Dollar remains generally pressured today even though selling momentum seems to be easing a little bit. A focus will be on FOMC minutes which is unlikely to provide anything about the next policy move. Instead, investors would be more eager to know how Fed would shape the results of the year-long strategy review. Back in the currency markets, Yen is currently the second weakest, followed by Swiss Franc. New Zealand Dollar, strongest for today, is finally recovery some of recent losses.

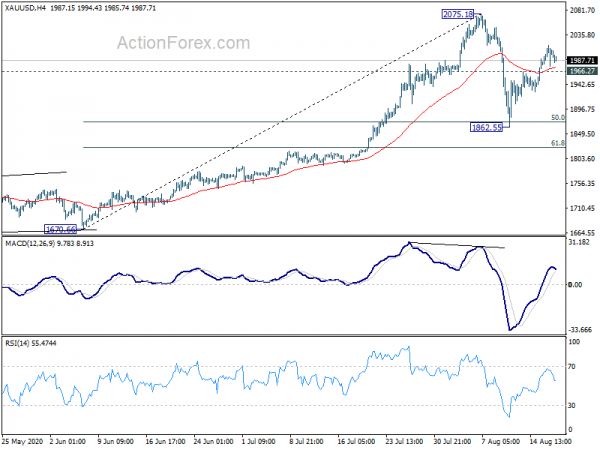

Technically, Gold is back below 2000 handle after hitting as high as 2015.66 yesterday. Rebound from 1862.55, as the second leg of the consolidation pattern from 2075.18, should have met the minium price movement already. A near term reversal could happen any time and break of 1966.27 support would likely start the third leg back to 1862.55 low. GBP/JPY just drew notable support from 4 hour 55 EMA and rebounded. Focus is back on 140.20 resistance and break will indicate rally resumption.

In Asia, Nikkei closed up 0.26%. Hong Kong HSI is down -0.89%. China Shanghai SSE is down -1.29%. Singapore Strait Times is down -0.05%. 10-year JGB yield is down -0.0074 at 0.032. Overnight, DOW dropped -0.24%. S&P 500 rose 0.23% to 3389.78. after hitting new record at 3395.06. NASDAQ rose 0.73% to new record. 10-year yield dropped -0.014 to 0.669.

UK CPI accelerated to 1.0%, core CPI at 1.8%

UK headline CPI accelerated to 1.0% yoy in July, up fro 0.6% yoy, well above expectation of 0.7% yoy. Core CPI also jumped to 1.8% yoy, up from 1.4% yoy, well above expectation of 1.3% yoy. ONS said clothing, rising prices at the petrol pump, and furniture and household goods made large upward contributions consumer to inflation.

Also from UK, RPI was at 0.5% mom, 1.6% yoy, versus expectation of 0.1% mom, 1.2% yoy. PPI input came in at 1.8% mom, -5.7% yoy, PPI output at -0.3% mom, -0.9% yoy. PPI output core at -0.1% mom, 0.1% yoy.

Japan extended double digit drop in export in July

In non-seasonally adjusted terms, Japan’s exports dropped -19.2% yoy to JPY 5369B in July. The double digit slump extended into a fifth month. Imports dropped -22.3% yoy to JPY 5357B. Trade recorded JPY 11.6B surplus.

In seasonally adjusted terms, Japan’s export rose 4.7% mom in July, to JPY 5118B. Imports dropped -2.7% mom to JPY 5213B. Trade deficit narrowed to JPY -34.8B, better than expectation of JPY 44B.

Also released, core machinery orders dropped -7.6% mom in June, much worse than expectation of 2.1% rise.

Westpac: Victoria contraction to offset recovery in other Australian states in Q3

Australia Westpac leading index rose slightly to -4.37% in July, up from -4.43%. The six-month annualized growth rate, remained in deep negative territory, consistent with recession. Nevertheless, a bottom was likely already reached in April’s -5.61%, while Q2 was already marked the low point in the growth cycle.

Overall, Westpac expected growth in Q3 to be flat. Victorian economy is expected to contract by -9% due to lockdown, which will offset the recovery in other states. It expects economy to grow 2.8% in Q4, on the assumption that Victoria moves through stage 4 to stage 2 restrictions, while other states could avoid second wave of coronavirus infections.

Westpac expects RBA to keep monetary policies unchanged on September 1. The next major event will be the Commonwealth Budget on October 6.

From New Zealand, PPI input dropped -1.0% qoq in Q2. PPI output dropped -0.3% qoq.

Looking ahead

Eurozone current account and CPI final are the main focuses in European session. Later in the day, Canada CPI and wholesale sales will be featured. FOMC will also release meeting minutes.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9005; (P) 0.9037; (R1) 0.9063; More…

USD/CHF’s decline is still in progress and intraday bias remains on the downside. Current fall should target 61.8% projection of 0.9467 to 0.9050 from 0.9197 at 0.8939. Break will target 100% projection at 0.8780 next. On the upside, break of 0.9197 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). Current development suggests that such pattern is still extending. Sustain trading below 100% projection of 1.0342 to 0.9186 from 1.0237 at 0.9081 will pave the way to 138.2% projection at 0.8639. On the upside, break of 0.9376 resistance is needed to be the first sign of medium term bottoming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q2 | -1.00% | -0.30% | ||

| 22:45 | NZD | PPI Output Q/Q Q2 | -0.30% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Jul | -0.03T | -0.44T | -0.42T | -0.41T |

| 0:30 | AUD | Westpac Leading Index M/M Jul | 0.10% | 0.44% | 0.50% | |

| 6:00 | GBP | CPI M/M Jul | 0.40% | -0.10% | 0.10% | |

| 6:00 | GBP | CPI Y/Y Jul | 1.00% | 0.70% | 0.60% | |

| 6:00 | GBP | Core CPI Y/Y Jul | 1.80% | 1.30% | 1.40% | |

| 6:00 | GBP | RPI M/M Jul | 0.50% | 0.10% | 0.20% | |

| 6:00 | GBP | RPI Y/Y Jul | 1.60% | 1.20% | 1.10% | |

| 6:00 | GBP | PPI Input M/M Jul | 1.80% | 2.40% | ||

| 6:00 | GBP | PPI Input Y/Y Jul | -5.70% | -6.40% | ||

| 6:00 | GBP | PPI Output M/M Jul | -0.30% | 0.20% | 0.30% | |

| 6:00 | GBP | PPI Output Y/Y Jul | -0.90% | -0.90% | -0.80% | |

| 6:00 | GBP | PPI Core Output M/M Jul | -0.10% | 0.00% | ||

| 6:00 | GBP | PPI Core Output Y/Y Jul | 0.10% | 0.50% | ||

| 8:00 | EUR | Eurozone Current Account (EUR) Jun | 8.0B | |||

| 9:00 | EUR | Eurozone CPI Y/Y Jul F | 0.40% | 0.40% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Jul F | 1.20% | 1.20% | ||

| 12:30 | CAD | Wholesale Sales M/M Jun | 8.50% | 5.70% | ||

| 12:30 | CAD | CPI M/M Jul | 0.40% | 0.80% | ||

| 12:30 | CAD | CPI Y/Y Jul | 0.30% | 0.70% | ||

| 12:30 | CAD | CPI Common Y/Y Jul | 1.50% | |||

| 12:30 | CAD | CPI Median Y/Y Jul | 1.90% | |||

| 12:30 | CAD | CPI Trimmed Y/Y Jul | 1.80% | |||

| 14:30 | USD | Crude Oil Inventories | -4.5M | |||

| 18:00 | USD | FOMC Minutes |