Dollar is given a lift in early US session by a set of overall solid employment. After initial hesitation, the greenback is gaining some upside momentum with GBP/USD dropping through 1.3096 minor support. USD/CHF also breaks last week’s high at 0.9726 to resume rebound from 0.9347. Focus will now turn to 110.97 minor resistance in USD/JPY and break there will indicate near term bottoming. EUR/USD, though, stays firm above 1.1722 minor support and it’s near term bullishness remains relatively safe.

July non-farm payroll report showed 209k growth in US, above expectation of 180k. Prior month’s figure was also revised up to 231k, from 222k. Unemployment rate dropped 0.1% to 4.3%, back at 16 year low. Participation rate also rose to 62.9%, up from 62.8%. Average hourly earnings rose 0.3% mom, in line with expectations. Average weekly hours was unchanged at 34.5. Also from US, trade deficit narrowed notably to USD -43.6b in June, from USD -46.4b in May.

Canadian economy added 10.9k jobs in July, below expectation of 19.0k. However, unemployment rate dropped to 6.3%, down from 6.5%. Unemployment rate was at the lowest level since October 2008. Canada trade deficit widened to CAD -3.6b in June. USD/CAD is set to extend the corrective recovery from 1.2412 and more upside would be seen.

Release earlier today, Eurozone retail PMI dropped to 51 in July. German factory orders rose 1.0% mom in June, above expectation of 0.5% mom. Australia retail sales rose 0.3% mom in June versus expectation of 0.2% mom. Japan labor cash earnings dropped -0.4% yoy in June, below expectation of 0.6% yoy.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3076; (P) 1.3172; (R1) 1.3231; More…

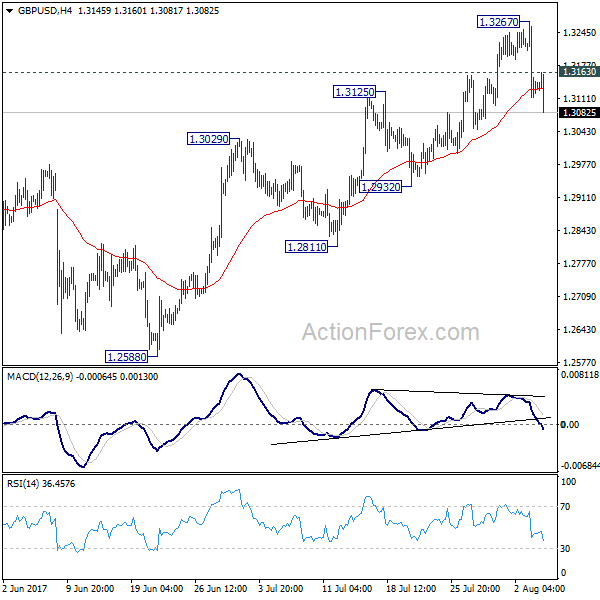

GBP/USD’s fall from 1.3267 resumes in early US session and breaks 1.3096 minor support. This is taken as the first sign of near term reversal, with bearish divergence condition in 4 hour MACD. Price actions from 1.1946 are viewed as a corrective pattern and could have completed. Intraday bias is back on the downside for 1.2932 support next. Break there will affirm this bearish case and target 1.2588 key near term support next. On the upside, above 1.3163 minor resistance will turn bias back to the upside for 1.3267 instead.

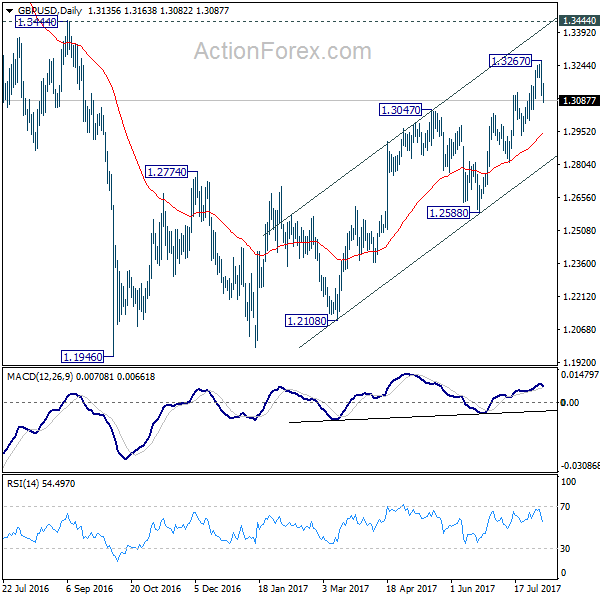

In the bigger picture, overall, price actions from 1.1946 medium term low are seen as a corrective pattern that is still in progress. While further upside is expected, larger outlook remains bearish as long as 1.3444 key resistance holds. Down trend from 1.7190 (2014 high) is expected to resume later after the correction completes. And break of 1.2588 will indicate that such down trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | JPY | Labor Cash Earnings Y/Y Jun | -0.40% | 0.60% | 0.70% | 0.60% |

| 01:30 | AUD | Retail Sales M/M Jun | 0.30% | 0.20% | 0.60% | |

| 01:30 | AUD | RBA Statement on Monetary Policy | ||||

| 06:00 | EUR | German Factory Orders M/M Jun | 1.00% | 0.50% | 1.00% | 1.10% |

| 08:10 | EUR | Eurozone Retail PMI Jul | 51 | 53.2 | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Jun | -3.6B | -0.90B | -1.09B | -1.36 |

| 12:30 | CAD | Net Change in Employment Jul | 10.9K | 19.0K | 45.3K | |

| 12:30 | CAD | Unemployment Rate Jul | 6.30% | 6.50% | 6.50% | |

| 12:30 | USD | Trade Balance Jun | -43.6B | -45.6B | -46.5B | -46.4B |

| 12:30 | USD | Change in Non-farm Payrolls Jul | 209K | 180K | 222K | 231K |

| 12:30 | USD | Unemployment Rate Jul | 4.30% | 4.30% | 4.40% | |

| 12:30 | USD | Average Hourly Earnings M/M Jul | 0.30% | 0.30% | 0.20% | |

| 14:00 | CAD | Ivey PMIs Jul | 59.2 | 61.6 |