Yen rises broadly today as global treasury yields appear to be turning south. In particular, US 10-year yield is back below 0.7 handle in pre-markets. Dollar is pressured but holds on to recently established range. But overall markets are mixed with major European indices bounded in tight range. Australian and New Zealand Dollar continue to diverge, with the latter having general elections postponed due to coronavirus outbreak. Gold is mildly higher but stays well below 2000 handle so far. WTI crude oil is back below 42.

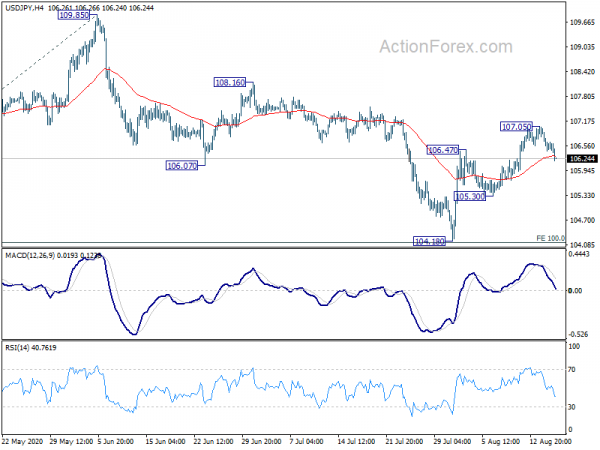

Technically, Yen crosses are back in focuses today. Both EUR/JPY and GBP/JPY display loss of upside momentum as seen in 4 hour MACDs. But near term outlook will stay bullish as long as 124.31 and 137.84 support levels hold respectively. Similarly, USD/JPY’s rebound from 104.18 is expected to resume sooner or later as long as 105.30 support holds. While EUR/USD attempt a rally earlier today, it seems there is no follow through momentum to send it through 1.1916 resistance yet.

In Europe, currently, FTSE is up 0.58%. DAX is up 0.26%. CAC is up 0.17%. German 10-year yield is down -0.0099 at -0.429. Earlier in Asia, Nikkei dropped -0.83%. Hong Kong HSI rose 0.65%. China Shanghai SSE rose 2.34%. Singapore Strait Times dropped -0.38%. Japan 10-year JGB yield dropped -0.0064 to 0.044.

US Empire state manufacturing conditions dropped sharply to 3.7

US Empire State manufacturing business conditions dropped sharply to 3.7 in August, down from 17.2, well below expectation of 16.5. Looking at some details, new orders dropped -15.6 pts and turned negative to -1.7. Shipments dropped -11.8 pts to 6.7. Number of employees rose 2.0 pts to 2.4. But average employment workweek dropped -4.2 pts to -6.8.

For six months ahead, general business conditions dropped -4.1 to 34.3. New orders dropped -4.7 to 37.2. Number of employees dropped -5.6 to 155 Average employee workweek dropped -1.9 to 2.0. Capital expenditures dropped -3.1 to 6.0.

Japan Q2 GDP contracted record -27.8% annualized, Nishimura pledges flexible and timely support

Japan’s GDP contracted -7.8% qoq in Q2, worse than expectation of -7.6% qoq. Annualized, GDP contracted -27.8%, versus expectation of -27.2%. The annualized contraction was worst since comparable data was available since 1980. It also well surpassed the -17.8% annualized decline in GDP in Q1 2009 during the global financial crisis.

Looking at some details, private consumption plunged -8.2% qoq, versus expectation of -7.1% qoq. Capital expenditure dropped -1.5% qoq, better than expectation of -4.2% qoq. External demand dropped -3.0% qoq, also slightly better than expectation of -3.2% qoq. Price index rose 1.5% yoy, below expectation of 1.9% yoy.

Economy Minister Yasutoshi Nishimura pledged “flexible, timely” action to support the economy. “We hope to do our utmost to push Japan’s economy, which likely bottomed out in April and May, back to a recovery path driven by domestic demand,” he added.

PBoC kept MLF rate at 2.95% for 4th month, USD/CNH softer in range

China’s central bank PBoC rolled over CNY 700B maturing medium-term loans today. Rate was kept at 2.95%, unchanged for the fourth straight month. The injection was well above the two set batches of MLF that are set to expire in August, totalling CNY 500B. Markets are expecting no change to the benchmark loan prime rate on Thursday.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 106.33; (P) 106.68; (R1) 106.93; More...

USD/JPY’s retreat from 107.05 extends lower today but stays above 105.30 support. Intraday bias remains neutral first and further rally is in favor. We’d holding on to the bullish case. That is, corrective fall from 111.71 has completed with three waves down to 104.18, after missing 100% projection of 111.71 to 105.98 from 109.85 at 104.12. On the upside, above 107.05 will target 108.16 resistance next. However, break of 105.30 support will turn bias back to the downside for 104.18 low instead.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Aug | -0.20% | 2.40% | ||

| 23:50 | JPY | GDP Q/Q Q2 P | -7.80% | -7.60% | -0.60% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | 1.50% | 1.90% | 0.90% | |

| 04:30 | JPY | Industrial Production M/M Jun F | 1.90% | 2.70% | 2.70% | |

| 12:30 | USD | Empire State Manufacturing Index Aug | 3.7 | 16.5 | 17.2 | |

| 12:30 | CAD | Foreign Securities Purchases (CAD) Jun | -13.52B | 20.00B | 22.41B | |

| 14:00 | USD | NAHB Housing Market Index Aug | 78 | 74 | 72 |