New Zealand Dollar tumbles broadly today as weighed down by double-whammy of RBNZ QE expansion and return to lockdown. The selloff in Kiwi is somewhat dragging down Aussie and Canadian too. On the other hand, Dollar is staging a strong rebound, with help from much steeper than expected correction in Gold price. The strong rebound is 10-year yield also helps Euro and Sterling are so far resilient, with the latter supported by slightly better than expected June GDP figure.

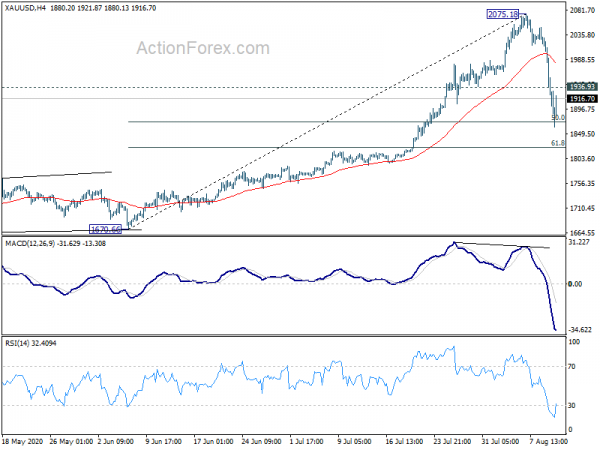

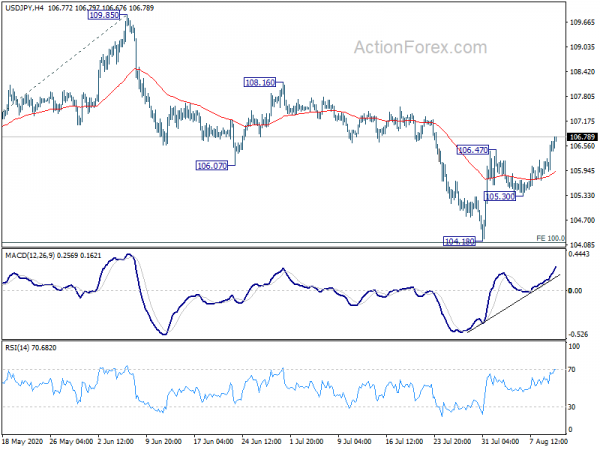

Technically, no support was seen from Gold from 38.2% retracement of 1670.66 to 2075.18 at 1872.92. Focus is back on 1936.93 minor resistance and break will suggest stabilization and bring stronger rebound. Though, another selloff would push gold to 61.8% retracement at 1825.18. USD/JPY’s break of 106.47 suggests resumption of rise form 104.18. More importantly, it reaffirms the case that corrective decline form 111.71 has completed at 104.18. Further rise should be seen to 108.16 next.

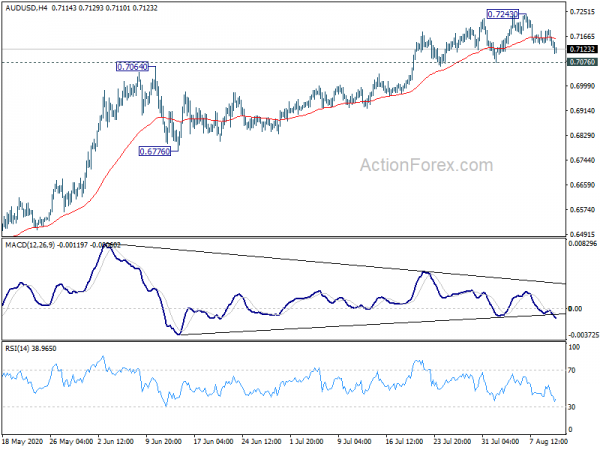

An important thing to note is that Dollar is still limited below near term structure resistance against all other major currencies. These level need to be taken out to confirm a sustainable rebound – 1.1695 support in EUR/USD. 1.2982 support in GBP/USD. 0.7076 support in AUD/USD. 0.9241 resistance in USD/CHF, and 1.3459 resistance in USD/CAD.

