overnight but the positive sentiments are not carried forward to Asia. The forex markets are also treading water, with major pairs and crosses stuck inside last week’s range. US and Canadian Dollars are the relatively weaker ones while European majors are firm. But there is not clear sign of breakout yet. While Fed Chair Jerome Powell’s Jackson Hole speech is the main events for the week, markets would hope to get some inspirations today from Germany Ifo and US consumer confidence first.

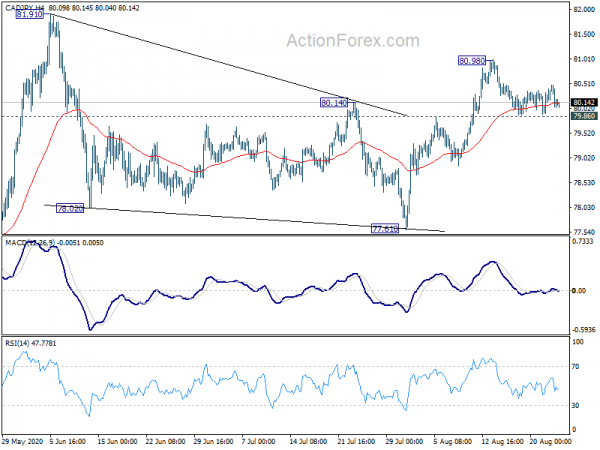

Technically, USD/CAD recovered ahead of 1.3133 temporary low after brief dip yesterday. Focus is back on 1.3271 resistance. Break there should confirm short term bottoming on bullish convergence condition in 4 hour MACD. CAD/JPY is also eyeing 79.86 resistance turned support again and break will firstly resume the fall from 80.98. Secondly, that would suggest completion of the rebound form 77.61. What’s next for these two pairs could depend on whether WTI could take out 43.38 resistance firmly, or finally be rejected there.

In Asia, currently, Nikkei is up 1.84%. Hong Kong HSI is down -0.69%. China Shanghai SSE is down -0.19%. Singapore Strait Times is up 1.24%. Japan 10-year JGB yield is up 0.0048 at 0.030. Overnight, DOW rose 1.35%. S&P 500 rose 1.00% to 3431.28, new record. NASDAQ rose 0.60% to 11379.72, new record. 10-year yield rose 0.0006 to 0.646.

S&P 500 hits record on vaccine hopes, heading to 3643 next

S&P 500 finally took out 3393.52 key resistance with conviction, and closed up 1.00% at 3431.28 record high. Optimism on coronavirus treatment boosted sentiments in general. In particular, shares of AstraZenca surged nearly 2%, boosted by reports that US is considering fast-tracking its coronavirus vaccine candidate.

Technically, the focus now is whether SPX will pick up upside momentum after clearing 3393.52. But in any case, near term outlook will remain bullish as long as 3354.69 support holds. Next near term target will be 61.8% projection of 2191.86 to 3233.13 from 2999.74 at 3643.24.

USTR said progress made in US-China trade deal implementation

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin finally held a “regularly scheduled call” with Chinese Vice Premier Liu He to review the progress of the implementation of the trade deal phase one.

USTR said in a statement, the parties addressed steps that China has taken to “effectuate structural changes” for greater IP rights protections, “remove impediments” to Americans companies in financial services and agriculture, eliminate forced technology transfer. China’s purchases of US goods were also discussed. It added, “both sides see progress and are committed to taking the steps necessary to ensure the success of the agreement.”

Chinese Commerce Ministry also confirmed the two sides had a “constructive dialog on strengthening the coordination of the macroeconomic policies of the two countries”. Both sides “agreed to create conditions and atmosphere to continue to push forward the implementation of the phase-one of the China-US economic and trade agreement”.

On the data front

Germany will release Q2 GDP final today but focus should be on Ifo business climate. Later in the day, US consumer confidence will take center stage while hour price indices and new home sales will be released.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7141; (P) 0.7173; (R1) 0.7193; More…

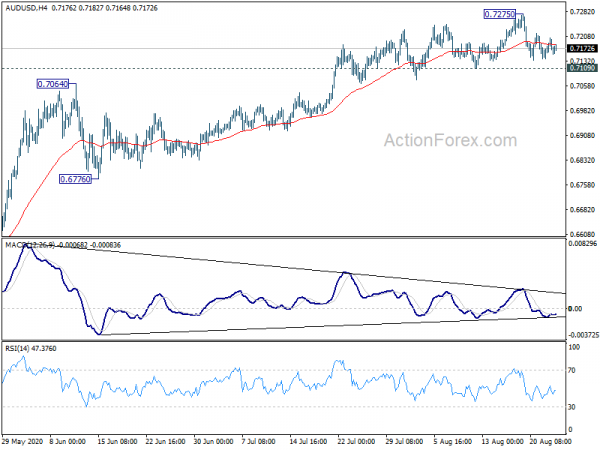

AUD/USD is staying in range of 0.7109/7275 for now. Intraday bias remains neutral and outlook is unchanged. Further rise could be seen with 0.7109 intact. above 0.7275 will extend the rise from 0.5506 to 0.7311 long term EMA. However, considering persistent bearish divergence condition in 4 hour MACD, break of 0.7109 support should confirm short term topping. Intraday bias will be turned back to the downside for correction towards 0.6776 support.

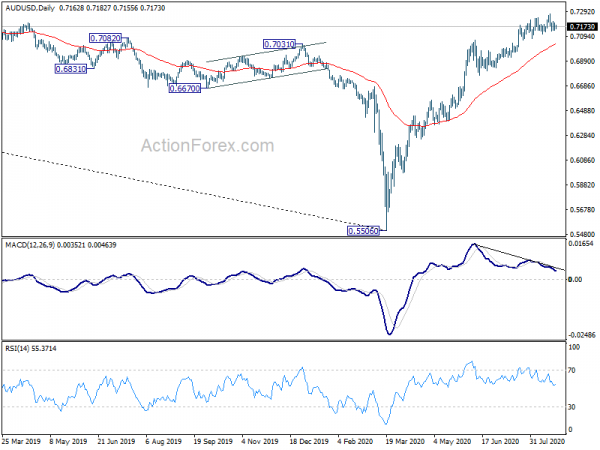

In the bigger picture, rebound from 0.5506 medium term bottom could be correcting whole long term down trend from 1.1079 (2011 high). Further rally would be seen to 55 month EMA (now at 0.7311). This will remain the preferred case as long as it stays above 55 week EMA (now at 0.6817). However, sustained trading below 55 week EMA will turn focus back to 0.5506 low instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany GDP Q/Q Q2 F | -10.10% | -10.10% | ||

| 08:00 | EUR | Germany IFO Business Climate Aug | 92.0 | 90.5 | ||

| 08:00 | EUR | Germany IFO Current Assessment Aug | 87.0 | 84.5 | ||

| 08:00 | EUR | Germany IFO Expectations Aug | 98.1 | 97.0 | ||

| 10:00 | GBP | CBI Realized Sales Aug | 8% | 4% | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jun | 4.00% | 3.70% | ||

| 13:00 | USD | Housing Price Index M/M Jun | 0.30% | -0.30% | ||

| 14:00 | USD | Consumer Confidence Aug | 93.2 | 92.6 | ||

| 14:00 | USD | New Home Sales Jul | 775K | 776K |