Dollar recovers mildly as markets turned mixed ahead of monthly close, but remains the second weakest for the week. Canadian Dollar is currently still the worst performing, as dragged by oil selloff. But we’ll see if better than expected GDP data could give the Loonie a lift before the final hours. Euro is paring some gains but remains the second strongest for the week, following Sterling. Yen and Swiss Franc are mixed.

Technically, EUR/JPY finally breaks 124.43 resistance to resume the rise from 114.42. GBP/JPY might follow to have a test on 139.73 resistance soon. USD/JPY appears to be rebounding just ahead of 104.12. projection level. Break of 105.29 will indicate short term bottoming and bring stronger rebound. Gold edged to new record high at 1983.23 but upside momentum is very weak. We’ll focus on 1939.20 support instead for sign of short term topping.

In Europe, currently, FTSE is down -0.18%. DAX is up 0.75%. CAC is up 0.18%. Germany 10-year yield is down -0.001 at -0.541. Earlier in Asia, Nikkei dropped -2.82%. Hong Kong HSI dropped -0.47%. China Shanghai SSE rose 0.71%. Singapore Strait Times dropped -1.70%. Japan 10-year JGB yield dropped -0.0044 to 0.015.

US personal income dropped -1.1% in June, spending rose 5.6%

US personal income dropped -1.1% mom or USD 222.8B in June, worse than expectation of -0.8% mom. Spending, on the other hand, rose 5.6% mom or USD 737.7B, above expectation of 5.0% mom.

Headline PCE price index rebounded to 0.8% yoy, up from 0.5% yoy, above expectation of 0.5% yoy. Core PCE price index slipped to 0.9% yoy, down from 1.0% yoy, missed expectation of 1.0% yoy.

Canada GDP grew 4.5% in May, could growth another 4% in Jun

Canada GDP grew 4.5% mom in May, better than expectation of 3.1% mom. Both goods-producing (8.0%) and services-producing industries (3.4%) were up, as 17 of 20 industrial sectors posted increases.

StatCan also said based on preliminary information, real GDP would grow 5% in June. Output across several industrial sectors, including manufacturing, retail and wholesale trade, construction, transportation, accommodation and food services, and the public sector, increased. For Q2, flash estimates points to an approximate -12% decline.

Also released, IPPI rose 0.4% mom, RMPI rose 7.5% mom.

Eurozone GDP contracted record -12.1% in Q2, EU shrank -11.9%

Eurozone GDP contracted -12.1% qoq in Q2, slightly worse than expectation of -12.0% qoq. Over the year, GDP contracted -15.0% yoy. EU GDP contracted -11.9% qoq, -14.4% yoy. These are all the worst decline since the time series started back in 1995.

Among the Member States, for which data are available for the second quarter 2020, Spain (-18.5%) recorded the highest decline compared to the previous quarter, followed by Portugal (-14.1%) and France (-13.8%). Lithuania (-5.1%) recorded the lowest decline.

Eurozone CPI rose back to 0.4% yoy, core CPI up to 1.2% yoy

Eurozone CPI rose back to 0.4% yoy in July, up from 0.3% yoy, above expectation of 0.2% yoy. CPI core also jumped to 1.2% yoy, up from 0.8% yoy, above expectation of 0.7% yoy. Look at the main components, food, alcohol & tobacco rose 2.0% yoy. Non-energy industrial goods rose 1.7% yoy. Services rose 0.9% yoy. Energy dropped -8.3% yoy.

Also released, France GDP dropped -13.8% qoq in Q2, better than expectation of -15.2% qoq. CPI jumped back to 0.9% yoy in July versus expectation of 0.2% yoy. Italy GDP contracted -12.4% qoq in Q2, better than expectation of -15.0% qoq. Germany retail sales dropped -1.6% mom, better than expectation of -3.5% mom. Swiss retail sales rose 1.1% yoy in June, below expectation of 3.9% yoy.

Japan industrial production rose 2.7% in June, unemployment rate dropped to 2.8%

Japan industrial production rose 2.7% mom in June, above expectation of 1.2% mom. Annually, production dropped -17.7% yoy. Looking at some details, shipment rose 5.2% mom, inventories dropped -2.4% mom, inventory ratio dropped -7.0%. The data showed slight improvement after production hit its decade low in May. The METI also said manufacturers are expecting further rebound in production by 11.3% mom in July and 3.4% in August.

Also released, unemployment rate dropped to 2.8% in June, down from 3-year high of 2.9% in May, better than expectation of 3.1%. housing starts dropped -12.8% yoy in June, slightly worse than expectation of -12.6% yoy. Consumer confidence rose slightly to 29.4 in July, up from 28.4, missed expectation of 32.7.

China PMI manufacturing edged higher to 51.1

China’s official PMI Manufacturing rose to 51.1 in July, up from 50.9, slightly above expectation of 51.0. That’s the highest reading since March too. Looking at some details, production rose 0.1 to 54.0. New orders also improved by 0.3 to 51.7. New export orders rose notably by 5.8 to 48.4, but stayed in contraction. PMI Non-Manufacturing retreated mildly to 52.3, down from 54.4, but beat expectation of 51.2. Overall, the set of data suggests that recovery in on track, but it will remain a long road back to pre-pandemic levels.

Australia private sector credit dropped -0.2% in June

Australia private sector credit dropped -0.2% mom in June, wore than expectation of 0.2% mom. Housing credits rose 0.2% mom. But personal credits dropped -0.6% mom while business credits dropped even more by -0.8% mom. PPI dropped -1.2% qoq in Q2, much worse than expectation of 0.3% qoq. Annually, PPI turned negative to -0.4% yoy versus expectation of 1.3% yoy.

