Euro strengthens mildly in generally mixed Asian markets today. There is no clear direction as Japan stocks diverge from others while gold and oil are rangebound. Canadian and Australian Dollar are following as the next strongest but movements are limited. Yen and Dollar are trading with an undertone. But New Zealand Dollar is the worst one after Prime Minister Jacinda Ardern postponed the general election by a month to mid-October on coronavirus outbreak.

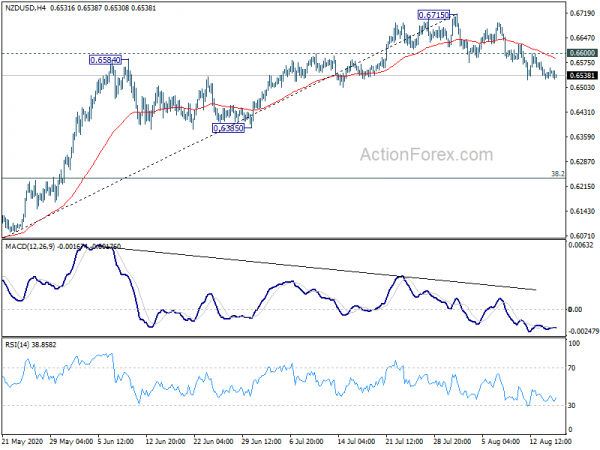

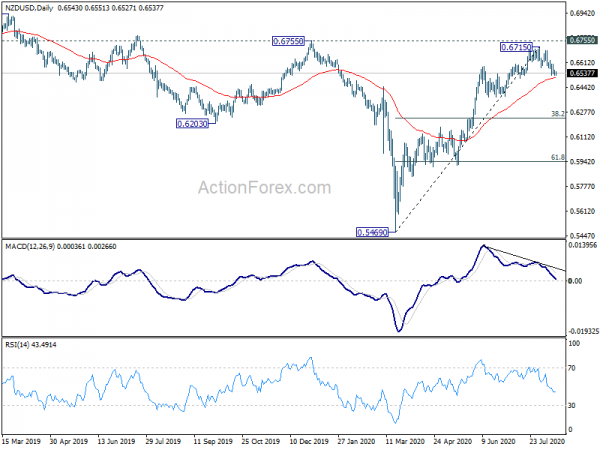

Technically, 1.1916 temporary top is EUR/USD is a focus today and break will resume larger rebound from 1.0635. Correspondingly, GBP/USD could take on 1.3185 resistance while USD/CHF might test 0.9050 support. NZD/USD is also worth a watch as it’s starting to lose downside momentum, approaching 55 day EMA. A break of 0.6600 minor resistance would bring recovery. That might give the Kiwi some breathing space after recent broad based decline.

In Asia, Nikkei closed down -0.83%. Hong Kong HSI is up 1.19%. China Shanghai SSE is up 2.30%. Singapore Strait Times is down -0.25%. Japan 10-year JGB yield is down -0.0076 at 0.042.

Japan Q2 GDP contracted record -27.8% annualized, Nishimura pledges flexible and timely support

Japan’s GDP contracted -7.8% qoq in Q2, worse than expectation of -7.6% qoq. Annualized, GDP contracted -27.8%, versus expectation of -27.2%. The annualized contraction was worst since comparable data was available since 1980. It also well surpassed the -17.8% annualized decline in GDP in Q1 2009 during the global financial crisis.

Looking at some details, private consumption plunged -8.2% qoq, versus expectation of -7.1% qoq. Capital expenditure dropped -1.5% qoq, better than expectation of -4.2% qoq. External demand dropped -3.0% qoq, also slightly better than expectation of -3.2% qoq. Price index rose 1.5% yoy, below expectation of 1.9% yoy.

Economy Minister Yasutoshi Nishimura pledged “flexible, timely” action to support the economy. “We hope to do our utmost to push Japan’s economy, which likely bottomed out in April and May, back to a recovery path driven by domestic demand,” he added.

PBoC kept MLF rate at 2.95% for 4th month, USD/CNH softer in range

China’s central bank PBoC rolled over CNY 700B maturing medium-term loans today. Rate was kept at 2.95%, unchanged for the fourth straight month. The injection was well above the two set batches of MLF that are set to expire in August, totalling CNY 500B. Markets are expecting no change to the benchmark loan prime rate on Thursday.