In Asia, Nikkei closed up 0.41%. Hong Kong HSI is up 0.96%. China Shanghai SSE is down -0.69%. Singapore Strait Times is up 0.47%. Japan 10-year JGB yield is up 0.0116 at 0.045. Overnight, DOW dropped -0.38%. S&P 500 dropped -0.80%. NASDAQ dropped -1.69%. 10-year yield rose 0.084 to 0.658.

UK GDP rose 8.7% mom in June, down -20.4% qoq in Q2, -17.2% below Feb’s level

UK GDP grew 8.7% mom in June, better than expectation of 8.0% mom, and a strong improvement from May’s 2.4% mom. For the quarter, Q2 GDP, however, still contracted -20.4% qoq, slightly below expectation of -20.2% qoq. That’s also notable deterioration from Q1’s -2.2% qoq. Overall, GDP remains -17.2% below levels seen back in February, before the full impact of the coronavirus.

In June, services grew 7.7% mom. Production rose 9.3% mom. Manufacturing rose 11.0% mom. Construction rose 23.5% mom. Agriculture rose 2.7% mom. But all sectors were down in the rolling three-month to April-to June, with services down -19.9% 3mo3m, production down -16.9% 3mo3m, manufacturing down -20.2% 3mo3m, construction down -35.0% 3mo3m, and agriculture down -4.8% 3mo3m.

Also from UK, goods trade deficit widened to GBP -5.1B in June, larger than expectation of GBP -4.5B.

RBNZ expands QE, prepare for negative rates, NZD/USD tumbles

RBNZ kept the Official Cash Rate unchanged at 0.25% today, but expanded the Large Scale Asset Purchase program to NZD 100B, up from NZD 60B. Eligible assets for the program remain unchanged. RBNZ also said a “package of additional monetary instruments must remain in active preparation”, including negative interest rates and purchases of foreign assets. Full statement here.

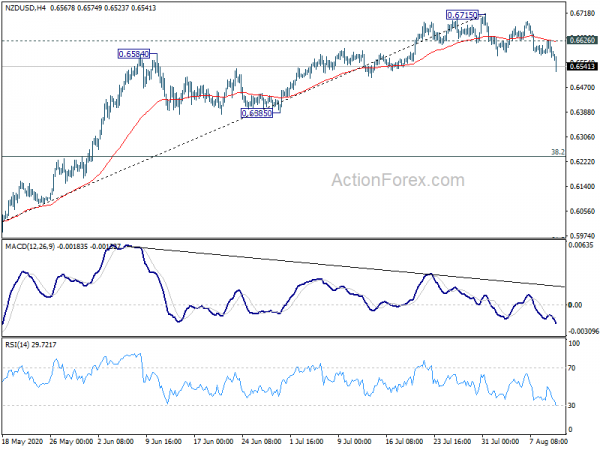

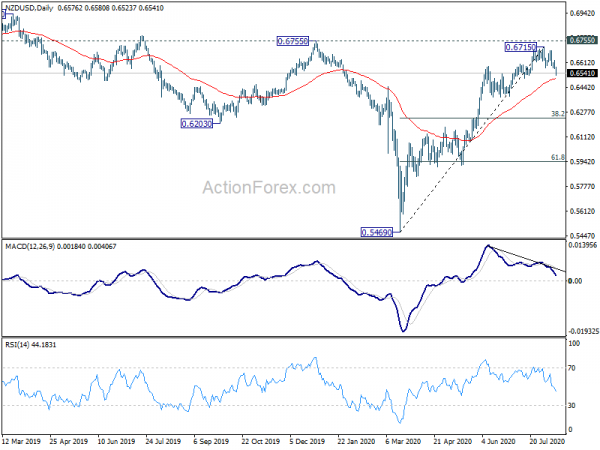

NSD/USD tumbles notable after the announcement. The development should confirm short term topping at 0.6715, after rejection by 0.6755 medium term resistance, on bearish divergence condition in daily MACD. The correction will likely take some time to complete and should eventually target 38.2% retracement of 0.5469 to 0.6715 at 0.6239. This will now remain the favored case as long as 0.6626 resistance holds, in case of recovery.

