Asian markets surge broadly today, following the strong close in US stocks. DOW is finally catching up by a powerful break through June’s high while S&P 500 is closing in on record high. Investors welcomed the news of falling coronavirus hospitalizations in New Work, California and Texas. The trade of sanctions between US and China was generally shrugged. Yen and Dollar are both back under selling pressure, together with Swiss Franc. Commodity currencies are generally stronger, with Aussie leading the way higher.

Technically, Hong Kong HSI seems to be weathering the political turmoils rather well with strong 2.3% gain at the time of writing. Near term channel support seems to be defended well and focus is back on 25201 resistance to confirm. That would temporarily ease the risk of risk aversion out of Asia. Focus could be turned to near term support of Dollar for indicating selloff resumption, in particular against commodity currencies. Levels include 0.7243 resistance in AUD/USD, 0.6715 resistance in NZD/USD and 1.3233 support in USD/CAD.

In Asia, currently, Nikkei is up 1.90%. Hong Kong HSI is up 2.30%. China Shanghai SSE is up 0.33%. Singapore Strait Times is up 0.22%. Japan 10-year JGB yield is up 0.0176 at 0.028. Overnight, DOW rose 1.30%. S&P 500 rose 0.27%. NASDAQ dropped -0.39%. 10-year yield rose 0.012 to 0.574.

BoE Ramsden: Significant headroom to do more QE

Deputy Governor Dave Ramsden said in a the Times interview that the BoE “still got significant headroom to do more QE if we saw a much weaker recovery”. The pace of QE could accelerate is there are signs of market “dysfunction.

Ramsden is “confident” that there wouldn’t be more quarterly GDP contractions ahead. But “a key outcome is what happens to the labour market. Some companies are going to go under. Some jobs are going to be lost.”

UK BRC total sales rose 3.2%, still catching up lost ground

UK BRC total sales rose 3.2% yoy in July, second straight month of increase since the start of the coronavirus pandemic. Also, it’s above 3-month average growth of 0.4% and 12 month average decline of -1.9%. Like-for-like sales grew 4.3% yoy.

Helen Dickinson OBE, Chief Executive of BRC: “While the rise in retail sales is a step in the right direction, the industry is still trying to catch up lost ground, with most shops having suffered months of closures. The fragile economic situation continues to bear down on consumer confidence, with some retailers hanging by only a thread in the face of rising costs and lower sales.”

Fed Evans: New policies needed to address this unique recession

Chicago Fed President Charles Evans said the current recession is “unique in its swiftness severity and scope”, without modern precedent. He added that not all businesses could survive even after the coronavirus subsides. New policies are required to help the people affected through the downturn.

“Tragically, the most affected are our most vulnerable neighbors – those who don’t enjoy paid sick leave, can’t work from home or don’t have much cushion in their savings accounts. Their future is highly uncertain and will require new policies to help them through this difficult transition,” he said.

Australia NAB business confidence dropped to -14, deteriorated even before Melbourne stage 4 lockdown

Australia NAB Business Confidence dropped sharply to -14 in July, down from June’s 0. Business Conditions improved to 0, up from -8. Trading conditions turned position to 1 (up from -6), while profitability rose to 2 (up from -8). Employment also improved from -11 to -2 but stayed negative.

The survey was conducted prior to stage 4 lockdown in Melbourne as confidence already deteriorated of fear of the spread of the coronavirus. Alan Oster, NAB Group Chief Economist said, “while the improvement in conditions is very welcome, capacity utilisation and forward orders point to ongoing weakness overall. Therefore, with confidence still fragile there is some risk that conditions lose some of their recent gains in coming months.

Elsewhere

Japan bank lending rose 6.3% yoy in July, versus expectation of 6.5% yoy. Current account surplus widened to JPY 1.05T in June, above expectation of JPY 1.0T.

UK job data will be a focus in the European session. Germany ZEW economic sentiment is another. Later in the day, US will release PPI.

USD/CAD Daily Outlook

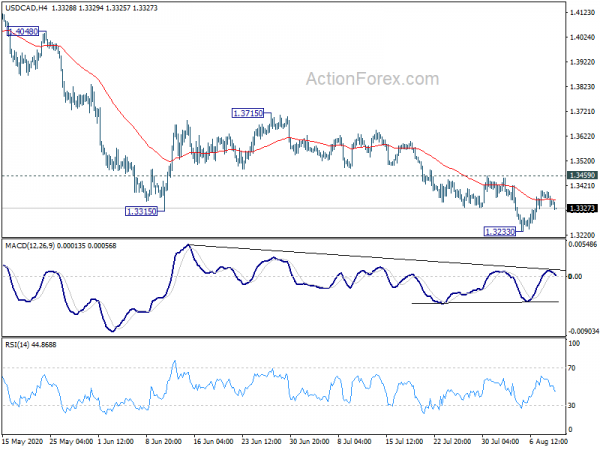

Daily Pivots: (S1) 1.3326; (P) 1.3361; (R1) 1.3387; More….

USD/CAD is staying in consolidation from 1.3233 and intraday bias remains neutral first. Further decline is expected as long as 1.3459 resistance holds. On the downside, break of 1.3233 will resume the fall from 1.4667 and target long term fibonacci level at 1.3056. However, firm break of 1.3459 will indicate short term bottoming, and turn bias back to the upside for 1.3715 resistance instead.

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement of 1.2061 to 1.4667 at 1.3056 and possibly below. This will now remain the favored case as long as 1.3715 resistance holds. However, sustained break of 1.3715 will turn focus back to 1.4689 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jul | 4.30% | 10.90% | ||

| 23:50 | JPY | Bank Lending Y/Y Jul | 6.30% | 6.50% | 6.20% | |

| 23:50 | JPY | Current Account (JPY) Jun | 1.05T | 1.00T | 0.82T | |

| 01:30 | AUD | NAB Business Confidence Jul | -14 | 1 | 0 | |

| 05:00 | JPY | Eco Watchers Survey: Current Jul | 46.6 | 38.8 | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Jun | 4.20% | 3.90% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Jun | -1.20% | -0.30% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jun | -0.10% | 0.70% | ||

| 06:00 | GBP | Claimant Count Change Jul | 9.7K | -28.1K | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Aug | 55 | 59.3 | ||

| 09:00 | EUR | Germany ZEW Current Situation Aug | -69.5 | -80.9 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Aug | 55.3 | 59.6 | ||

| 10:00 | USD | NFIB Business Optimism Index Jul | 105.9 | 100.6 | ||

| 12:30 | USD | PPI M/M Jul | 0.30% | -0.20% | ||

| 12:30 | USD | PPI Y/Y Jul | -0.60% | -0.80% | ||

| 12:30 | USD | PPI Core M/M Jul | 0.10% | -0.30% | ||

| 12:30 | USD | PPI Core Y/Y Jul | 0.30% | 0.10% |