The week starts with a rather subdued tone without much activity. It’s National Day of Singapore while Japan is also on Mountain Day holiday. There is also no further price movements on US-China tensions. Major forex pairs and crosses are stuck inside Friday’s range, with Dollar and Swiss Franc slightly softer. New Zealand Dollar is mixed even though confidence data suggests that the post-lockdown lift is fading.

Technically, Dollar will remain a focus as questions is on whether it could strike a sustainable rebound. Levels to watch include 1.1695 support in EUR/USD, 1.2982 support in GBP/USD, 0.7076 support in AUD/USD, 0.9241 resistance in USD/CHF, 106.47 resistance in USD/JPY and 1.3459 resistance in USD/CAD. At the same time, Yen is also worth as note as both EUR/JPY and GBP/JPY lost much upside momentum. Though, near term bullishness could be retained as long as 123.01 support in EUR/JPY and 136.62 support in GBP/JPY hold.

In Asia, currently, Hong Kong HSI is down -0.23%. China Shanghai SSE is up 1.07%. Japan and Singapore are on holidays.

Fed Evans: Another support package is really incredibly important

Chicago Fed President Charles Evans said in a CBS interview that “we’ve not control over the virus spread,” and “another support package is really incredibly important”. He emphasized the importance of public confidence “so that people feel good about going back to work, they feel safe they can go out to retail establishments and enjoy leisure and hospitality that put people back to work.”

Evans said the actual unemployment rate is “somewhat higher” that the official number at 10%. “If we got the kind of support that we needed as quickly as possible, got control of the virus, perhaps all the people who were sent home to stay safe could be brought back by their- by their previous employers. ”

New Zealand ANZ business confidence dropped to -42.2, post-lockdown rebound run its course

August’ preliminary reading of New Zealand ANZ Business Confidence dropped back to -42.4, down form -31.8. It’s still above lockdown low of -55, though. Own Activity Outlook also dropped to -17.0, down from -8.9.

ANZ said the reading “adds to the evidence that the post-lockdown rebound may have run its course.” “There are three prongs to this economic crisis: lockdown, closed borders, and an incredibly synchronised global slowdown that will hit exports.”

RBNZ to expand QE, some data from US, Germany, UK, Australia, China to watch

RBNZ meeting is the main central bank activity this week. The central bank is expected to keep OCR unchanged at 0.25%. There are expectations for an increase in the size of the Large-Scale Asset Purchase (LSAP) Program (QE) to NZD 80-90B from the current NZD 60B. The accompany statement might also deliver a dovish tone, give that the post-lockdown rebound might start to fade. More in RBNZ Preview: Expect QE Size Expansion and More Discussion on Negative Rates.

The economic is relatively light this week but there are some important data to watch, including UK employment and GDP, German ZEW, US CPI and retail sales, Australia employment and some data from China. Here are some highlights for the week.

- Monday: New Zealand ANZ business confidence; China CPI, PPI; Swiss unemployment rate; Eurozone Sentix investor confidence; Canada housing starts.

- Tuesday: Australia NAB business confidence; Japan bank leading, current account; UK employment; German ZEW; US PPI, leading indicator.

- Wednesday: Australia Westpac consumer sentiment, wage price index; RBNZ rate decision; UK GDP, trade balance, productions; Eurozone industrial production; US CPI.

- Thursday: Australia employment; Germany CPI final; US jobless claims, import prices.

- Friday: New Zealand BusinessNZ manufacturing index; China industrial production, retail sales, fixed asset investment; Japan tertiary industry index; Swiss PPI; Eurozone GDP, trade balance; Canada manufacturing sales; US retail sales, non-farm productivity, industrial production, business inventories, U of Michigan consumer sentiment.

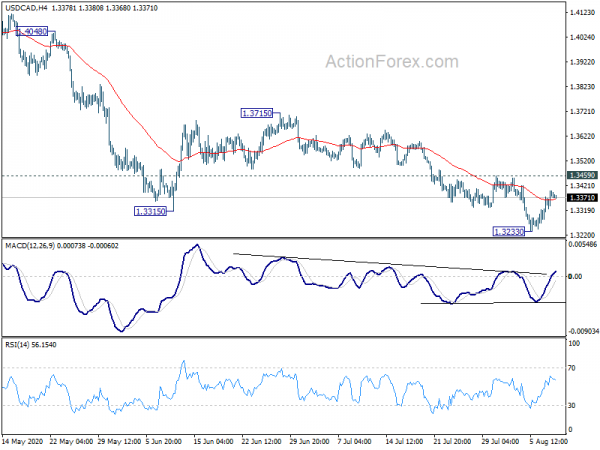

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3323; (P) 1.3361; (R1) 1.3424; More….

Intraday bias in USD/CAD remains neutral first. Further fall is expected as long as 1.3459 resistance holds. Break of 1.3233 will target long term fibonacci level at 1.3056. However, firm break of 1.3459 will indicate short term bottoming, and turn bias back to the upside for 1.3715 resistance instead.

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement of 1.2061 to 1.4667 at 1.3056 and possibly below. This will now remain the favored case as long as 1.3715 resistance holds. However, sustained break of 1.3715 will turn focus back to 1.4689 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | NZD | ANZ Business Confidence Aug P | -42.4 | -31.8 | ||

| 1:30 | CNY | CPI Y/Y Jul | 2.70% | 2.60% | 2.50% | |

| 1:30 | CNY | PPI Y/Y Jul | -2.40% | -2.50% | -3.00% | |

| 5:45 | CHF | Unemployment Rate Jul | 3.30% | 3.40% | 3.30% | |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Aug | -15.2 | -18.2 |