European majors turn slightly stronger today, in mixed markets. Euro appears to be supported by news that US is refraining from tariffs hikes on Airbus subsidies retaliation. Though, except versus Yen, Euro’s strength is not too convincing yet. Dollar turns soft again following strong rally in US stocks overnight. But surprisingly, commodity currencies are not riding on solid risk-on sentiments at all. Even a set of positive job data from Australia is not able to lift the Aussie. Focus will now turn to jobless claims from US later in the day.

Technically, USD/CAD’s breach of 1.3233 support suggests resumption of decline from 1.4667. But AUD/USD is held well below equivalent resistance at 0.7243. NZD/USD is also well below 0.6715 resistance. While Euro and Sterling are firm, EUR/USD is held below 1.1916 resistance and GBP/USD below 1.3185 resistance. USD/CHF is held above 0.9050 support. That is, dollar pairs are still generally range bound.

In Asia, Nikkei closed up 1.78%. Hong Kong HSI is down -0.24%. China Shanghai SSE is up 0.04%. Singapore Strait Times is up 1.33%. Japan 10-year JGB yield is down -0.0119 at 0.032. Overnight, DOW rose 1.05%. S&P 500 rose 1.40% to 3380.35, just inch below record high of 3393.52. NASDAQ rose 2.13%. 10 year yield rose for another day, by 0.012 to 0.670. It remains to be seen if the rebound in yield is there to stay on not.

US holds off tariff hike on EU, to start new negotiations instead

The US held off from a threatened tariff hike on EU products regarding the 16-year Airbus subsidies dispute, and signal its willingness to go back to negotiation table. The amount of products subject to the tariffs are kept unchanged at USD 7.5B, with 15% rate for aircraft and 25% on for other products.

“The EU and member states have not taken the actions necessary to come into compliance with WTO decisions,” Trade Representative Robert Lighthizer stated. “The United States, however, is committed to obtaining a long-term resolution to this dispute. Accordingly, the United States will begin a new process with the EU in an effort to reach an agreement that will remedy the conduct that harmed the U.S. aviation industry and workers and will ensure a level playing field for U.S. companies. ”

“The Commission acknowledges the decision of the U.S. not to exacerbate the ongoing aircraft dispute by increasing tariffs on European products,” an EU official said in response. “The EU believes that both sides should now build on this decision and intensify their efforts to find a negotiated solution to the ongoing trade irritants.”

Fed Kaplan: Resurgence in coronavirus muted economy recovery

Dallas Fed President Robert Kaplan said the resurgence in coronavirus has “muted the recovery” of the economy. While unemployment rate could fall to 9% or below by year end, “it requires adherence to protocols particularly wearing masks…If we don’t follow that, while people may feel freer, the economy will grow slower.”

Boston Fed President Eric Rosengren also warned, “limited or inconsistent efforts by states to control the virus based on public health guidance are not only placing citizens at unnecessary risk of severe illness and possible death – but are also likely to prolong the economic downturn.”

Fed Daly: Longer support to economy needed with resurgence in coronavirus

San Francisco Fed President Mary Daly said she expects recovery to be slow and gradual, depending on the coronavirus. A V-shaped recovery is not expected. “As we get more information about how the virus will affect the economy, we will be thinking about how can we use forward guidance to telegraph to people, to signal to markets, households and businesses what our intentions are in terms of supporting the economy going forward”, she said.

Also, with resurgence in infections, more stimulus is needed for the economy. “It’s becoming quite clear that the virus will be with us for longer and more vigorously than anyone had hoped for,” she said in an interview Tuesday. “The length of the support that the economy is going to need, before we can ever stimulate the economy, it just has to be longer.”

Australia employment rose 11.47 in July, participation rate jumped

Australia employment rose 114.7k to 12.46m in July, better than expectation of 40k. It’s also a positive for full-time job to rise 43.5k to 8.55m. Part-time jobs rose 71.2k to 3.91m. Unemployment rate rose less than 0.1% to 7.5%, better than expectation of 7.8%, even though that’s a 22-year high. Participation rate also rose 0.6% to 64.7%.