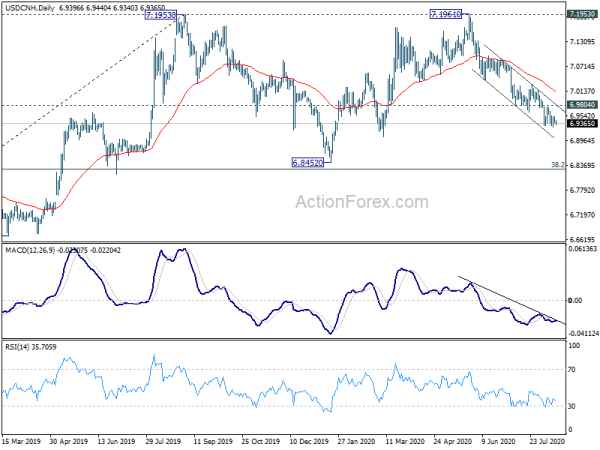

USD/CNH is mildly softer in range today, mildly due to Dollar’s movements. It’s staying in near term falling channel. Further fall is expected as long as 6.9804 support turned resistance. USD/CNH would target 6.8452 support. But we’d expect strong support around there to complete the three-wave consolidation pattern from 7.1953.

UK Liz pledges to fight to consign unacceptable and unfair US tariffs

UK Trade Minister Liz Truss wrote in a Telegraph op-ed that US tariffs on Scotch whisky are “unacceptable and unfair”. “I cannot be clearer about that,” she added. “Whisky-making is one of our great industries and a jewel in our national crown.” Truss pledged to “fight to consign these unfair tariffs to the bin of history”

She also stated her position as “I firmly believe free and fair trade remains the best way forward for the world and for Britain”. Regarding the trade negotiations with Japan, “we have consensus on the major elements of a deal that will go beyond the agreement the EU has with Japan.” She is targeting to complete the trade deal with Japan by the end of August.

RBA, Fed and ECB to release minutes; PMIs in focus

RBA, Fed and ECB will release monetary meeting minutes this week. As all have be communicating rather with the markets, we’re not expecting any special surprise data. Focuses will be more on data including Japan GDP, UK CPI, Canada CPI and retail sales. The major market movers, though, would likely be PMIs from Australia, Japan, Eurozone, UK and US.

Here are some highlights for the week:

- Monday: Japan GDP; Canada foreign securities purchases; US Empire State manufacturing, NAHB housing index.

- Tuesday: RBA minutes; US building permits and housing starts.

- Wednesday: New Zealand PPI; Australia leading index; Japan trade balance, machines orders; UK CPI, PPI; Eurozone current account, CPI final; Canada CPI; FOMC minutes.

- Thursday: Swiss trade balance; Germany PPI; ECB minutes; Canada ADP employment; US Philly Fed survey, jobless claims.

- Friday: Australia PMIs; Japan CPI, PMI manufacturing; UK Gfk consumer confidence, retail sales, public sector net borrowing, PMIs. Eurozone PMIs, consumer confidence; Canada retail sales, new housing price index; US PMIs, existing home sales.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1799; (P) 1.1824; (R1) 1.1867; More…..

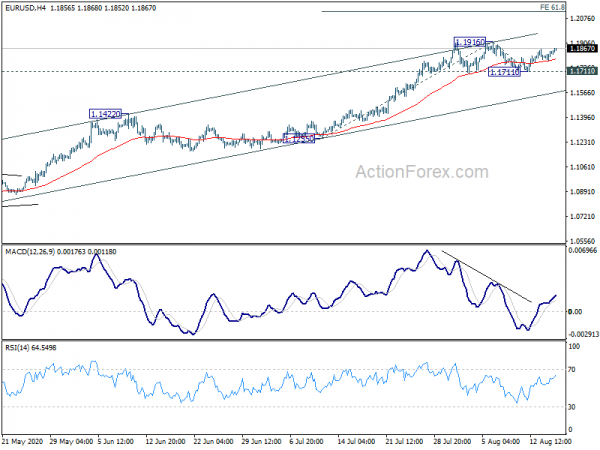

EUR/USD rises mildly today but stays below 1.1916 resistance. Intraday bias remains neutral first. As long as 1.1711 support holds, further rise is in favor. On the upside, break of 1.1916 will resume larger rise from 1.0635. Next near term target will be 61.8% projection of 1.1255 to 1.1916 from 1.1711 at 1.2119. On the downside, though, break of 1.1711 should short term topping. Intraday bias will be turned back to the downside towards 55 day EMA (now at 1.1494).

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise form 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Aug | -0.20% | 2.40% | ||

| 23:50 | JPY | GDP Q/Q Q2 P | -7.80% | -7.60% | -0.60% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | 1.50% | 1.90% | 0.90% | |

| 04:30 | JPY | Industrial Production M/M Jun F | 1.90% | 2.70% | 2.70% | |

| 12:30 | USD | Empire State Manufacturing Index Aug | 16.5 | 17.2 | ||

| 12:30 | CAD | Foreign Securities Purchases (CAD) Jun | 22.41B | |||

| 14:00 | USD | NAHB Housing Market Index Aug | 74 | 72 |