New Zealand delay dissolution of parliament, Auckland back in lockdown

New Zealand Prime Minister Jacinda Ardern put Auckland back into stage 3 lockdown, for three days as a “precautionary approach”. That came after the country recorded first new local coronavirus cases in 102 days. More importantly, the mystery cases, which were all diagnosed in one family, was spread from an unknown source.

Besides, Arden also decided to postpone the dissolution of parliament, due on Wednesday, ahead of an election just weeks away. The electoral commission was working through the implications of the coronavirus outbreak, and a decision would be on on the elections which are scheduled for September 19.

Australia consumer confidence plunged back near April low

Australia Westpac consumer confidence dropped -9.5% to 79.5 in August, down from 87.9. Westpac said “the scale of the fall comes as a major surprise” and it’s now back near the “extreme low” of 75.6 made in April. Nevertheless, that could prove to be a “significant overreaction” to the return to lockdown.

Westpac expects RBA to maintain current policies in the upcoming September 1 meeting. The next major event would be the Commonwealth Budget in October 6. As the consumer sentiment survey highlights the uncertainties around the current outlook, Westpac expects the government commit to providing “generous ongoing support the the economy”.

Also from Australia, wage price index rose 0.2% qoq in Q2, below expectation of 0.3% qoq.

Looking ahead

Eurozone will release industrial production. US will release CPI and crude oil inventories.

USD/JPY Daily Outlook

Daily Pivots: (S1) 106.06; (P) 106.37; (R1) 106.82; More...

USD/JPY’s break of 106.47 suggests resumption of rebound from 104.18. We’re also holding on the bullish case that corrective fall from 111.71 has completed with three waves down to 104.18, after missing 100% projection of 111.71 to 105.98 from 109.85 at 104.12. Intraday bias is back on the upside for 108.16 resistance. Firm break will will target 109.85 and above. This will now remain the favored case as long as 105.30 support holds, even in case of retreat.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jul | 7.90% | 7.60% | 7.20% | 7.30% |

| 0:30 | AUD | Westpac Consumer Confidence Aug | -9.50% | -6.10% | ||

| 1:30 | AUD | Wage Price Index Q/Q Q2 | 0.20% | 0.30% | 0.50% | |

| 2:00 | NZD | RBNZ Rate Decision | 0.25% | 0.25% | 0.25% | |

| 3:00 | NZD | RBNZ Press Conference | ||||

| 6:00 | JPY | Machine Tool Orders Y/Y Jul P | -31.10% | -32.10% | ||

| 6:00 | GBP | GDP M/M Jun | 8.70% | 8.00% | 1.80% | 2.40% |

| 6:00 | GBP | GDP Q/Q Q2 P | -20.40% | -20.20% | -2.20% | |

| 6:00 | GBP | Industrial Production M/M Jun | 9.30% | 9.40% | 6.00% | 6.20% |

| 6:00 | GBP | Industrial Production Y/Y Jun | -12.50% | -13.10% | -20.00% | |

| 6:00 | GBP | Manufacturing Production M/M Jun | 11.00% | 10.00% | 8.40% | 8.30% |

| 6:00 | GBP | Manufacturing Production Y/Y Jun | -14.60% | -15.00% | -22.80% | |

| 6:00 | GBP | Index of Services 3M/3M Jun | -19.90% | -19.20% | -18.90% | -18.50% |

| 6:00 | GBP | Goods Trade Balance (GBP) Jun | -5.1B | -4.5B | -2.8B | |

| 9:00 | EUR | Eurozone Industrial Production M/M Jun | 10.00% | 12.40% | ||

| 12:30 | USD | CPI M/M Jul | 0.40% | 0.60% | ||

| 12:30 | USD | CPI Y/Y Jul | 0.80% | 0.60% | ||

| 12:30 | USD | CPI Core M/M Jul | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Jul | 1.20% | 1.20% | ||

| 12:30 | USD | CPI Core s.a Jul | 266.07 | |||

| 13:00 | GBP | NIESR GDP Estimate (3M) Jul | -21.20% | |||

| 14:30 | USD | Crude Oil Inventories | -7.4M |