Still, Bjorn Jarvis, head of Labour Statistics at the ABS, said: “The July figures indicate that employment had recovered by 343,000 people and hours worked had also recovered 5.5 per cent since May. Employment remained over half a million people lower than seen in March, while hours worked remained 5.5 per cent lower. ”

“The July data provides insight into the Australian labour market during Stage 3 restrictions in Victoria. The August Labour Force data will provide the first indication of the impact of Stage 4 restrictions.” Jarvis said.

RBNZ Bascand would consider more monetary stimulus if coronavirus and lockdown prolong

RBNZ Deputy Governor Geoff Bascand said resurgence of coronavirus infections is “a major risk to out outlook”. “If we get periods of resurgence and have longer lockdown periods then the unfortunate consequence of that is we will see downside risks to our outlook…things will be worse. We would have to consider doing more in terms of our monetary stimulus,” he said.

While New Zealand has been doing better domestically, “this is a big economic shock and its not over,” he added. “It was a little bit of wonderful feeling when we had 100 days of containment, but its a long haul to recovery”.

Separately, chief economist Chief Economist Yuong Ha said the central bank would like a weaker exchange rate and lower bond yields. The expansion of QE from NZD 60B to NZD 100B reflects that intention. Negative rate remains a policy option for RBNZ, but it’s not inevitable.

Looking ahead

US jobless claims will be a major focus today while import price index will also be released.

EUR/USD Daily Outlook

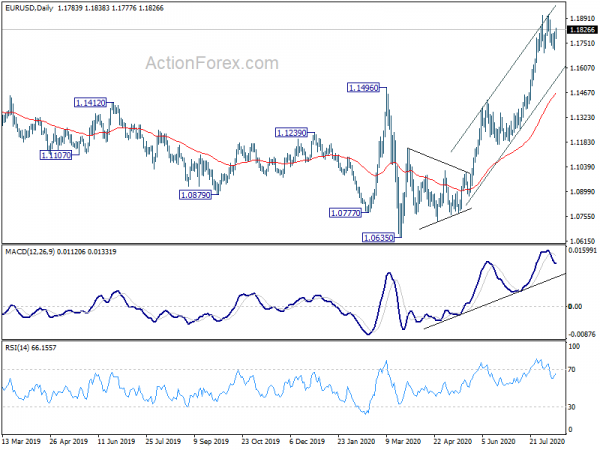

Daily Pivots: (S1) 1.1726; (P) 1.1771; (R1) 1.1832; More…..

EUR/USD recovers ahead of 1.1695 support but stays well below 1.1916 resistance. Intraday bias remains neutral first. Further rally is in favor as long as 1.1695 support holds. Break of 1.1916 will resume whole rise form 1.0635. However, on the downside, firm break of 1.1695 should confirm short term topping. Intraday bias will be turned back to the downside towards 55 day EMA (now at 1.1467).

In the bigger picture, down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise form 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jul | 12% | -5% | -15% | -13% |

| 23:50 | JPY | PPI Y/Y Jul | -0.90% | -1.10% | -1.60% | |

| 1:00 | AUD | Consumer Inflation Expectations Aug | 3.30% | 3.20% | ||

| 1:30 | AUD | Employment Change Jul | 114.7K | 40.0K | 210.8K | |

| 1:30 | AUD | Unemployment Rate Jul | 7.50% | 7.80% | 7.40% | |

| 6:00 | EUR | Germany CPI M/M Jul F | -0.50% | -0.50% | -0.50% | |

| 6:00 | EUR | Germany CPI Y/Y Jul F | -0.10% | -0.10% | -0.10% | |

| 12:30 | USD | Initial Jobless Claims (Aug 7) | 1200K | 1186K | ||

| 12:30 | USD | Import Price Index M/M Jul | 0.30% | 1.40% | ||

| 14:30 | USD | Natural Gas Storage | 33B |