USD/JPY Mid-Day Outlook

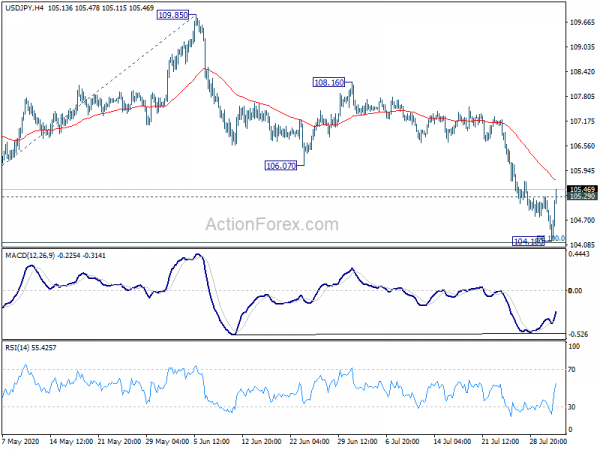

Daily Pivots: (S1) 104.52; (P) 104.90; (R1) 105.13; More...

USD/JPY’s strong rebound and break of 105.29 resistance suggests short term bottoming at 104.18. That came just ahead of 100% projection of 111.71 to 105.98 from 109.85 at 104.12. Intraday bias is turn back to the upside for stronger recovery. Focus is back on 106.07 support turned resistance. As long as 106.07 holds, larger decline from 111.71 is still in favor to extend lower. However, sustained break of 106.07 will indicate near term bullish reversal and target 108.18 resistance next.

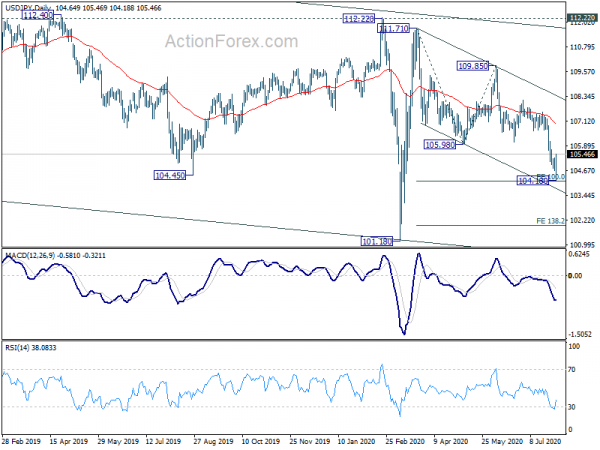

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jun | 2.80% | 3.10% | 2.90% | |

| 23:50 | JPY | Industrial Production M/M Jun P | 2.70% | 1.20% | -8.90% | |

| 01:00 | CNY | Manufacturing PMI Jul | 51.1 | 51 | 50.9 | |

| 01:00 | CNY | Non-Manufacturing PMI Jul | 54.2 | 51.2 | 54.4 | |

| 01:30 | AUD | Private Sector Credit M/M Jun | -0.20% | 0.20% | -0.10% | |

| 01:30 | AUD | PPI Q/Q Q2 | -1.20% | 0.30% | 0.20% | |

| 01:30 | AUD | PPI Y/Y Q2 | -0.40% | 1.30% | 1.30% | |

| 05:00 | JPY | Housing Starts Y/Y Jun | -12.80% | -12.60% | -12.30% | |

| 05:00 | JPY | Consumer Confidence Index Jul | 29.5 | 32.7 | 28.4 | |

| 05:30 | EUR | France GDP Q/Q Q2 P | -13.80% | -15.20% | -5.30% | |

| 06:00 | EUR | Germany Retail Sales M/M Jun | -1.60% | -3.50% | 13.90% | |

| 06:30 | CHF | Real Retail Sales Y/Y Jun | 1.10% | 3.90% | 6.60% | 6.20% |

| 06:45 | EUR | France CPI M/M Jul P | 0.40% | 0.00% | 0.10% | |

| 06:45 | EUR | France CPI Y/Y Jul P | 0.90% | 0.20% | 0.20% | |

| 08:00 | EUR | Italy GDP Q/Q Q2 P | -12.40% | -15.00% | -5.30% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | -12.10% | -12.00% | -3.60% | |

| 09:00 | EUR | Eurozone CPI Y/Y Jul P | 0.40% | 0.20% | 0.30% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Jul P | 1.20% | 0.70% | 0.80% | |

| 12:30 | CAD | GDP M/M May | 4.50% | 3.10% | -11.60% | -11.70% |

| 12:30 | CAD | Raw Material Price Index M/M Jun | 7.50% | 7.00% | 16.40% | |

| 12:30 | CAD | Industrial Product Price M/M Jun | 0.40% | 0.10% | 1.20% | |

| 12:30 | USD | Personal Income M/M Jun | -1.10% | -0.80% | -4.20% | -4.40% |

| 12:30 | USD | Personal Spending Jun | 5.60% | 5.00% | 8.20% | 8.50% |

| 12:30 | USD | PCE Price Index M/M Jun | 0.40% | 0.00% | 0.10% | |

| 12:30 | USD | PCE Price Index Y/Y Jun | 0.80% | 0.50% | 0.50% | |

| 12:30 | USD | Core PCE Price Index M/M Jun | 0.20% | 0.20% | 0.10% | 0.20% |

| 12:30 | USD | Core PCE Price Index Y/Y Jun | 0.90% | 1.00% | 1.00% | |

| 12:30 | USD | Employment Cost Index Q2 | 0.50% | 0.60% | 0.80% | |

| 13:45 | USD | Chicago PMI Jul | 43 | 36.6 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul F | 72.8 | 73.2 |